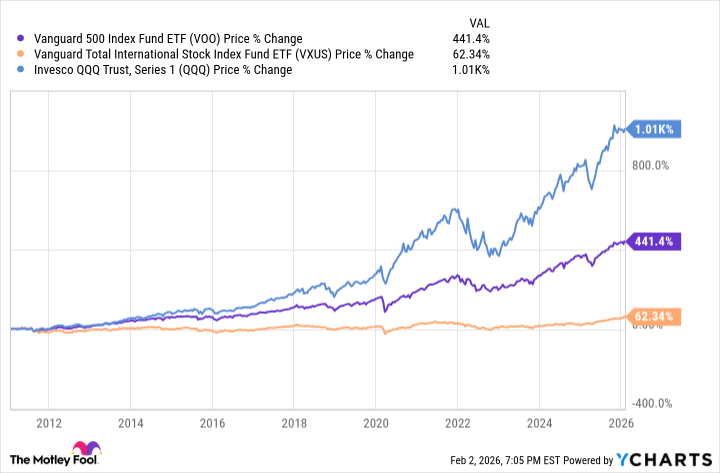

For most of the past 15 years, the U.S. stock market has been the envy of the world. Since the start of 2011, the S&P 500 index is up 441%, while the tech-heavy Nasdaq-100 is up by more than 1,000%.

Equity markets in the rest of the world have also grown, but at paces that have lagged Wall Street. The share price of the Vanguard Total International Stock ETF (VXUS 0.07%), which tracks stock markets outside the U.S., is up by only 62% in the past 15 years. Even on a total return basis (factoring in the reinvestment of its dividends, which have yielded an average of 2.8% since the fund's inception in January 2011), it's only up by about 156%, with average annualized returns of 6.3%. That's still well behind the major U.S. indexes.

But this trend of the U.S. stock market beating the world might be coming under pressure. During the past year, the Vanguard Total International Stock ETF gained 32.8%, double the 16.4% return of the S&P 500 index. It even outperformed the Nasdaq-100, which was up 20.9%.

There are a few big reasons why this could be a good time to buy international stocks, and why you might specifically want to add this Vanguard ETF to your portfolio.

The risks of the "sell America" trade

A big theme among international investors in 2026 is the "sell America" trade. If that trend solidifies and accelerates, more investors around the world might choose to sell assets like the U.S. dollar, U.S. government bonds, and U.S. stocks.

Possible underlying reasons that could drive the "sell America" trade include worries about the excessive valuations of American technology stocks, concerns about U.S. foreign trade policy and tariffs, and doubts about the continued independence of the Federal Reserve. If investors fear that America is becoming a less trustworthy destination for capital, the resulting loss of confidence could show up in the form of rising U.S. bond yields, a higher price of gold, and a weaker dollar.

Image source: Getty Images.

Is the "sell America" trade really happening? Signals are mixed. In the past year, the yield on the U.S. 10-year Treasury has dropped from about 4.6% to 4.3% -- but it's up by around 0.3 percentage points from its recent lows in October 2025. The price of gold is up by 68.6% in the past year, but also down by more than 14% from the all-time high it touched in January.

Global investors don't seem to be panic-selling U.S. assets just yet. But the U.S. dollar has gotten considerably weaker in the past year, losing 13% of its value against the euro. For American investors, getting some portfolio protection against the impacts of a weak dollar could be one of the best reasons to increase their exposure to international stocks.

Why this Vanguard international stock ETF is a good choice

The Vanguard Total International Stock ETF holds a portfolio of more than 8,600 stocks, and charges shareholders a low expense ratio of 0.05%. This gives you broad exposure to the global economy beyond America, and spares you the trouble of trying to pick among sectors or choose which countries' stock markets you think will do better than others.

NASDAQ: VXUS

Key Data Points

Some of the fund's top holdings include well-known chip manufacturers like Taiwan Semiconductor Manufacturing, consumer brands like Samsung Electronics, major pharmaceutical companies like Roche and AstraZeneca, and household names like Nestle and Toyota. But among its extensive holdings, only TSMC, Chinese tech giant Tencent, and Netherlands-based semiconductor equipment leader ASML account for positions larger than 1% of the portfolio.

The future of international stocks could be bright. The 2026 Vanguard Economic and Market Outlook report projects that non-U.S. stocks will deliver annualized returns in the 4.9% to 6.9% range for the next 10 years. The forecast range for U.S. stocks is only 4% to 5%.

Whether the "sell America" trade becomes a real long-term challenge for U.S. assets or not, American investors might benefit from diversifying into international stocks in 2026. And buying the Vanguard Total International Stock ETF would be an easy, low-cost way to do it.