I've personally used Fidelity for over 10 years, and today, I manage 11 separate accounts on its platform. That includes everything from IRAs and HSAs to brokerage and custodial accounts for my kids and nephews.

Fidelity is my go-to brokerage recommendation for nearly everyone I talk to -- from beginner investors to folks managing a big portfolio. It also just won Best Overall Stock Broker in the 2026 Motley Fool Money Awards.

Here's my honest take on Fidelity, a review of its features, and what I love most about it.

Fidelity

Fidelity makes investing easy with $0 commission trades, powerful tools, and 24/7 support. Trade stocks, ETFs, options, and even crypto -- all in one place. Get expert insights, automate your investing, and potentially earn more on uninvested cash.

$0 commission for online U.S. stock and ETFs*. No account fees****.

$0****

At Motley Fool Money, brokerages are rated on a scale of one to five stars. We primarily focus on fees, available assets, and user experience; however, we also take into account features like research, education, tax-loss harvesting, and customer service. Our highest-rated brokerages generally include low fees, a diverse range of assets and account types, and useful platform features.

Our aim is to maintain a balanced best-of list featuring top-scoring brokerages from reputable brands. Ordering within lists is influenced by advertiser compensation, including featured placements at the top of a given list, but our product recommendations are NEVER influenced by advertisers. Learn more about how Motley Fool Money rates brokerage accounts.

At Motley Fool Money, brokerages are rated on a scale of one to five stars. We primarily focus on fees, available assets, and user experience; however, we also take into account features like research, education, tax-loss harvesting, and customer service. Our highest-rated brokerages generally include low fees, a diverse range of assets and account types, and useful platform features.

Our aim is to maintain a balanced best-of list featuring top-scoring brokerages from reputable brands. Ordering within lists is influenced by advertiser compensation, including featured placements at the top of a given list, but our product recommendations are NEVER influenced by advertisers. Learn more about how Motley Fool Money rates brokerage accounts.

What I like about Fidelity

There are a ton of reasons why I stick with Fidelity over other brokerage firms. Here are the biggest wins that keep me coming back.

No account fees, and no minimums

Account fees are a pet peeve of mine. So I only bank and invest with places that don't charge any. Fidelity offers no account minimums and no monthly maintenance fees. Better yet, many of its transaction fees for trading ETFs and funds are waived too.

This is extremely important for beginner investors. You don't want to be hit with sneaky fees that take away from the wealth pile you're trying to build.

Zero expense ratio index funds

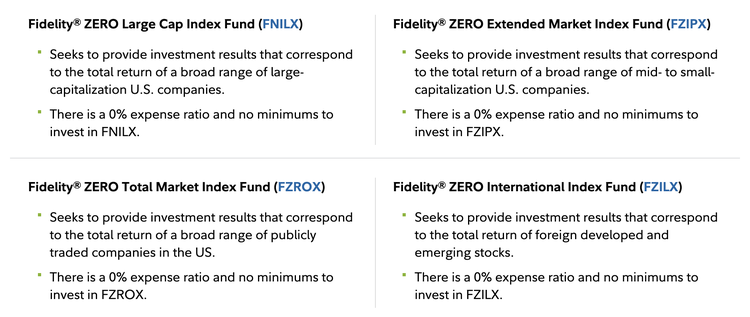

Fidelity recently introduced zero expense ratio index mutual funds. A big chunk of my long-term investments are parked in FZROX, which is Fidelity's Total Market Index Fund that charges a 0% expense ratio.

That means every single dollar I invest is working for me. Nothing is getting skimmed off the top.

Here's a screenshot of the funds it offers with 0% expense ratio (these also have no minimums to invest!)

Image source: Fidelity.com

Amazing customer service (even on weekends)

I don't have time to call financial companies during the week, so I love that Fidelity's support lines are open on Saturdays and Sundays. Its reps have walked me through some pretty complex stuff -- like rolling over a 401(k) or transferring assets from brokerage to brokerage.

Fidelity's remote support is excellent, but it also has physical investor centers if you ever need in-person help or want to work with an advisor. I've visited a few over the years, but most of my questions get handled right over the phone.

Tons of account options

Fidelity offers nearly every type of account you'll ever need. So if you're like me with a handful of different finance buckets and goals, you can manage everything within the same dashboard.

Here are some of the most common accounts Fidelity supports:

- Individual and joint brokerage accounts

- Roth and traditional IRAs

- Custodial brokerage accounts for minors

- 529 college savings plans

- Health savings accounts (HSAs)

- Business retirement plans (like SEP IRAs and solo 401(k)s)

- High-yield savings and cash management accounts

- Life insurance and annuities

Whether you're investing for the next 40 years or managing money for multiple family members, Fidelity is built to handle it and make it feel simple.

Trusted by millions (and trillions)

Fidelity is one of the largest brokerage firms in the world, managing trillions of dollars in assets. That kind of scale doesn't happen without trust and lengthy experience.

The company takes security seriously, with robust protections in place to keep your accounts safe. When you're investing your hard-earned money, it helps to know it's with a firm that's big, stable, and built to last.

Ready to start investing?

