Breakfast News: WBD Draws Major Suitors

November 14, 2025

| Thursday's Markets |

|---|

| S&P 500 6,737 (-1.66%) |

| Nasdaq 22,870 (-2.29%) |

| Dow 47,457 (-1.65%) |

| Bitcoin $98,505 (-3.26%) |

1. WBD Bidding Heats Up as Deadline Nears

The WSJ reports Netflix (NFLX +1.08%), Paramount Skydance (PSKY 1.63%) and Comcast (CMCSA +0.31%) are preparing bids for Warner Bros Discovery (WBD 1.24%) ahead of a November 20 deadline.

- Warner Bros is currently moving forward to split studio and streaming business from cable network: Paramount reportedly is the only contender wanting the entire company, with Comcast and Netflix only interested in the studios and HBO Max streaming service.

- "WBD has some wonderful media brands": Back in June, TMF chief investment officer Andy Cross mentioned "the legacy weight of the cobbled together enterprise has been too much (incl $38 billion in gross debt). These companies are better apart, but still face stiff headwinds to get more dollars from the asset value like HBO, DC Studios, Discovery, etc."

2. AMAT and GLOB Struggle Whilst NU Impresses

Applied Materials (AMAT 0.97%) fell almost 5% after the market closed as quarterly results showed a sales decline with guidance for a further drop in the current period, with CEO Gary Dickerson saying growth was "tempered due to increased trade restrictions and an unfavorable market mix".

- Beating the S&P 500 by 45% since November 2023 Rule Breakers rec: Nu Holdings (NU 2.03%) popped 3% higher following the closing bell as earnings increased by 40% from a year earlier, with CFO Guilherme Lago noting AI "can help us accelerate growth with the same risk level."

- "Significant FX headwinds coming from LATAM currencies": Globant (GLOB 4.24%) fell over 10% in pre-market trading before recovering some of the losses, as CFO Juan Urthiague expanded on why adjusted earnings fell 6% for the quarter.

3. Stocks Fall as Fed Rate Cut Hope Fades

All major U.S. stock indices posted their steepest one-day declines in over a month, with futures contracts in the red ahead of the market open, as uncertainty around the looming Federal Reserve meeting and tech valuations weigh on investors.

- 67 stocks in the Nasdaq 100 closed the day lower: Large-cap tech names including Tesla (TSLA 3.65%) and Shopify (SHOP 3.97%) fell over 5%, as growth shares took the hardest hit.

- Lack of economic data clouding outcome for December Fed meeting: The probability of a 25bps rate cut (a positive for the stock market) has decreased from 95% a month back to 49.6%, according to the CME FedWatch tool.

4. GOOG Offers E.U. Ad Choice to Avoid Split

Alphabet (GOOG 3.89%) has confirmed it will provide publishers and advertisers across its ad tech services more choice and flexibility, as a way of settling an E.U. antitrust penalty order.

- "Our proposal fully addresses the EC's decision without a disruptive break-up": Alphabet stopped short of agreeing to sell any part of its business to address conflicts of interest, something the regulator may revert back on in coming months.

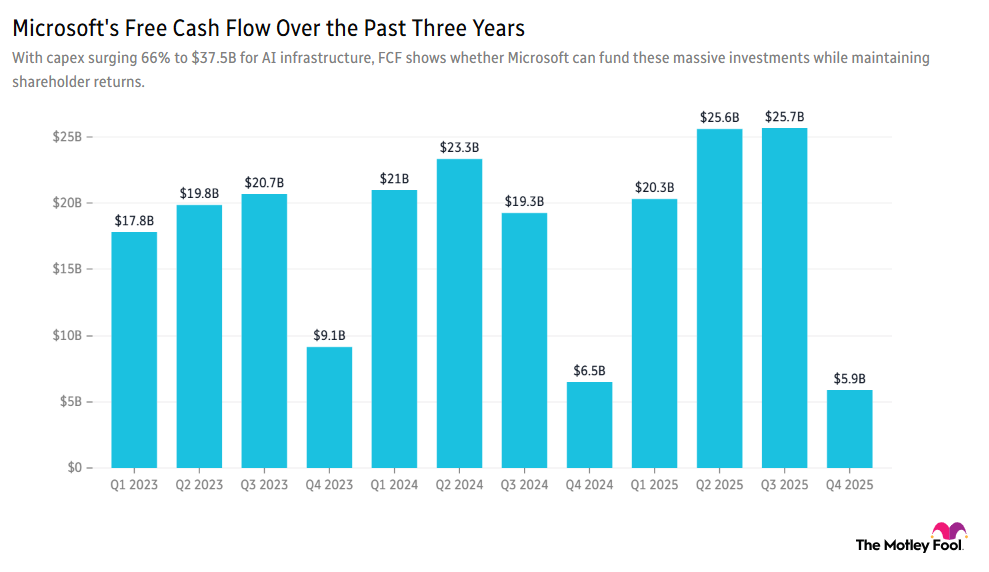

- $3.4 billion penalty might not be the end of the saga: The E.U. commission could still push for a breakup, using a precedent case from Microsoft (MSFT 3.36%) back in 2007 relating to the Windows operating system.

5. Your Take

Already this month, we've seen the Nasdaq pull back sharply twice. Are you treating these rotations out of tech stocks as a buying opportunity, or are you putting new investable dollars into other sectors – and if so, which? Discuss with friends and family, or become a member to hear what your fellow Fools are saying.