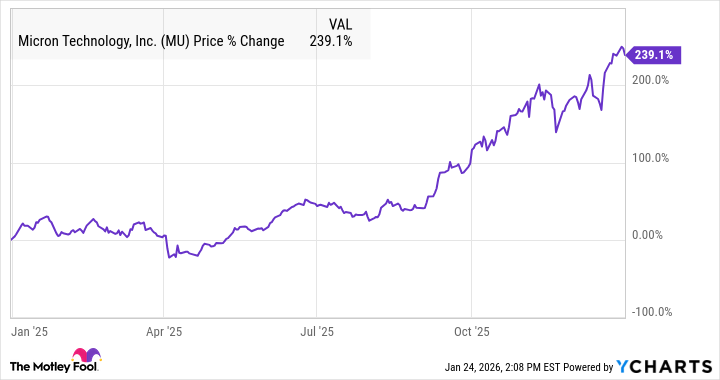

Micron (MU +5.30%) has been one of the biggest winners of the artificial intelligence (AI) boom, and it was nearly the top-performing stock on the S&P 500 last year, finishing up 239% as you can see from the chart below.

The stock has continued to rally into 2026, and you can see that most of the gains came in the last third of the year. Last September, I predicted that Micron would soar over the next three years, and it's exceeded those expectations, jumping more than 150% since then. Micron's momentum has only accelerated since then, driven by a memory-chip shortage in the industry, which driven up prices, and the company's own strong execution.

After breaking out since September, here's what to expect for Micron this year.

Image source: Getty Images.

Where Micron is going in 2026

Through Jan. 23, Micron stock is already up 40% year-to-date on signs that the memory shortage is only getting worse and prices are continuing to rise.

Intel said on its earnings call last Thursday that supply constraints and rising prices in memory have become "a very big challenge," as CEO Lip-Bu Tan called it, and Wall Street analysts have observed in recent weeks that supply and demand dynamics for memory continue to tighten, favoring further price increases.

Micron has already contracted out its entire high-bandwidth memory supply for 2026, but what happens now will impact pricing into 2027 and possibly 2028.

Meanwhile, the company is undertaking a major capacity expansion project as it just broke ground on a $100 billion leading-edge memory manufacturing complex in upstate New York that will have up to four fabs (or factories) and will be the largest semiconductor facility in the U.S., with production aiming to start in 2030.

That's a reminder of another of Micron's competitive advantages, as there are only three major memory chip manufacturers in the world and the other two, SK Hynix and Samsung, are based in South Korea. While Intel has gotten more attention from the federal government as a national interest, Micron is larger than Intel both by revenue and market cap, and the recent shortage in memory shows how crucial its product is.

Where Micron stock will be at the end of the year

Predicting a company's share price is difficult as a lot of factors play into the price of a stock, including market sentiment, but given the momentum in memory, rising chip prices, and Micron's own still-cheap valuation at a forward P/E of just 12, I think a share price of $600, up 50% from today, is a reasonable target for the stock by the end of the year.