Although artificial intelligence (AI) has been Wall Street's hottest multiyear trend, it took a backseat to another technological innovation -- quantum computing -- that sent a small group of stocks soaring to the heavens in 2025.

At select points last year, shares of pure-play quantum computing stocks IonQ (IONQ +6.81%), Rigetti Computing (RGTI +3.72%), D-Wave Quantum (QBTS +0.38%), and Quantum Computing Inc. (QUBT +4.27%) had rallied by as much as 6,200% on a trailing 12-month basis. Investors who had the luck and foresight to invest in these early stage businesses generated potentially life-altering gains in one year (or less)!

While quantum computing stocks have given investors reasons to be excited, they've also inadvertently highlighted the risks inherent in next-big-thing technology investments. Last year, these pure-play stocks served up a $4.15 billion reality check for Wall Street. The all-important question is: Are investors paying attention?

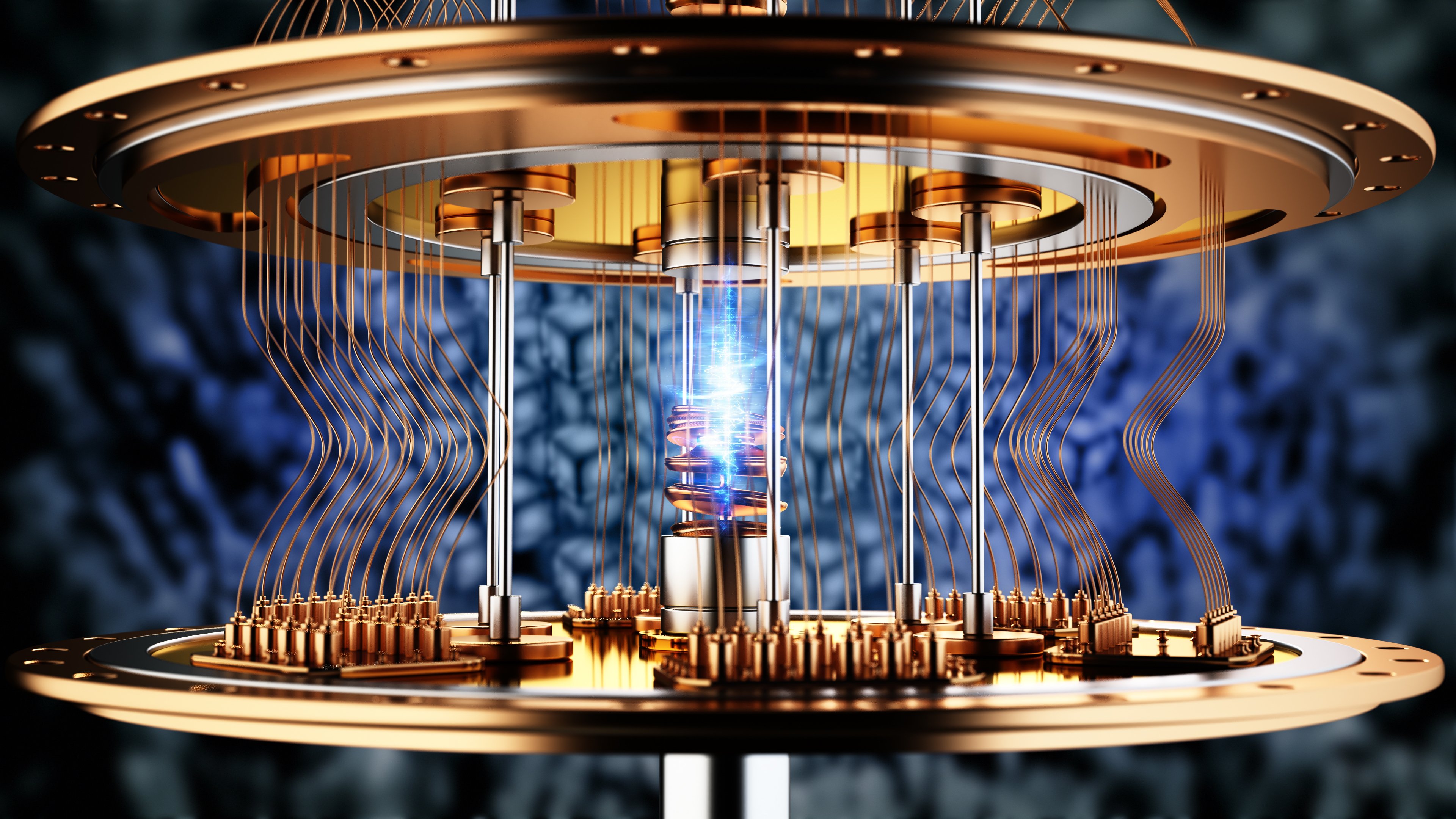

Image source: Getty Images.

