It's barely a full month into 2026, but there have already been significant price movements for some notable stocks on equity markets.

Take Shopify (SHOP 9.86%), an e-commerce leader that crushed the market last year. Things aren't starting so well this time around, with the company's shares already down 16%.

Despite this poor performance, there are good reasons to invest in Shopify for the long haul.

Image source: Getty Images.

The underlying business is strong

Shopify's performance in 2025 was no fluke. The company's financial results were strong throughout the year. In the third quarter, revenue jumped by a solid 32% year over year to $2.8 billion, driven by 32% growth in gross merchandise volume, which reached $92 billion for the period.

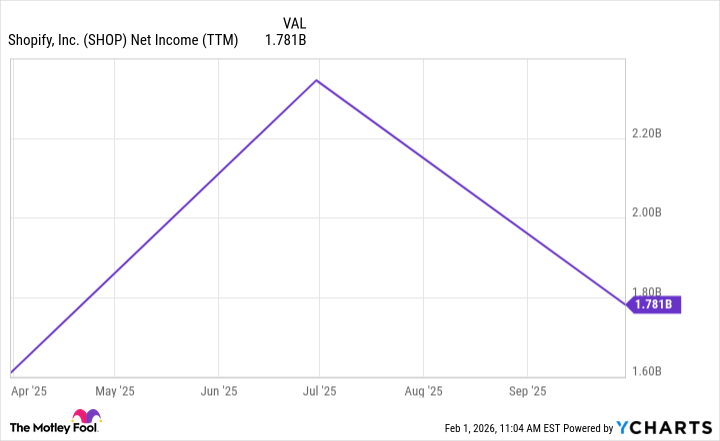

Importantly, Shopify has made significant strides toward profitability. The company's net income declined year over year in the third quarter due to the impact of an equity investment, but it is profitable over the trailing 12 months.

SHOP Net Income (TTM) data by YCharts

So, Shopify is doing well overall. But the company's shares seem overvalued. Shopify is trading at 75.7 times forward earnings, which seems too high by almost any standard, especially compared to the sector average of 26.3.

NASDAQ: SHOP

Key Data Points

Let's take a closer look

Shopify's business is going strong. That likely won't stop anytime soon. The company is a leader in its niche of the e-commerce market, helping merchants build online storefronts and providing a wide range of services to make running an e-commerce business as simple and seamless as possible. Shopify has found significant success, and with retail still growing, the company should ride that wave for a long time.

Will valuation remain an issue? Shopify hasn't been profitable for that long, so valuation metrics like forward price-to-earnings are less meaningful than they would be otherwise.

Even by other metrics, like the price/earnings-to-growth (PEG) ratio, Shopify's shares look less expensive. The company's PEG is a far more reasonable 1.1 (the undervalued range starts at 1 and below, so long as it is positive). Further, for investors willing to hold shares for, say, a decade, valuation will be far less of a problem.

Shopify may encounter significant volatility in the near term (as it often has since its 2015 IPO), but the company is well positioned to deliver above-average returns given the rapid growth of the e-commerce industry and its position in it. That's why the stock is worth investing in even at current levels, and especially after a 16% drop this year.