Downsides to consider

Nobody's perfect. And Fidelity has a few limitations that could be deal breakers for certain folks.

Not ideal for day traders

If you're into trading options, stocks, bonds, options, or crypto (I'm not, and I don't recommend it), Fidelity may feel a bit vanilla. The trading tools are solid, but not as specialized or super-advanced as other trading platforms.

Limited crypto options

Fidelity lets you trade some cryptocurrencies like Bitcoin, Ethereum, and Litecoin through a separate Fidelity Crypto account.

That's more than a lot of traditional brokerages offer -- but if you're deep into crypto and want access to dozens of altcoins, this probably isn't gonna cut it. These best crypto exchanges and apps might be a better fit.

Alternatives to Consider

We recommend comparing brokerage options to ensure the account you're selecting is the best fit for you. To make your search easier, here's a short list of our best trading platforms of 2026.

| Broker | Best For | Commissions | Learn More |

|---|---|---|---|

4.5/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Managing your finances under one roof | $0 for stocks, $0 for options contracts |

Learn More for SoFi Active Investing

On SoFi Active Investing's Secure Website. |

4.5/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Low-cost investing with a full-featured platform | $0 stock, ETF, and Schwab Mutual Fund OneSource® trades. No fees to buy fractional shares. |

Learn More for Charles Schwab

On Charles Schwab's Secure Website. |

5.0/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Full-service investing at every experience level | $0 commission for online U.S. stock and ETFs*. No account fees****. |

|

Who is Fidelity good for?

Like I mentioned earlier, I personally recommend opening a Fidelity account to anyone and everyone. But here are a few specific types of people that are a perfect match:

- Beginner investors

- Families opening custodial or college savings accounts

- Retirement-focused investors (Roth, traditional, SEP IRAs)

- People rolling over old 401(k)s

- Anyone who prefers hands-off, passive investing

- Folks who value great customer support and flexibility

If you're looking for a trusted partner for the long haul, not just a trendy trading app, Fidelity is a great brokerage to work with.

Related: Does Fidelity Offer Promotions?

Final thoughts

After more than a decade using Fidelity, it's still the brokerage I trust the most. I manage everything from retirement accounts to custodial investments for my kids -- all from one clean, easy-to-use platform.

Fidelity makes long-term investing feel simple and stress-free. It's a perfect broker for anyone who wants reliable service, broad account flexibility, and low-cost investing that just works behind the scenes.

Ready to get started? .

-

Sources

FAQs

-

Yes, Fidelity is one of the best brokerages for first-time investors. You can open an account in minutes, there are no account minimums or monthly fees, and it offers a ton of learning tools to help you build confidence as you go.

-

Fidelity has no account minimums and zero commissions for U.S. stock, ETF, and options trades. However, certain mutual funds and third-party services may come with fees, so it's always good to double-check before investing.

-

Yes, but the options are limited to just a few cryptocurrencies. If you're looking to trade a wide range of altcoins, you'll need to use a dedicated crypto exchange.

-

Yes. Fidelity is one of the most reputable brokers in the world with decades of experience. Accounts are protected by SIPC insurance (up to $500,000, including $250,000 in cash), and it uses strong encryption and two-factor authentication to keep your data secure.

Fidelity disclosure

Investing involves risk, including risk of loss

* - $0.00 commission applies to online U.S. equity trades and exchange-traded funds (ETFs) in a Fidelity retail account only for Fidelity Brokerage Services LLC retail clients. Sell orders are subject to an activity assessment fee (historically from $0.01 to $0.03 per $1,000 of principal). Other exclusions and conditions may apply. A limited number of ETFs are subject to a transaction-based service fee of $100. See full list at Fidelity.com/commissions. Employee equity compensation transactions and accounts managed by advisors or intermediaries through Fidelity Institutional® are subject to different commission schedules.

**Fidelity Crypto® is offered by Fidelity Digital Assets®. Investing involves risk, including risk of total loss. Crypto as an asset class is highly volatile, can become illiquid at any time, and is for investors with a high risk tolerance. Crypto may also be more susceptible to market manipulation than securities. Crypto is not insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation. Investors in crypto do not benefit from the same regulatory protections applicable to registered securities. Fidelity Crypto® accounts and custody and trading of crypto in such accounts are provided by Fidelity Digital Asset Services, LLC, which is chartered as a limited purpose trust company by the New York State Department of Financial Services to engage in virtual currency business (NMLS ID 1773897). Brokerage services in support of securities trading are provided by Fidelity Brokerage Services LLC (“FBS”), and related custody services are provided by National Financial Services LLC (“NFS”), each a registered broker-dealer and member NYSE and SIPC. Neither FBS nor NFS offer crypto as a direct investment nor provide trading or custody services for such assets. Fidelity Crypto and Fidelity Digital Assets are registered service marks of FMR LLC.

***Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Options. Supporting documentation for any claims, if applicable, will be furnished upon request.

****Zero account minimums and zero account fees apply to retail brokerage accounts only. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs) and commissions, interest charges, or other expenses for transactions may still apply. See Fidelity.com/commissions for further details.