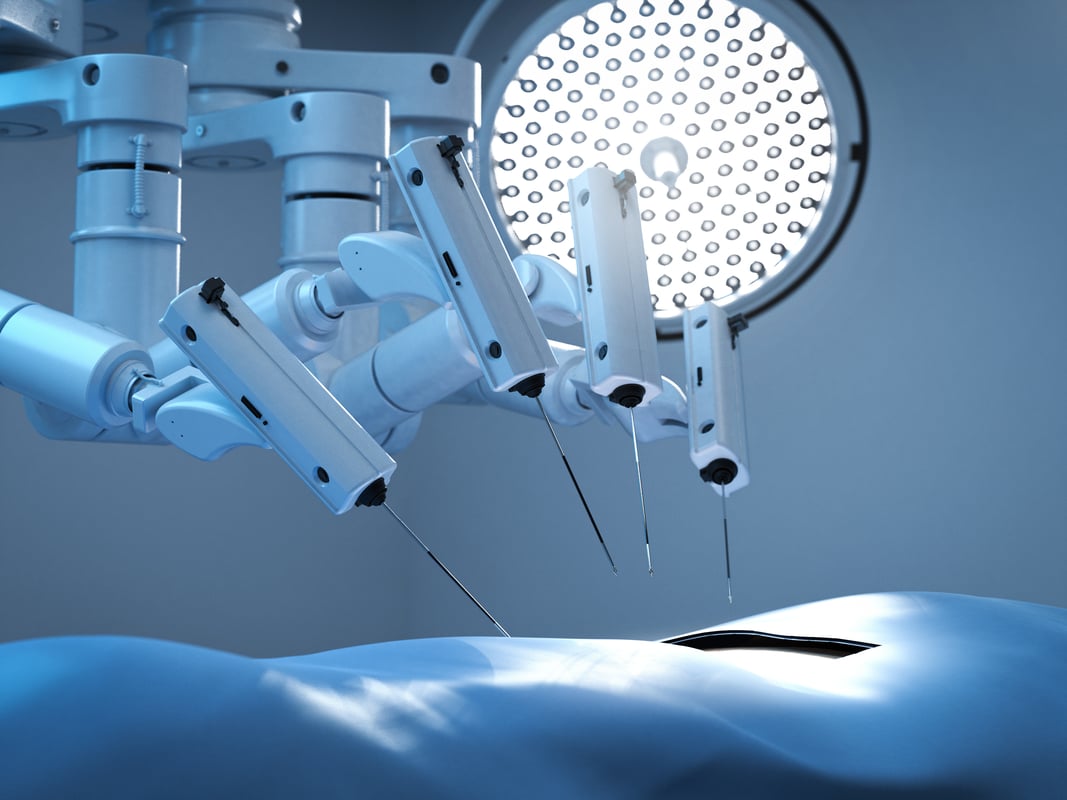

Intuitive Surgical (ISRG 0.71%) ended 2025 on a strong note. The tech/healthcare company placed 532 of its da Vinci surgical robots in the fourth quarter, up from 493 in the final quarter of 2024. There are now 11,106 da Vinci systems operating around the world, up 12% from the previous year. But the big story isn't the robots.

What does Intuitive Surgical do?

From a big-picture perspective, Intuitive Surgical makes the da Vinci surgical robotic system. So, the fact that it is selling more robots is good news. But when you dig in a little, you'll find that selling the actual surgical robot accounted for only around 25% of sales in 2025. That's not a fluke; da Vinci sales made up roughly 24% of the income statement's top line in 2024.

Image source: Getty Images.

The rest of the medical device company's revenue comes from services, instruments, and accessories. Services are the smallest part of the business, at roughly 15% of revenue. So, the biggest business is selling instruments and accessories, which account for roughly 60% of overall sales.

That said, around 75% of the company's revenue is recurring in nature. That's an annuity-like income stream that grows with each new da Vinci unit installed. Recurring revenue is the true flywheel of the business, since robots need maintenance and parts over time. Notably, more use means more recurring revenue.

This is why it is important to know that 18% more procedures were performed with the company's da Vinci system in 2025 than in 2024. That's well above the growth rate of the installed base, showing strong patient demand for surgical robots, too. The company currently projects surgery growth of up to 15% in 2026.

Is the opportunity big enough?

There are future catalysts to consider here as well, with artificial intelligence a major opportunity. The company is already integrating AI into its products to assist surgeons. In late 2025, the company received FDA approval for an AI tool that provides real-time visual enhancements for doctors performing lung biopsies. While this is seemingly a small step, it could be a vital tool, given that the lungs are constantly moving. Essentially, any pre-surgery images would be out of date by the time the surgery began. Looking further out, it isn't a stretch to think that AI could, someday, perform surgery all on its own.

Still, Intuitive Surgical's strengths and opportunities haven't gone unnoticed on Wall Street. The stock is trading with a price-to-earnings ratio of nearly 67x. For comparison, the S&P 500 index (^GSPC 0.43%), which is trading near all-time highs, has a P/E ratio of 28 times. If you have a value bias, this is not a stock that you will find interesting.

NASDAQ: ISRG

Key Data Points

For growth investors, however, the story is a bit different. Intuitive Surgical's average P/E over the past five years was nearly 72 times. Compared to that, the current P/E looks a lot more attractive. That said, the average growth stock, using the Vanguard Growth ETF as a proxy, has a P/E ratio of just under 40 times. So, Intuitive Surgical is expensive, but not quite as expensive as it has been historically.

Understand what you are getting into

Intuitive Surgical appears to have a significant opportunity ahead as surgical robotics continues to advance. However, Wall Street is aware of the opportunity and has priced the stock accordingly. If you buy Intuitive Surgical today, you have to be willing to hold for the long term, or you may end up disappointed with your outcome. Indeed, drawdowns of 30% or more are not uncommon. If you are patient, it might make more sense to wait for a deep sell-off.