Gold and silver just surpassed two closely watched thresholds, with prices of the yellow stuff surging past $5,000 per ounce and silver blowing past $100 per ounce. The price growth rate ofgold and silver is crushing the comparable performance of the S&P 500 (^GSPC 0.13%) in 2026 -- building upon outperformances from 2024 and 2025.

Let's take a closer look at what's driving the rally in gold and silver, if there's room for this rally to run, and simple ways you can get exposure to precious metals through your brokerage account.

Image source: Getty Images.

Factors driving gold and silver higher

Anytime an asset rises rapidly in value, the key is to separate fundamentals from greed. Gold and silver are running up partially due to investor enthusiasm and borderline euphoria. But the fundamentals are incredibly strong, too. And then there are some additional factors affecting the prices:

- Gold and silver are traditionally used as hedges against inflation and fiat currency instability.

- Central banks -- namely in China and India -- have been bolstering their gold reserves.

- Gold can be seen as a safe-haven asset amid a weakening U.S. dollar and escalating geopolitical tensions between the U.S. and other countries.

- The dollar is coming off its worst year since 2017. Investors who believe the dollar will continue to lose value to other currencies may prefer to hold assets like gold and silver that aren't tied to the U.S. dollar. In this vein, gold and silver offer significant diversification from other dollar-sensitive asset classes -- like U.S. equities, U.S. bonds, and Treasury bills.

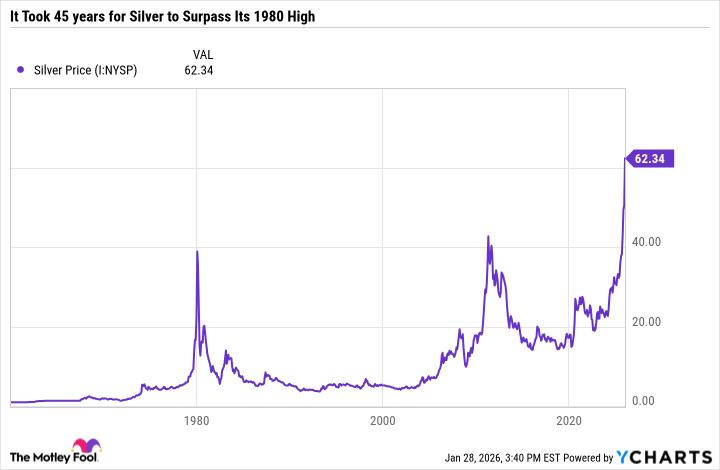

- Silver's price growth rate had been lagging gold's, but it had a breakout year in 2025, finally surpassing its previous high (in 1980) in October 2025.

Data by YCharts.

Silver's price has more than doubled from that October 2025 level -- at just under $115 per ounce at the time of this writing. The grey stuff is used in industrial processes, electric vehicles, and artificial intelligence (AI) data centers, among other use cases. Similar to the boom in AI memory stocks like Micron Technology, investors are looking for out-of-the-box ways to invest in AI without hitching a ride to the usual suspects of Nvidia and the hyperscalers.

Incorporating precious metals into a diversified portfolio

Gold and silver are far more difficult to evaluate than stocks. Building an investment thesis for a company involves looking at its financial position, where it is, where it could go, and then deciding on a fair price to pay for a partial ownership stake in that business. Earnings act as the yardstick to measure a company's performance -- but gold and silver are commodities. Price is driven by supply and demand. And right now, demand is surging due to monetary policy, investor demand, and practical use cases.

One look at the price chart of silver, and the parabolic growth screams a bubble begging to burst. A similar argument could be made for gold. But instead of trying to time either precious metal, I think a far better approach is to decide the role you want gold and silver to play in your broader portfolio.

For example, do you want precious metals to make up less than 5% of your financial portfolio, 10%, or maybe even more? There are wildly contrasting views on gold, with famous investor Warren Buffett avoiding it on the belief that stocks will outperform over the long run. And with some believing Bitcoin is the modern-day digital gold, there's a fair argument that cryptocurrency deserves a role in a diversified financial portfolio as well.

One of the biggest mistakes investors can make is getting enamored by rising prices of a stock or asset they don't understand and trying to ride the rocket ship higher. So if you're interested in gold and silver just because they have been red hot, it's probably a good idea to take a pause and try and separate the price action from the fundamentals.

Buying gold and silver through precious metals ETFs

If you believe that central banks, institutional investors, and retail investors will continue buying gold and silver for their practical use cases, as a store of value, and because of potential instability with major fiat currencies like the U.S. dollar, then carving out a certain percentage of your portfolio in these assets, even at all-time highs, is reasonable. And in that case, one of the best ways to buy gold and silver is through exchange-traded funds (ETFs).

Holding physical gold and silver comes with a slew of security, storage, and liquidity risks. ETFs like SPDR Gold Shares (GLD +0.27%) or BlackRock's iShares Gold Trust (IAU +0.32%) and iShares Silver Trust (SLV 0.03%) work with financial institutions (custodians) that hold physical tonnes (metric) of precious metals assets on their behalf.

This way, an investor can buy the precious metal in a brokerage account, which provides far better liquidity, straightforward tax accounting, and greater clarity on true allocation compared to other holdings in the overall financial portfolio.

One noteworthy drawback of using precious metal ETFs is their expense ratios -- the fees the investment management company charges for its services. Massive, passive ETFs like the Vanguard S&P 500 ETF have a very small expense ratio of just 0.03%, or $3 for every $10,000 invested. Whereas ETFs tied to a fund manager, like Cathie Wood's flagship ARK Innovation Fund, have an expense ratio of 0.75%.

SPDR Gold Shares has an expense ratio of 0.4%, but the iShares Gold Trust has a more reasonable 0.25% expense ratio. The iShares Silver Trust has a relatively high expense ratio of 0.5%, but it is by far the most reputable silver ETF available with $38 billion in net assets.

Staying even-keeled when approaching gold and silver

Gold and silver are already crushing the S&P 500 in 2026 and could continue to do so for the factors discussed. But instead of deciding on stocks versus precious metals, a better approach is to determine what role you want gold and silver to play in your portfolio and your preferred way of building exposure to precious metals (such as ETFs versus bullion or coins).

By focusing on portfolio allocation, you can build a position in gold and silver without letting the price action steer your investment decisions.

For folks who are still contributing new savings to their investment accounts, it could be worth considering dollar-cost averaging into gold and silver ETFs over time. That way, you avoid the emotional stress that could come from opening a position in gold or silver, only for the price to tumble.