NuScale Power's (SMR 4.80%) small modular reactor (SMR) technology could revolutionize the way nuclear energy is deployed. With their modular design, its power modules can be factory-built and transported to sites, significantly reducing construction time and costs. Each self-contained unit operates independently, allowing utilities to scale capacity as needed.

The company is the only one to have its SMR design certified by the U.S. Nuclear Regulatory Commission and it is targeting energy-intensive industries like AI data centers, mining, and semiconductor manufacturing, which require massive amounts of electricity.

The stock has gone on a roller coaster over the past year, reaching as high as $57 per share. As of Friday morning, NuScale is trading for around $21 per share. But before you scoop up the stock thinking it's cheap, there is something you'll want to consider first.

NYSE: SMR

Key Data Points

Unpacking the NuScale-ENTRA1 Deal

One crucial factor affecting NuScale Power's economics is its agreement with ENTRA1, a partner that will help it commercialize and deploy its power module technology. As part of this deal, NuScale will supply its power modules to ENTRA1 energy plants, which look to provide carbon-free baseload power for data centers and industrial use.

The move gives NuScale a potential long-term partner to help deploy its technology on a wide scale. Its small modular reactor (SMR) technology was selected for ENTRA1's agreement with the Tennessee Valley Authority (TVA). NuScale CEO John Hopkins called it a "historic agreement" and the "largest SMR deployment program in U.S. history."

This arrangement is a response to the failure of NuScale's previous project (the Carbon Free Power Project in Idaho), which was cancelled in 2023 due to rising costs. By using ENTRA1 as an intermediary, NuScale can deploy its technology without requiring utilities to take on the massive upfront debt typically associated with nuclear construction.

Image source: Getty Images.

Growth will come at a cost

While the structure of this agreement alleviates utilities' financial burden, it puts significant pressure on ENTRA1 and NuScale to finance the venture and could be highly dilutive to shareholders. According to analysts at BNP Paribas, the deal fundamentally changes how NuScale should be valued, and they estimate that NuScale could pay $6 billion over the next 15 years under this agreement.

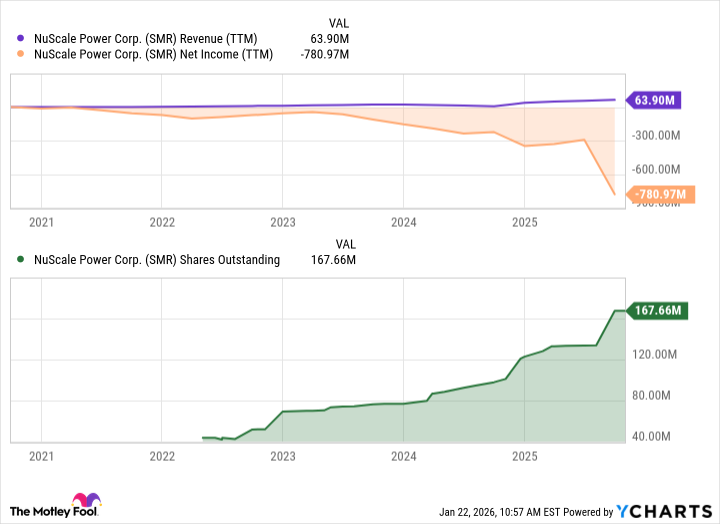

In the third quarter, NuScale recorded a $495 million cash outflow associated with its first TVA milestone payment. In addition, shareholders approved NuScale increasing its authorized share count from 332 million to 662 million. It's likely that NuScale continues to use equity to fund future payments, and this dilutive impact cannot be overlooked.

SMR Revenue (TTM) data by YCharts

Not only that, but the partnership and deployment of NuScale's power modules are still in very early stages. The first TVA plant may not even be operational until 2030 at the soonest, with additional plants (a total of six) to follow later. This is in addition to its RoPower project in Romania, which would be its first operating SMR power plant and is expected to open around 2028.

An early-stage stock with a lot of risk

NuScale's SMR technology could reimagine how nuclear power is used. Its modular design could change how nuclear power plants are deployed, enabling smaller plants that can power factories or data centers.

With that in mind, its technology is still a couple of years away from being commercially available, at the soonest, and delays aren't out of the question for new technologies like this. Also, while its deal with ENTRA1 could help it deploy its technology on a wide scale, it is also highly dilutive to shareholders.

While I like its potential, I think most investors should steer clear of NuScale Power until there is evidence it can operate commercially over the next few years.