If you want to invest in quantum computing, IonQ (IONQ 3.68%) probably comes to mind first. It's a pure play, it's publicly traded, and it's got buzz. It even generates about $80 million of annual sales, making it closer to a successful business operation than the other quantum specialists.

But is IonQ the best way to bet on this groundbreaking technology? I don't think so. The five following stocks have serious quantum computing programs, stronger balance sheets, and diversified businesses. If their quantum research projects don't result in cash-cow businesses over time, they can fall back on their other operations.

In short, I expect all of them to be worth more than IonQ in five years. For the record, IonQ's market cap is $13.7 billion as of this writing on Feb. 2, 2026.

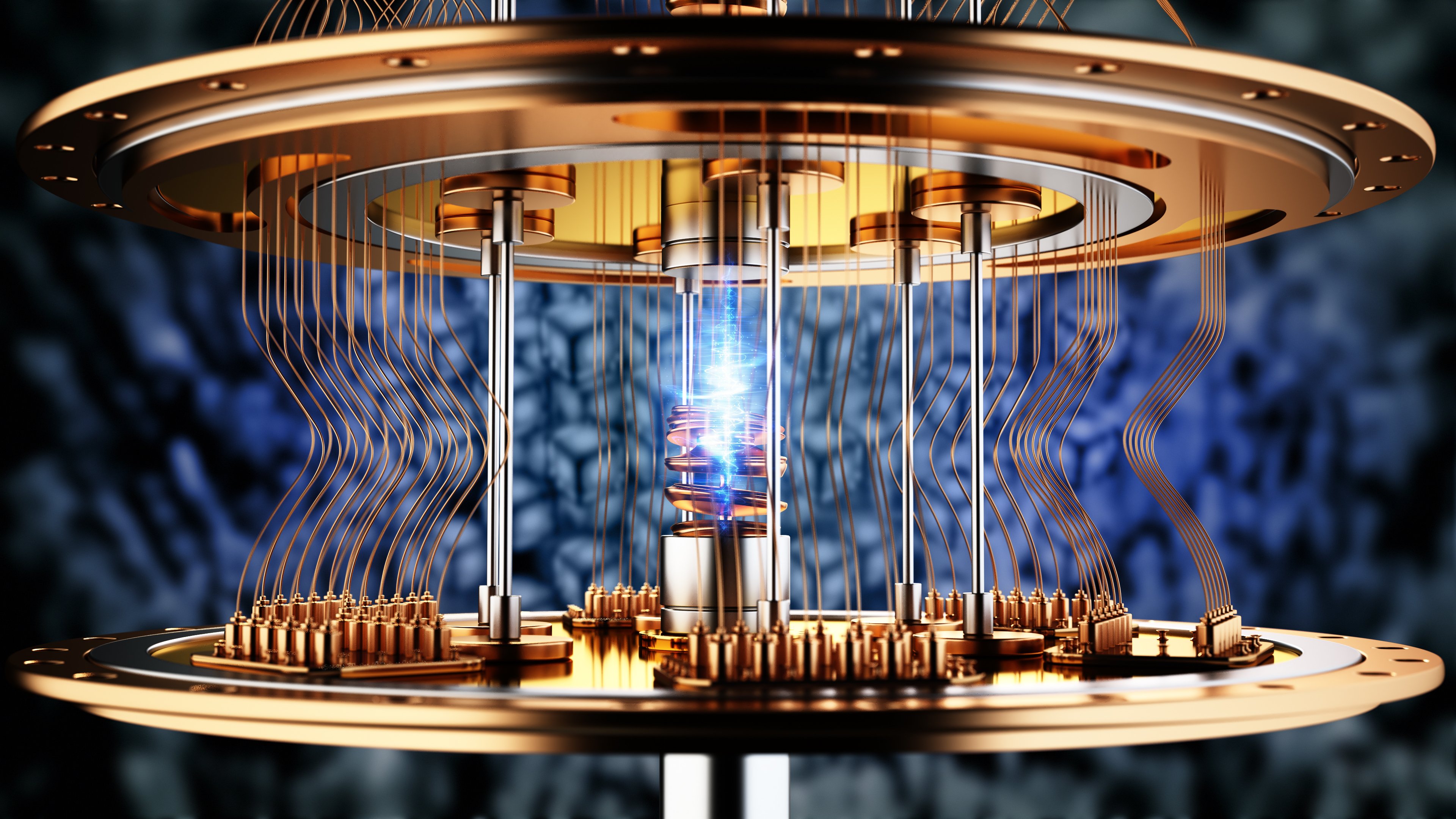

Image source: Getty Images.

