One of the best financial stocks to own in recent years has been American Express (AXP 0.68%). The company is a top credit card issuer and caters to an affluent customer base that's been willing to spend heavily, even amid inflation and growing economic concerns. The stock is up over 210% in just the past five years, which is far better than the S&P 500's gains of around 81% in the same period (returns are as of Jan. 27).

For investors, the inevitable concern after such a strong rally is whether the stock is still a good buy or has gotten too expensive. Let's take a look at Amex's fundamentals and overall valuation to see if this is a stock that's still worth buying today.

Image source: Getty Images.

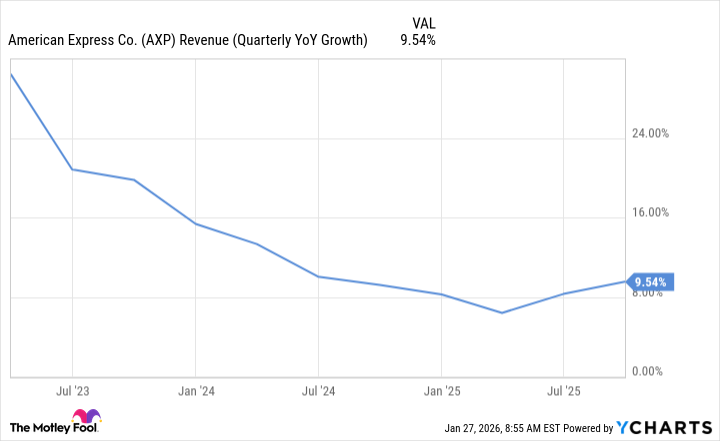

The company's growth rate has been declining but remains positive

In previous years, Amex was growing much faster than it is now. But with the company still generating growth around the double digits, it seems to be doing well, even while other businesses are struggling. It shows excellent resilience. Amid more favorable economic conditions, the company's growth may accelerate.

AXP Revenue (Quarterly YoY Growth) data by YCharts

It's currently trading at a price-to-earnings (P/E) multiple of 24, and its valuation looks reasonable given the rate of growth. At a higher premium, you'd likely expect stronger growth. But its P/E multiple is actually lower than the S&P 500 average of 27, and you could make the case that more of a rally is justifiable for the stock.

Is Amex's stock likely to rise even higher this year?

Year to date, Amex's stock has fallen by 2% as concerns about the government putting a 10% cap on credit card interest rates has investors pulling back on many financial stocks. The proposed legislation could stifle growth prospects for credit card companies such as Amex, which would need to be more careful about whom they extend credit to.

NYSE: AXP

Key Data Points

If such legislation ends up passing, it could hurt Amex and other financial stocks. But President Donald Trump is calling for a 10% cap to be put in place for only one year. For now, long-term investors don't need to worry.

What's important is that with a solid brand, consistent and steady growth, and an attractive valuation, Amex remains a good stock to buy, even with its valuation having risen sharply in recent years. While it may stumble this year due to the uncertainty around government legislation, it can still be an excellent investment for the long haul.