Quantum computing stocks were red hot in 2025 -- and with good reason

Without getting overly technical, quantum computing relies on specialized computers to perform rapid, often simultaneous calculations to help solve complex problems that classical computers simply aren't capable of performing.

Part of the reason for the liftoff of pure-play quantum computing stocks in 2025 has to do with the real-world use cases for this technology. In particular, quantum computers can accelerate the learning curves of AI algorithms, potentially making large language models more useful at a considerably faster pace.

Additionally, quantum computers can be used to run molecular interaction simulations to determine the best courses of action for developing novel therapies or optimizing clinical drug trials for success.

Quantum Computing 1 Year Returns 🤯$RGTI +6,217% $QBTS +3,912%$QUBT +2,798%$IONQ +670% pic.twitter.com/tzSN5ZqVjj

-- Connor Bates (@ConnorJBates_) October 13, 2025

Although addressable market estimates vary wildly, as is to be expected of an early stage technological innovation, analysts at Boston Consulting Group foresee quantum computing adding between $450 billion and $850 billion in global economic value by 2040. Online publication The Quantum Insider is even more optimistic, with a call for $1 trillion in created economic value by 2035. If either of these estimates is remotely in the ballpark, it would lead to a laundry list of beneficiaries and, presumably, some very happy investors.

Speaking of investments, IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. all soared early in the fourth quarter of 2025 after JPMorgan Chase outlined its $1.5 trillion Security and Resiliency Initiative. America's largest bank by total assets laid out its 10-year plan to "facilitate, finance and invest in industries critical to national economic security and resiliency." Quantum computing was identified as one of the initial 27 sub-areas for investment by JPMorgan Chase.

Lastly, early stage collaborations and contracts helped fuel the significant rally observed in pure-play quantum computing stocks. For instance, Amazon's quantum-cloud service Braket and Microsoft's Azure Quantum service are both allowing subscribers access to IonQ's and Rigetti's quantum computers to run simulations and test their quantum hardware. Landing members of the "Magnificent Seven" as clients is a big deal.

Image source: Getty Images.

Quantum computing stocks gave Wall Street and investors a huge reality check

But as Wall Street's most popular disclaimer goes, "past performance is no guarantee of future results."

While quantum computing stocks undeniably benefited in 2025, they also served up warnings for investors who paid close attention.

One of the foundational aspects of game-changing technologies is their need for time to mature and evolve. No matter how exciting an innovation may seem, it takes time to gain adoption and for businesses to optimize it. We've witnessed this play out with every technological leap forward over the past three decades, including the internet, 3D printing, and blockchain technology, to name a few.

Although quantum computing is a groundbreaking technology, the pure-play stocks at the forefront of this trend are still in the very early stages of commercializing their quantum computers. Most Wall Street analysts anticipate it'll be several years before quantum computers can tackle practical problem-solving more cost-effectively than classical computers.

NYSE: IONQ

Key Data Points

While IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. are expected to generate sustained high double-digit or triple-digit annual sales growth for the foreseeable future, there's a good likelihood that all four companies with be losing money and burning cash for years to come.

With unproven operating models and limited/no access to basic financial services, this quartet of quantum computing highfliers have turned to dilutive share offerings to raise capital. Last year, cumulative at-the-market or private share offerings respectively totaled:

- IonQ: $2 billion

- Rigetti Computing: $350 million

- D-Wave Quantum: $550 million

- Quantum Computing Inc.: $1.25 billion

Two separate private placements from Quantum Computing Inc., two offerings from D-Wave Quantum, an at-the-market offering by Rigetti Computing, and IonQ's October equity offering, combine for $4.15 billion in stock/warrants issued by quantum computing companies in 2025.

NASDAQ: RGTI

Key Data Points

This $4.15 billion reality check serves as a reminder that quantum computing stocks have a long way to go before their operating models are validated and generate positive cash flow. It also signals the possibility of additional share-based dilution for further research and development.

Furthermore, this eye-popping $4.15 billion figure demonstrates just how much of a disadvantage IonQ, Rigetti, D-Wave, and Quantum Computing Inc. are at compared to members of the Magnificent Seven.

For example, Microsoft and Alphabet have several highly profitable operating segments, with both companies sitting on veritable mountains of cash that they can deploy at any time. Microsoft and Alphabet have also developed quantum processing units (Majorana 1 for Microsoft and Willow for Alphabet). Magnificent Seven companies aren't shy about wanting their piece of next-big-thing technology pies, and the barrier to entry in quantum computing may be substantially lower than investors realize.

The prospect of ongoing share-based dilution adds another layer of concern for pure-play quantum computing stocks.