Breakfast News: Meta And Microsoft Surge

July 31, 2025

| Wednesday's Markets |

|---|

| S&P 500 6,363 (-0.12%) |

| Nasdaq 21,130 (+0.15%) |

| Dow 44,461 (-0.38%) |

| Bitcoin $117,175 (-0.38%) |

Source: Image Created by Jester AI.

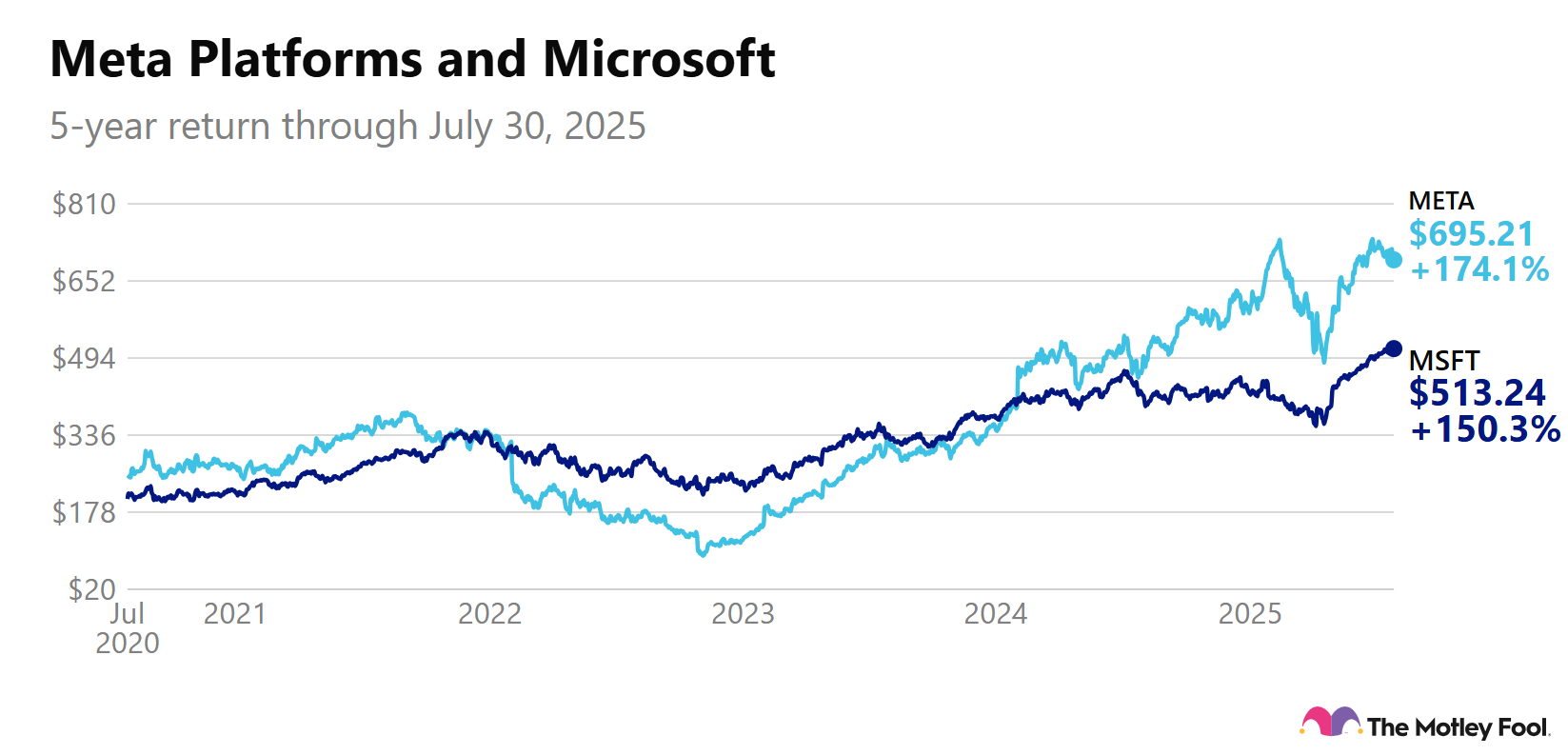

1. Meta Soars Over 10% on Strong Q2 Results

Meta Platforms (META 0.42%) rose more than 11% after the closing bell thanks to quarterly revenue and earnings beating analyst expectations, with investors happy with the ramp up in capex spend as the focus on AI and superintelligence gathers pace.

