"The one that got away" stories are common in life. Whether you're talking about a past significant other, a big fish, or a stock, everyone has something that has gotten away from them. For many investors, Nvidia (NVDA 3.18%) might seem like the one that got away. From Jan. 1, 2023, to Jan. 30, 2026, the stock has risen by over 1,200%. That turned $10,000 invested into more than $130,000.

Unfortunately, many investors, including myself, downplayed the potential of huge AI spending. However, I recognized my mistake and purchased shares last April during the marketwide pullback, and the stock has been a huge winner ever since. I think there's still time for investors to pivot and invest in Nvidia. Although they won't be able to re-create 1,200% returns, I still think there is a huge market-beating opportunity here, and investors aren't too late to benefit from one of the greatest stock picks of our lifetime.

Image source: Nvidia.

Nvidia's growth trend isn't expected to wrap up for several years

Although there have been many calls about Nvidia's stock being in a bubble, those have all proved wrong so far. The reality is that AI hyperscalers are still spending huge amounts on building out AI computing capabilities. Nvidia's graphics processing units (GPUs) are the go-to computing units for AI training and inference right now, so it is benefiting from this massive spending spree more than nearly any other company in the market.

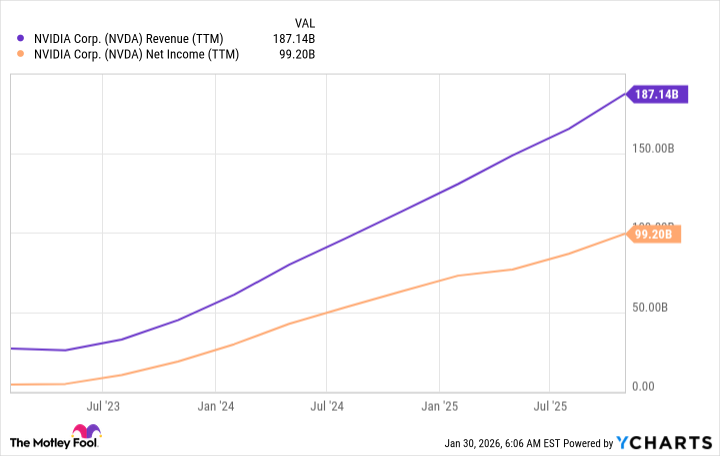

This has led to massive growth for the company. Since 2023, its revenue and net income have skyrocketed.

NVDA Revenue (TTM) data by YCharts.

While that's impressive growth, the trend is expected to last for more years.

For fiscal year 2026 (ending January 2026), Wall Street analysts expect 63% revenue growth. For FY 2027, they project 52%. While that is a slowdown, it's still incredible growth for the largest company in the world.

Additionally, Nvidia believes that global data center spend will reach $3 trillion to $4 trillion by 2030. That's up from $600 billion in 2025, indicating a 42% growth rate over that five-year time frame. That illustrates that Nvidia's growth story is just getting started, and if Nvidia's growth rate manages to stay above 40% through 2030, it will reach heights never before seen in the stock market.

NASDAQ: NVDA

Key Data Points

I think this makes Nvidia a no-brainer buy right now, as it's still playing a critical role in the buildout of generative AI capabilities. While it's not going to rise 1,200% in three years again, I think a double or a triple is entirely possible between now and 2030, thanks to huge AI spending.