The artificial intelligence AI realm is full of exciting investments, but none is more popular than Nvidia (NVDA 0.72%). Nvidia makes graphics processing units (GPUs), and these have been the most widely deployed computing units in the AI sector. However, Nvidia's GPUs aren't the cheapest option, and AI hypercalers have to pay a premium to deploy the best-in-class hardware.

Instead of using Nvidia's products, some hyperscalers are starting to explore alternatives from Broadcom (AVGO +0.17%). Broadcom is taking a different path in designing AI computing units, and the strategy looks to be paying off for it.

But which is the better AI stock to invest in right now? Let's take a look.

Image source: Getty Images.

Broadcom's approach may steal some Nvidia market share

As mentioned above, Nvidia makes broad-purpose GPUs, which can be deployed in a wide variety of tasks. The flexibility of a GPU is necessary for tasks like AI model training, where it may see a wide variety of workloads and information come across. However, for tasks like inference, where the inputs and outputs are fairly standard, using a GPU may be a bit inefficient.

That opens the door to Broadcom, which makes custom AI chips for its clients. These are known as ASICs, or application-specific integrated circuits. ASICs are nothing new; they've been deployed in industry for a long time for specific roles. So, it should come as no surprise that a company decided to start using them for artificial intelligence. Instead of marketing broad computing capabilities, Broadcom partners directly with a specific client to make a chip specifically catered to their needs. This eliminates unnecessary features that drive the price tag of a GPU up, and only leaves the remaining elements that make it the right tool for the job.

NASDAQ: AVGO

Key Data Points

The most famous example of a computing unit that Broadcom has partnered with an AI hyperscaler to make is Google's Tensor Processing Unit (TPU). The TPU has been Alphabet's (GOOG 0.02%) (GOOGL 0.05%) secret weapon in catching up in the AI arms race, so it comes as no surprise that other companies are following in its footsteps. Many clients, including OpenAI, have announced a custom chip with Broadcom, and those are expected to start rolling out over the next few years, which could extend Broadcom's growth for a while, but is that enough to warrant investing in it over Nvidia?

Nvidia is still the king right now

For Nvidia's fiscal year 2027 (ending January 2027), Wall Street analysts expect 52% revenue growth from Nvidia. Considering Nvidia has a market cap of about $4.5 trillion, that's an unbelievable growth rate. Broadcom is expected to grow at the same pace, 52%, during its FY 2026 (ending early November 2026). Clearly, these two are about even in expectations, which is what makes Nvidia all the more impressive.

NASDAQ: NVDA

Key Data Points

It's well known that the larger a company is, the harder it is to grow. During their respective fiscal years, analysts expect Nvidia's revenue to total $323 billion while Broadcom's is $133 billion. I'd give the nod to Nvidia in this aspect because Nvidia is growing so quickly despite rising competition, and its size is unheard of.

Furthermore, the market is really excited about Broadcom's prospects.

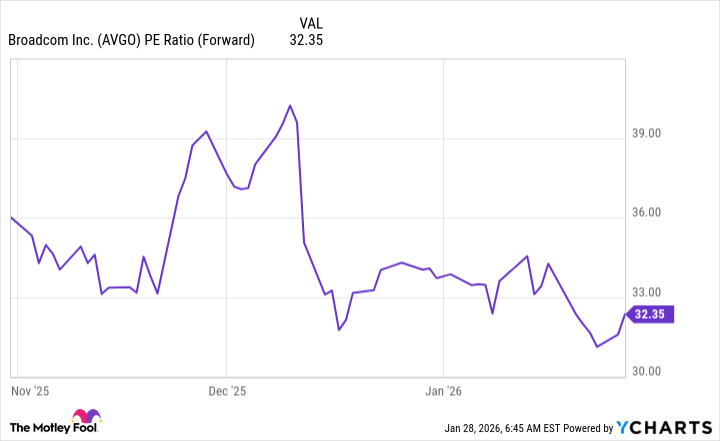

Data by YCharts.

Broadcom stock trades for 32.4 times forward earnings. Nvidia trades for 24.6 times FY 2027 earnings, so you have to pay a decent premium to own Broadcom stock.

So, is Broadcom the better AI stock to own? I'd say no. Nvidia is still the king right now. However, I think Broadcom is a great stock to buy alongside Nvidia because it represents a different way to invest in AI. It's impossible to tell which way the industry will shift over the next few years, and owning two of the leaders is a great way to ensure you have exposure to both potential winners.