Breakfast News: AWS Powers Amazon Boom

October 31, 2025

| Thursday's Markets |

|---|

| S&P 500 6,822 (-0.99%) |

| Nasdaq 23,581 (-1.57%) |

| Dow 47,522 (-0.23%) |

| Bitcoin $106,451 (-3.77%) |

1. Amazon Soars Over 10% on AWS Growth

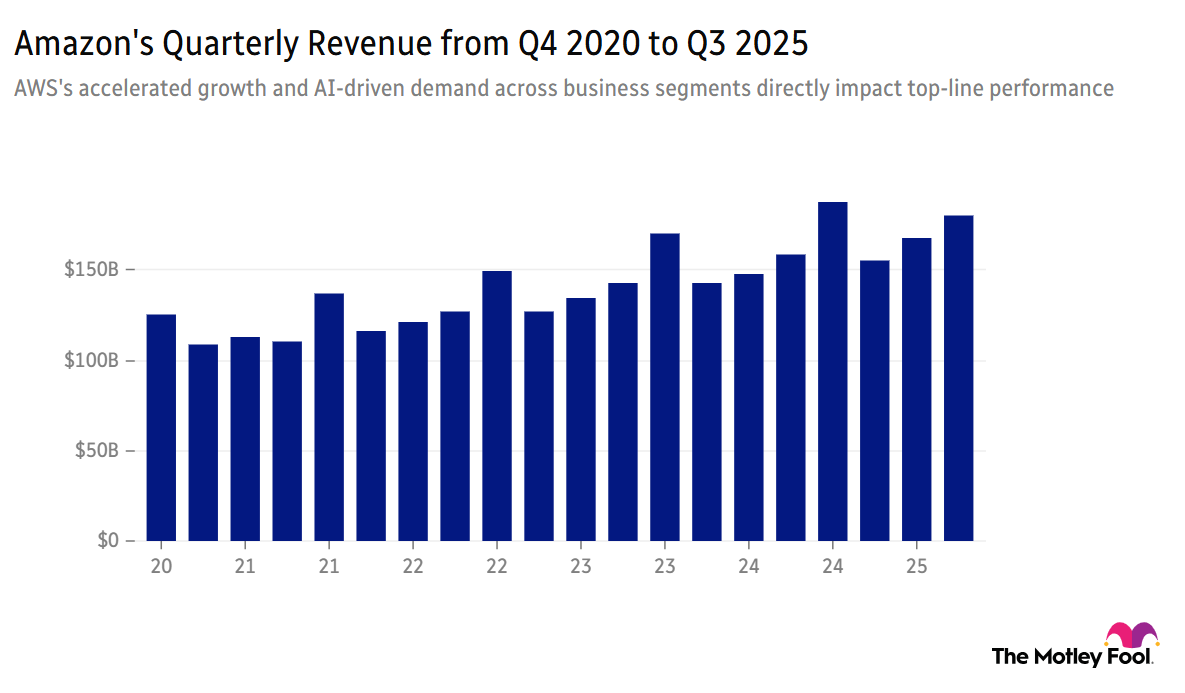

Amazon (AMZN +1.17%) jumped over 13% after the market closed thanks to the AWS cloud unit posting its largest revenue growth rate since 2022, enabling overall revenue and earnings to easily beat expectations.

- "We continue to see strong demand in AI and core infrastructure, and we've been focused on accelerating capacity.": CEO Andy Jassy said AI was driving meaningful improvements in every corner of the business, with Rufus (the shopping chatbot) expected to deliver an extra $10 billion in annual sales alone.

- "Amazon just keeps finding new ways to win": Fool contributing analyst Lou Whiteman recently suggested the broader rally is "fueled by continued excitement about artificial intelligence, cloud services, and Amazon's broad reach into consumer and business markets."

2. AAPL, TWLO, and NET Rise on Earning Beats

Apple (AAPL +0.03%) rose more than 2% following the closing bell after providing an upbeat December quarter outlook, with the company struggling to keep up with demand for new iPhone 17 models.

- "We saw broad-based strength across customer segments, ranging from start-ups to enterprises": Stock Advisor recommendation Twilio (TWLO 1.31%) popped 8% in pre-market trading after CEO Khozema Shipchandler raised revenue and profit forecasts for the full year.

- Beating the S&P 500 by 45% since June 2021 Rule Breakers rec: Cloudflare (NET 0.65%) surged almost 10% after the market closed due to results showing a 31% revenue increase as its AI products continue to attract clients.

3. Netflix Splits Stock, Eyes WBD Studio

Netflix (NFLX +0.58%) announced a 10-for-1 stock split, with Reuters reporting the company is actively exploring a bid for the studio and streaming business of Warner Bros Discovery (WBD 0.33%).

- "Reset the market price...to a range that will be more accessible to employees": Netflix detailed the reason for the stock split, the first one since 2015, as the 23% year-to-date gain has easily vaulted the share price beyond $1,000.

- Owning Warner Bros' studio business would provide control over iconic franchises: Should a bid be submitted and accepted, it would act to boost the existing content slate but also provide easier integration, as Warner Bros' studio already produces some of Netflix's hit shows.

4. Next Up: Berkshire and Dividend Investor Recs Report

Berkshire Hathaway (BRK.B 0.24%) will release quarterly earnings tomorrow, with low insurance claims likely to aid operating profits and a focus on the cash-balance change from $344 billion from last quarter.

- Beating earnings estimates in three of the past four quarters: Chevron (CVX 0.31%) continued the performance from last quarter, as net income declined by 21% versus last year, impacted by lower oil prices and tariff worries.

- Dividend yield of 4.97% versus the S&P 500's 1.14%: T. Rowe Price (TROW +1.16%) should also post earnings ahead of the market opening, with a focus on changes in assets under management (AUM) and investment advisory fees.

5. Happy Halloween!

Which industry or sector gives you the creeps right now, and why are you avoiding it? Share with friends and family, or become a member to hear what your fellow Fools are saying.