At $144.8 billion, Honeywell is more than thermostats

Most investors don't associate Honeywell (HON +1.55%) with cutting-edge quantum research. That's understandable. The company is better known for aerospace components and building technologies. The builder put a Honeywell thermostat in my house, for example.

But Honeywell has been quietly building one of the strongest positions in quantum computing through Quantinuum. Honeywell formed this standalone company in 2021 by merging its Quantum Solutions division with Cambridge Quantum. Yes, I'm talking about the famous British university, which has close ties to this organization. Cambridge Quantum was founded by Ilyas Khan, a longtime Cambridge University fellow.

Quantinuum combines Honeywell's trapped-ion hardware with Cambridge Quantum's software expertise, and the results have been impressive. The company has posted industry-leading scores on quantum volume benchmarks and is already generating revenue from enterprise customers. Honeywell shareholders get exposure to this upside without betting the farm on it.

The core business provides ballast; Quantinuum adds optionality. Quantinuum is planning a public offering in 2026, but Honeywell remains the largest shareholder with a 54% stake and is the safer way to approach this quantum computing leader.

Intel's $243.6 billion market cap has room for an under-the-radar quantum play

Investors don't see Intel (INTC 0.26%) as a quantum computing researcher. They think about CPUs, foundry struggles, and missed opportunities in AI. Quantum computing rarely enters the conversation.

But Intel has been quietly working on quantum hardware for years, and its approach is different from most competitors. Instead of exotic technologies like superconducting circuits or trapped ions, Intel is betting on silicon spin qubits. The Tunnel Falls processor, released in 2023, puts 12 qubits of crypto processing hardware on a chip manufactured with processes Intel already knows well.

The logic is simple: If quantum computers eventually need millions of qubits, the company that can fabricate them at a massive scale will win. Intel knows semiconductor manufacturing better than anyone, aiming to challenge sector leader Taiwan Semiconductor (TSM +0.15%) over time. That expertise could matter a lot in five years.

NYSE: IBM

Key Data Points

IBM's $293.7 billion empire includes quantum's biggest fleet

IBM (IBM 4.50%) isn't a secret quantum play. It's one of the most visible options. But investors still underestimate how far ahead Big Blue is.

The company has been building quantum computers since the 2010s and now operates the largest fleet of quantum systems available to the public. Its Condor processor crossed 1,000 qubits in 2023, and the company has published a detailed roadmap stretching to 2033.

IBM also generates real revenue from quantum through its IBM Quantum Network, which gives enterprise customers cloud access to its hardware. This isn't a research project buried in some lab. It's a functioning business unit with paying clients, delivered as a cloud computing service.

IonQ gets the hype, but IBM has the infrastructure.

Amazon's $2.6 trillion cap includes a quantum side hustle

Did you know Amazon (AMZN 0.66%) has a quantum computing division? Many investors don't.

But it's obvious when you think about it. As part of the market-leading Amazon Web Services platform, Amazon offers Amazon Braket. This cloud service provides access to quantum hardware from several providers, including IonQ and Rigetti Computing (RGTI 3.57%) systems.

Amazon is also building its own quantum computers at a dedicated research center in California. The company hasn't made splashy announcements, but the strategy is classic Amazon: build the infrastructure layer, let the ecosystem develop on top, and then collect rent in the long run.

If quantum computing goes mainstream, Amazon plans to be the landlord.

NASDAQ: NVDA

Key Data Points

$4.5 trillion giant Nvidia is focused on a small part of the quantum market

What's Nvidia (NVDA 1.14%) doing on a quantum computing list? Fair question. Nvidia doesn't make quantum hardware, after all.

But every quantum computer needs classical systems to function. Digital CPUs and co-processors are crucial for functions such as control, error correction, simulation, and post-processing. Nvidia's CUDA-Q platform is designed for exactly this, and the company has partnered with quantum players across the board.

In this sector, Nvidia is a picks-and-shovels play. Nvidia doesn't need to bet on superconducting versus trapped-ion versus silicon spin. It wins as long as someone figures it out. Everyone needs the control systems and management software.