Above-average dividend yields go a long way toward explaining income investors' enthusiasm for the real estate sector. For example, the MSCI US IMI Real Estate 25/50 Index yields 3.72%, or more than triple the same metric on the S&P 500.

Income-hungry investors can do even better on the yield front with the Invesco KBW Premium Yield Equity REIT ETF (KBWY 1.36%). That exchange-traded fund (ETF) carried a stout 30-day SEC yield of 7.72% as of Jan. 15, and it delivers its payouts monthly rather than quarterly, but those aren't the big reasons this real estate investment trust (REIT) fund is a buy in 2026.

This high-yield real estate ETF has lagged, but it's a buy in 2026. Image source: Getty Images.

Yes, this ETF's yield is appealing, but it's not a risk-free bet. Fortunately, some solid fundamental factors support a constructive outlook for this fund.

Multiple tailwinds could emerge for this ETF

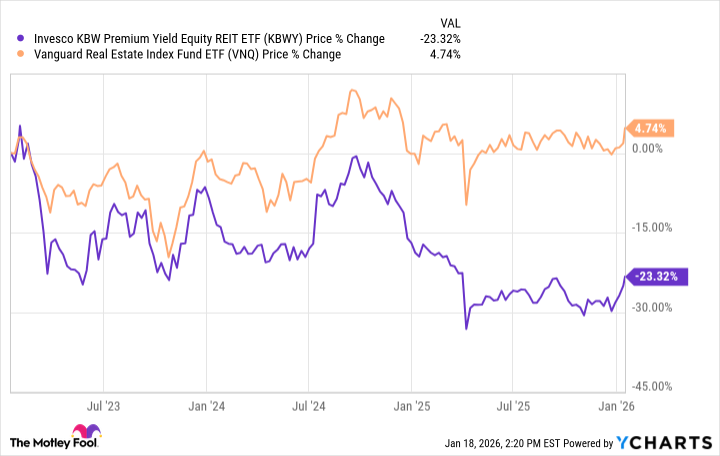

Getting down to brass tacks, the last three years haven't been kind to this fund, and it has badly lagged the largest ETF in the category. But that's in the rearview mirror and shouldn't diminish a potentially bullish setup going forward.

Data by YCharts.

Let's start with the dividends, which are a significant draw for this $268.6 million ETF. Last year, 73 U.S.-based REITs, including 11 last month, raised their payouts. Some of those boosters are among this ETF's 31 holdings.

The REIT dividend outlook is supported by strong balance sheets and solid funds from operations (FFO) trajectories. FFO is critical in evaluating landlords because the metric provides the clearest view of a REIT's operating performance. Good news for investors considering the Invesco ETF: Nearly two-thirds of REITs reported year-over-year FFO growth in 2025.

Second, there's a value case for real estate stocks as some market observers view the sector as one of just three that's credibly undervalued today. That sentiment applies to some of the Invesco ETF's holdings, including industrial REIT Americold Realty Trust and Healthpeak Properties. The former is this ETF's fifth-largest holding.

But wait. There's more.

Small stocks, mighty potential

Many of the most popular real estate ETFs are large-cap products, but the Invesco yield fund, which tracks the KBW Nasdaq Premium Yield Equity REIT Index, takes a different approach. The average market capitalization of this ETF's holdings is $2.46 billion, indicating that small caps are its focus.

That's important for a few reasons. First, the real estate ETF can be paired with broader, traditional small-cap funds because those funds aren't high-yield. The Russell 2000 Index yields barely more than 1%.

Second, smaller stocks are proving resurgent to start 2026, and there is some sense that the current small-cap rally could prove durable because market breadth is widening and interest rates are declining. Lower rates could benefit the Invesco ETF in two ways: Some smaller companies need cost-efficient access to capital markets, and real estate is considered one of the more rate-sensitive sectors.

So if the Federal Reserve continues its easing campaign, this high-yield REIT fund could benefit. The Invesco ETF's income and value benefits can be had for an annual expense ratio of 0.35%, or $35 on a $10,000 position.