- "We really believe that this is a time for us to really make investments in the future of AI": CFO Susan Li underscored AI technology, already integrated into ads products, is making meaningful revenue and should continue to do so.

- #2 in Rule Breakers July rankings: Fool analyst Loren Horst explains "at a $69 billion midpoint for FY25 capex guidance, repeating this year's $32 billion increase vs. FY24 could make Meta the first ever to spend $100 billion in a year on capex in 2026... if Amazon (AMZN 0.60%) doesn't get there first in 2025."

2. Cloud Drives Microsoft's Earnings Beat

Microsoft (MSFT +0.51%) posted a 24% jump in Q2 earnings versus the same period last year, causing the stock to jump almost 9% after the market closed, with the cloud computing division being a key driver.

- Planned capital spending of $30 billion for the upcoming quarter: Fool analyst Seth Jayson said, regarding the capex spend, that if "repeated 3x, that'd be a $120 billion run rate, a lot more than the $85 billion (itself a big increase) Alphabet (GOOG +0.47%) pledged to spend in the upcoming year."

- Market cap set to push past $4 trillion this morning: CFO Amy Hood released an internal memo following the release, calling for a further push with intensity, as both the pace of change and customer expectations are set to continuously accelerate.

3. Mixed Results: TMDX Flies; QCOM, CFLT Fall

TransMedics (TMDX +1.85%) lifted up more than 13% in pre-market trading due to earnings per share for the quarter rising 163% versus the same period last year, with higher usage of systems relating to liver and heart transplant procedures.

- 23% revenue growth in non-smartphone areas: Qualcomm (QCOM 0.14%) dropped over 5% despite results beating expectations, with underperformance in the smartphone-related business as the company continues to try and diversify into other areas.

- Cloud sales growth dropped below 30% for the first time ever: Confluent (CFLT +0.02%) plummeted 29% after the market closed due to missing revenue expectations and offered a rather underwhelming outlook for the rest of the year.

4. Tech Earnings: Apple, Amazon, Roblox Report

Hidden Gems recommendation Apple (AAPL 0.56%) will report quarterly earnings after the closing bell, with investors hoping the company has continued to navigate tariff-related uncertainties to beat expectations like last quarter.

- Earnings per share estimates beaten for the past four quarters: Amazon is also set to release results after the market closes. The AI-powered web services cloud will be closely watched after underwhelming last quarter, as well as the impact of tariffs on retail operations.

- Beating the S&P 500 by 164% since Nov 2023 Stock Advisor rec: Roblox (RBLX +4.46%) reports before the market opens, with previous concerns around growth momentum dwindling hoping to be quashed, although analysts expect an adjusted loss of $0.38 per share.

5. South Korea Wins, Copper Loses in Tariff Updates

S&P futures rose over 1%, in part due to the U.S. agreeing a trade deal with South Korea. A further flurry of trade announcements saw U.S. copper prices fell almost 20%, as President Trump announced a 50% tariff on copper products.

- Blanket tariffs on exports to the U.S. set at 15%: The deal marks a reduction from the 25% levels threatened earlier, with a $350 billion fund set up by South Korea for U.S.-driven investments.

- New copper tariffs a "massive market surprise": Natalie Scott-Gray, a senior metals analyst at StoneX Financial, expressed shock as new measures exclude copper as a raw material but include semi-finished products such as pipes and wires.

6. Your Take

Meta is up 199% over the last 5 years. Across the same period, the S&P 500 is up 95%. Will Meta be a market-beater over the next 5 years? If so, will there be a significant gap or do you expect it to be close? Debate with friends and family, or become a member to hear what your fellow Fools are saying.