Michael Burry achieved fame when he correctly predicted the housing crisis in 2008. Now he has made another controversial investment call. While it may not be as bold as his 2008 prediction, it is likely to capture the attention of investors.

His latest contrarian call involves purchasing shares of GameStop (GME +4.69%) stock. Although Burry was a GameStop shareholder in the past, the reasoning behind his move back into the stock may come as a surprise to investors, and here's why.

Image source: Getty Images.

Michael Burry and GameStop

Burry said he was not buying GameStop for its underlying business. Instead, he believes in its leader, CEO Ryan Cohen. He went so far as to compare Cohen to Warren Buffett, claiming GameStop could become a business like Berkshire Hathaway.

Buffett famously bought Berkshire in 1962 when it was a struggling New England textile manufacturer. He wholly redefined the business, investing in what he deemed high-quality companies during market downturns.

Indeed, some of Cohen's moves make such a comparison understandable. He added digital commerce to a dying retail video game business. He has also invested in collectibles and has invested some of the funds in Bitcoin.

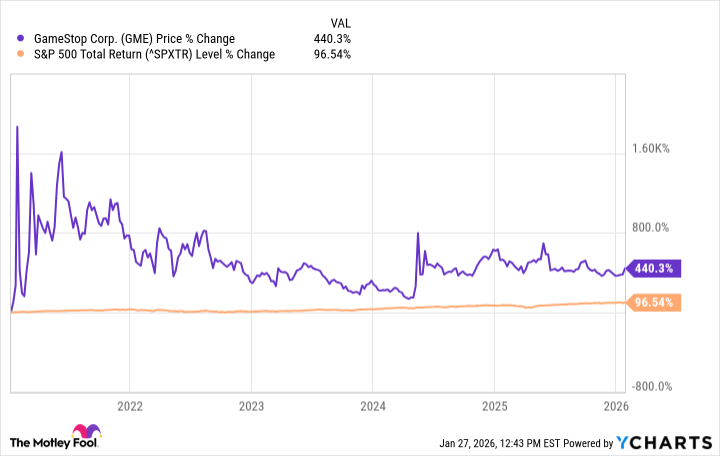

However, Cohen's largest investment may be GameStop stock itself. He now owns about 42.1 million shares, approximately 9% of the outstanding shares, and could receive options on more than 171.5 million shares if he meets certain performance goals. Since Cohen joined GameStop's board in January 2021, his vision has helped GameStop outperform the S&P 500.

Cohen as the next Warren Buffett

Despite such successes and Burry's optimism, it is likely premature to make Warren Buffett comparisons.

Indeed, Buffett frequently reinvested funds in Berkshire shares, as Cohen has bought shares of GameStop. Also, collectibles (which can be investments in themselves) and the Bitcoin purchase could pay off for GameStop shareholders.

Nonetheless, most of Cohen's efforts have so far involved remaking GameStop, and the only outside investment so far is the Bitcoin purchase. Hence, Cohen does not yet have an investment that compares to Berkshire's purchases of American Express or Coca-Cola. For this reason, investors will probably have to wait to see if such a comparison is valid.

NYSE: GME

Key Data Points

Is GameStop the next Berkshire Hathaway?

Ultimately, no one knows if GameStop is going to become a company like Berkshire Hathaway, and investors should probably avoid making aggressive purchases on that hope.

Cohen has turned a dying company into a market-beater, and over time, his investment prowess could turn GameStop into a conglomerate, making Burry's prediction come true.

Still, other than beating the market with GameStop stock itself, Cohen's ability to build such a business remains unproven. Thus, investors should probably take speculative positions in GameStop until Cohen makes more outside investments that boost its stock.