Breakfast News: Alphabet's AI Costs Soar

July 24, 2025

| S&P 500 6,359 (+0.78%) |

|

| Nasdaq 21,020 (+0.61%) |

|

| Dow 45,010 (+1.14%) |

|

| Bitcoin $118,163 (-1.35%) |

|

Source: Image Created by Jester AI.

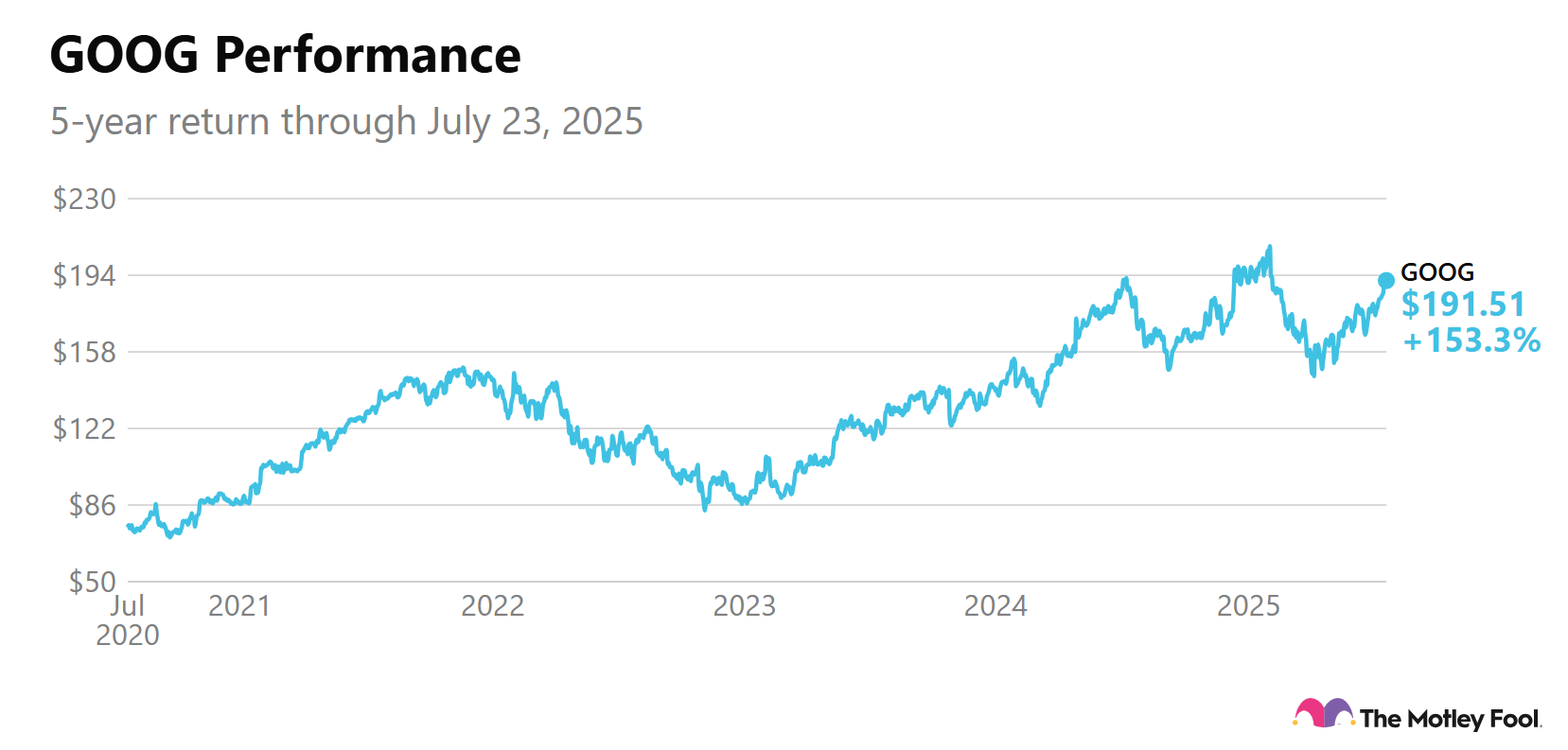

1. GOOG Earnings: Strong Growth, High Capex

Alphabet (GOOG -0.18%) posted second-quarter revenue and earnings beats yesterday. Despite significantly increased expenditure, which investors tend to punish in the market, the stock is up 3% in pre-market trading on hopes AI growth can boost long-term revenue.

- "The price to the AI show keeps climbing for hyperscalers": Fool chief investment officer Andy Cross noted Alphabet's capital expenditure is soaring ahead of buybacks. Buyback spend this quarter reached just 0.6 times capex – last year it came in at 1.18 times.

- "We continue to look at both our retention metrics, as well as the new talent coming in": Asked by Bernstein analyst Mark Shmulik about poaching between top AI companies, Alphabet CEO Sundar Pichai said it's not all about the money.

2. Tesla Falls Over 5% on Q2, Bets on Robotaxi

Tesla (TSLA -1.89%) fell before the market opened this morning, even though Q2 earnings matched Wall Street estimates with revenue slightly ahead. With car sales declining, the company said it's at a "seminal point" as CEO Elon Musk pinned hopes on two key developments.

- Robotaxi to reach "half the U.S. population" by the end of 2025: Musk described the required growth scale as "hyperexponential," adding approval for full self-driving can help sales to "improve significantly" in Europe.

- "Let the cat out of the bag there. Dancing cat that can talk and sing and dance": Perhaps accidentally revealing Tesla's upcoming affordable model will closely resemble the Model Y, Musk said price is the biggest hurdle to uptake, adding self-driving means "a very big deal when people can release their car to the fleet and have it earn money for them."

3. CMG, STM Fall on Weak Q2, NOW Rises

Long-standing Rule Breakers recommendation Chipotle (CMG 4.12%) lost 10% in pre-market trading after the company posted its second straight quarter of falling sales. Full-year guidance was lowered, with year-over-year comparable sales expected to be flat.

- Down 10% in pre-market trading: Netherlands-based semiconductor maker STMicroelectronics (STM -0.17%), which supplies chips to Apple (AAPL 0.40%) and Tesla, reported a Q2 loss of $133 million after it was hit by restructuring costs. The stock was already down 4.9% at market close.

- "Q2 was a spectacular quarter across the board": Gina Mastantuono, CFO of Stock Advisor rec ServiceNow (NOW 0.36%), told Barron's the company's AI-powered software should improve productivity and drive growth, after strong Q2 revenue and earnings beats. The stock popped 7% in early trading.

4. What to Watch on Thursday

Recommended across multiple TMF services, Kinsale Capital (KNSL 5.38%) will report Q2 after today's close. Q1 was hit by disaster-related insurance losses, as analysts expect an earnings rise of 18% year over year in Q2.

- Moneyball Superscore of 70: Hidden Gems rec Tractor Supply Company (TSCO -0.64%) posted a 4.5% rise in Q2 net sales to $4.4 billion this morning, reaffirming guidance for full-year sales growth between 4% and 8%.

- Building on Q1 growth: Oncology researcher Novocure (NVCR 4.34%) saw a 6% Q2 revenue rise, following on from Q1 beats. With new launches in the pipeline, CEO Ashley Cordova described the quarter as pivotal.

5. Your Take

If you were the CEO of Tesla for a day and you can eliminate one competitor, who do you eliminate and why? Become a member to hear what your fellow Fools are saying!