Investing in profitable, market-leading companies which pay and increase dividends like clockwork is a potent strategy for building long-term wealth. Companies that master this formula gain quite a following. But how do you know when a dividend itself becomes the story, even while the fundamental outlook of a particular company may have declined?

In this series, we seek to determine if companies renowned for their dividend prowess are still persuasive investment ideas going forward. Sometimes a dividend "beast" begins to backslide, or worse, doesn't make sense anymore as a total return investment (a bust). Let's examine 3M (MMM 2.38%), the industrial conglomerate best known for its adhesives products, including Scotch Tape and Post-It Notes.

Dividend consistency, growth, and yield

3M boasts a truly stellar dividend record. The company has paid consecutive quarterly dividends for over 96 years, and has increased the amount of its annual dividend for 54 consecutive years. Only a handful of U.S. corporations can publish better dividend records than this. If you're looking for predictable income, there is a high probability that 3M will continue to pay regular dividends in the coming years.

The current annual dividend yield on 3M shares is quite decent at 2.5%. This falls in what I believe to be a sustainable range of between 2% and 5%. Less than 2% of return may beg indifference from investors who seek yield, yet 2% and above provides a return that is attractive versus the almost non-existent return of short-term U.S. Treasury securities.

Payout ratio and share repurchases

3M's dividend payouts and net income exist in a healthy proportion. The company's current payout ratio is 36.6%, an acceptable ratio which indicates that the company is not stretching resources too thin in order to float checks to its shareholders.

Investors in potential dividend beasts need to be particularly aware of share repurchases, or buybacks. While buybacks reduce the number of shares outstanding and increase earnings per share, they're not always the most efficient use of a company's resources. Ideally, we should look at the amount of cash a company pays out in dividends in a given year along with what it shells out to buy back shares. Too much cash allocated to these items together can be a warning sign that cash is being inefficiently utilized.

In 2011, 3M paid out dividends of $1.6 billion, and repurchased a net of $1.8 billion worth of shares. This total of $3.4 billion represented 77% of 3M's 2011 net income of $4.4 billion, and 64% of 2011 operating cash flow of $5.3 billion. In its three latest reported quarters (January through September 2012), 3M paid out $1.2 billion of dividends, and repurchased a net of $720 million worth of shares. This equates to 53% of net income and 58% of operating cash flow for the period.

In a nutshell, 3M has recently directed more than 50% of net income in the form of operating cash back to shareholders through dividend payments and share repurchases. This should give us pause: Are generous dividends plus sizable share buybacks the best way for 3M to utilize excess cash?

Relevant ratios and highlights from the financials

Reviewing the balance sheet, the company exhibits excellent liquidity. 3M's current ratio, the ratio of current assets versus current liabilities, is almost too high at 2.20. This alleviates some concern regarding the significant recent share repurchases; it's clear the company can absorb them. The company's debt-to-equity ratio is also in fine shape at 35%. As for valuation, the trailing-12-month price-to-earnings ratio of 15.2 is a bit pricier than the conglomerate industry's P/E ratio of 13.3, but investors may be willing to pay a small premium for steady price, revenue, and earnings growth:

Total return performance versus competitors

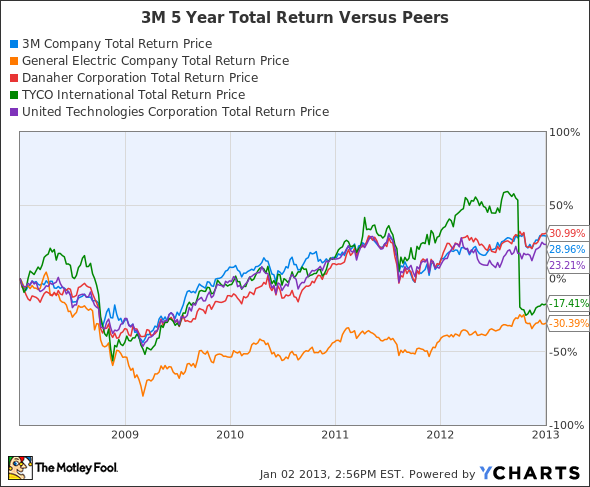

In a dividend investment strategy, you should reinvest your dividends as long as possible to increase both your holdings and your yield on original cost. For some perspective, we'll compare 3M's total return to other companies in the conglomerates sector. The following is a chart of price performance of 3M and competitors General Electric (GE 2.47%), Danaher, Tyco International, and United Technologies (RTX 0.36%) over the last five years:

MMM Total Return Price data by YCharts

During the period, 3M returned a total of nearly 29%, besting fellow industrial giant UTX by close to six percentage points. GE, which enjoyed a decent 2012, still lagged the group woefully during the five year period. Incidentally, GE's current dividend yield is 3.6%, a full point higher than either 3M or UTX (UTX has nearly the same yield as 3M, at 2.6%). Higher dividends don't always translate into higher total return.

Decision point

New CEO Inge Thulin projects solid annual EPS growth of 9%-11% over the next five years. The company plans to achieve this through organic sales growth of between 4% and 6%, acquisitions of $1 billion-$2 billion a year, improving operational performance, and continued share repurchases, among other factors. Investors should monitor the combination of dividends paid and share repurchases as outlined above on a quarterly basis. If the combined amounts relative to net income and operating cash increase much more from current levels, pay attention: true earnings growth may be waning. In sum, however, 3M continues to be a dividend beast, and should be considered a foundational stock in many long-term portfolios. Don't forget to reinvest those dividends.