Breakfast News: Musk Wins $1T Pay Vote

November 7, 2025

| Thursday's Markets |

|---|

| S&P 500 6,720 (-1.12%) |

| Nasdaq 23,054 (-1.90%) |

| Dow 46,912 (-0.84%) |

| Bitcoin $101,295 (-2.35%) |

1. Musk Pay Deal Passes With Focus on Products

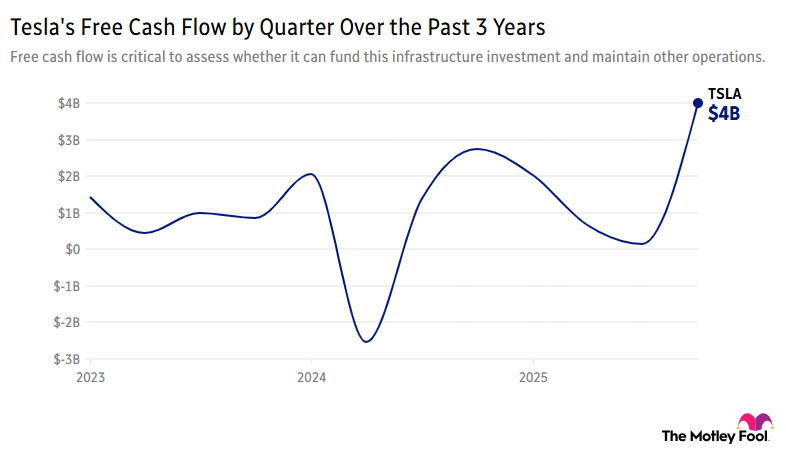

Tesla (TSLA 2.10%) board members approved CEO Elon Musk's compensation plan with over 75% support, which will vest if Tesla hits certain milestones, with the first one activated if the market cap exceeds $2 trillion. Up around 1.5% in pre-market trading, the shares are beating the S&P 500 by 113% since our 2023 recommendation in Stock Advisor.

- The "most exciting, whether it works or not, demo of any product ever": Musk confirmed the highly anticipated Roaster launch would be on April 1, with production roughly 12-18 months later. Production of the Cybercab was also announced for an April start.

- Proposed Tesla terra fab could rival capacity of existing chip giants: Musk said the growing demand needed to keep pace with his AI and robotics ambitions means Tesla could need to build its own "gigantic" chip fab, citing a lack of capacity from existing suppliers.

2. SA Recommendations Impress

Globus Medical (GMED 0.02%) surged almost 25% after the market closed thanks to topping earnings and revenue estimates as the recently acquired Nevro business continues to deliver financially.

- Customer retention rate above 95% for 11th consecutive year: The Trade Desk (TTD +0.50%) initially dipped then rose close to 2% following the closing bell, after increased demand for programmatic ads boosted quarterly revenue by 18%, although growing competition was noted.

- "It's never a sit-on-your-laurels type of company": Airbnb (ABNB +0.03%) was up over 5% in pre-market trading due to upbeat results as the company pushes international expansion. Fool analyst Alicia Alfiere previously noted "they've done a lot of product improvements that look to reduce the friction of booking/paying, and they're continuing to go after markets where they're underpenetrated."

3. Intellia, iRobot, and Doximity Fall on Earnings

Intellia Therapeutics (NTLA 1.56%) fell almost 20% when the market closed after quarterly results detailed how a client death caused a trial halt, with the related drugs studies being paused.

- Total robot units shipped declined 24% from the prior year: iRobot (IRBT +1.08%) slid over 15% in after-hours trading with revenue falling short of estimates, with a mix of higher costs and lower customer demand weighing on sentiment.

- 40% of sales from AI-optimized programs versus 5% a year back: Rule Breakers rec Doximity (DOCS 0.21%) fell close to 10% following the closing bell despite strong headline results, as management warned on ongoing policy and cost uncertainties going forward.

4. Next Up: Friday Pre-Market Results

Six Flags Entertainment (FUN +3.76%) reported before the market opened, with revenue meeting expectations but a net loss posted. This was partly due to having shifted more advertising spend to earlier this year, which impacted Q3 results. The stock rose around 1% in pre-market trading in response.

- Dividend raised twice since February 2023 Dividend Investor rec: Brookfield Asset Management (BAM 0.21%) is aiming to build on last quarter as it releases earnings ahead of the opening bell, as investors look not just for capital raises but how much is being deployed and monetized.

- Strategic pivot with past reliance on Covid-19 testing: Fulgent Genetics (FLGT 1.07%) should post quarterly results this morning, too. After raising full-year revenue guidance in August, further guidance will be key, along with any signs of flipping to a profit.

5. Your Take

The Trade Desk is down 44% over the last 5 years (following a 63% decline in the past 12 months). Across the same period, the S&P 500 is up 91.5%.

Will TTD be a market-beater over the next 5 years? Debate with friends and family, or become a member to hear what your fellow Fools are saying.