Nvidia (NVDA 0.72%) has been a no-brainer stock to own over the past few years and has delivered market-beating returns each year. While some investors may be growing concerned about an artificial intelligence (AI) bubble forming, the reality is that nearly every AI hyperscaler has plans in place to spend an incredible amount of money on AI computing capacity over the next few years. There are few companies better positioned to take advantage of this spending than Nvidia, and I think it's an incredible stock to buy and hold not only for 2026 but also five years beyond it.

I've got five reasons why Nvidia is a great stock to own in 2026, but there are likely countless more out there.

Image source: Getty Images.

1. Nvidia has sold out its production capacity

Nvidia announced during its third-quarter (Q3) earnings that it has effectively sold out of its cloud graphics processing units (GPUs). That shows just how massive the demand is for Nvidia's products. During Q3, Nvidia sold $51.2 billion of data center products, so it's not like Nvidia is selling a small amount either.

If there remains a supply constraint on computing capacity, Nvidia can charge a premium for its products. This will help keep Nvidia's margins high, boosting its earnings at an even faster pace than its revenue growth. Nvidia is still doing everything it can to increase production capacity, and this will be a trend to keep an eye on throughout 2026, but as of right now, being sold out indicates huge demand that isn't going away anytime soon.

2. New chip architecture is set to launch in 2026

Nvidia is also launching its new Rubin architecture, which will improve upon its Blackwell architecture. Rubin dramatically improves upon Blackwell's performance, requiring a fourth of the number of GPUs to train an AI model and a tenth of the number of GPUs to perform AI inference.

NASDAQ: NVDA

Key Data Points

Those improvements will drive many to purchase the newer, more expensive GPUs, boosting Nvidia's revenue growth even further. If you can get four-to-ten times the performance (depending on the task the GPU is set to), while paying maybe double the cost of the previous generation, that is a win-win for everyone involved.

3. China is back

In April 2025, the Trump administration stopped all GPU shipments to China. This caused a large hole in Nvidia's sales, but that looks like it will return in 2026. Nvidia will again be allowed to start selling its GPUs that meet export restriction requirements but will need to pay a tax on each GPU it sells to the U.S. government.

We'll see how successful this is, as Nvidia is likely passing this tax to its clients rather than eating it themselves. According to Reuters, there are orders for around 2 million H200 GPU chips from Chinese firms, which would provide an incredible amount of revenue. While there is no readily available price on an H200 GPU, some estimates peg its price at $30,000 to $40,000 a piece. That would translate into $60 billion to $80 billion in revenue for Nvidia. For reference, Wall Street believes Nvidia will generate $213 billion in revenue this fiscal year, so a return to the Chinese market would be a huge deal.

4. Nvidia isn't as expensive as some think

Somewhere over the past few years, Nvidia got the stigma that it is an expensive and overvalued stock, but that couldn't be further from the truth. The reality is, Nvidia's stock is actually quite cheap compared to its big tech peers.

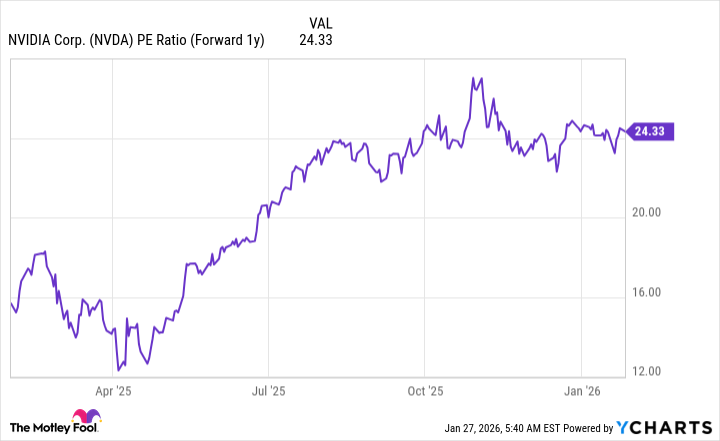

NVDA PE Ratio (Forward 1y) data by YCharts.

At 24 times fiscal-year 2027 earnings (ending January 2027), Nvidia is cheaper than many big tech companies that trade for 25-to-30 times forward earnings. This makes Nvidia a reasonably priced stock, and it could be a steal if its growth lasts beyond 2026.

5. Winners keep winning

Nvidia has a proven track record of success. That's something that cannot be replicated, and when a stock has as much momentum as Nvidia has alongside strong growth rates, it's nearly an unstoppable object. I don't want to bet against a company like this and would like to invest alongside it, and its history of outperformance is just another solid reason to invest in the stock for 2026.