Microsoft (MSFT 2.86%) has been one of the best tech stocks to own over the past five years. Although its performance during that stretch doesn't stack up to Nvidia's, it has still done quite well.

Before a sell-off following Microsoft's fiscal 2026 second-quarter earnings (for the period ending Dec. 31) release, its stock had more than doubled in value over the past five years. Following the sell-off, the five-year return has fallen to about 85.5%, just barely underperforming the S&P 500, which is up 87% over the same time frame.

I think this sell-off is a bit absurd, and now is the perfect time to buy the dip on the stock. I have three reasons it's an excellent choice now, and I think it can easily return to market-beating status over the next few months.

Image source: Getty Images.

1. Microsoft's cloud-computing revenue is growing rapidly

While Microsoft manages several business segments, what investors are most interested in is the health of its cloud computing division, Azure. It has been the backbone of the growth that has driven the stock higher over the past few years.

Azure is a clear beneficiary of AI spending because clients can use it to gain access to computing power that allows them to train and run AI models. For the second quarter, Microsoft delivered another impressive report, with Azure revenue rising 39% year over year. Management had told investors to expect 37% growth when it gave guidance for the fiscal third quarter, so this result was a great one.

NASDAQ: MSFT

Key Data Points

This outperformance theme was present throughout all of the results, as two of its three major divisions outperformed expectations. However, the market was looking for a bit more and sold off the stock as a result.

Whenever you see a company hit or exceed internal expectations, yet the stock still sells off, it's a sign that the market is likely being irrational with its expectations. And that is a strong buying opportunity.

2. Microsoft's OpenAI investment continues to soar in valuation

Although users can get access to a wide variety of generative AI models on its Azure platform, the company prefers them to use ChatGPT, made by OpenAI. Microsoft is a major investor in OpenAI and holds about a 27% stake in the business, so it benefits when OpenAI's models are used. There are rumors of OpenAI targeting an initial public offering later this year, and if it rolls out, Microsoft may be able to cash out some of its investment at an opportune time.

We'll see how Microsoft's OpenAI investment pans out over the next few years, but so far, it has been the market's only way to own a part of OpenAI's business.

3. The share price is reasonable

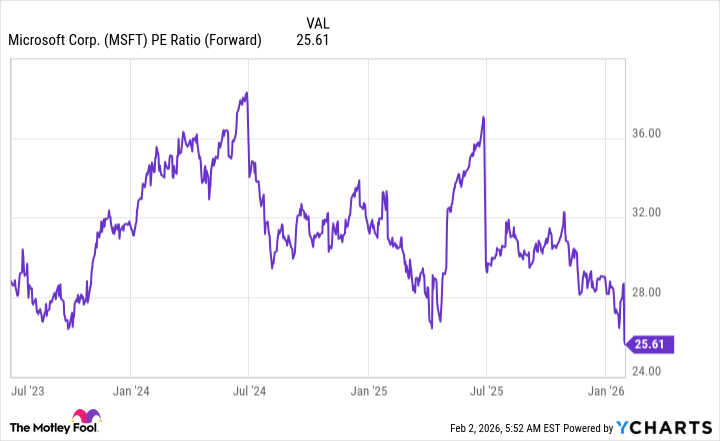

Following the sell-off, the stock looks well-priced. It now trades for less than 26 times forward earnings, a level that it has rarely seen over the past three years.

Data by YCharts: PE = price to earnings.

Microsoft earned its previous premium, since it had top-notch execution alongside a strong growth trajectory. None of that thesis changed following the second-quarter earnings release, but the stock dropped 10%. As a result, investors should use this opportunity to buy shares at a solid discount.

It isn't often Microsoft's stock goes on sale, and now is a great time to take a position in it. The company has $625 billion in remaining performance obligations in its Azure business, which equates to huge growth over the next few years since the AI race is far from over. That gives Microsoft plenty of room to continue growing and will be a top reason to own the stock over the next five years.