Investors have always been interested in stocks that pay dividends, but lately, low interest rates on bonds and other fixed-income investments have made solid dividend payers even more valuable. Among the most promising dividend stocks in the market is Cincinnati Financial (CINF 0.37%), and one big reason is that it is one of the few exclusive companies to make the list of Dividend Aristocrats. In order to become a member of this elite group, a company must have raised its dividend payouts to shareholders every single year for at least a quarter-century. Only a few dozen stocks manage to make the cut, and those that do tend to stay there for a long time.

Cincinnati Financial is hardly a household name, even among those who generally follow the insurance industry. But with its lines of property and casualty insurance policies, the company has managed to reward investors with more than 50 straight annual dividend increases. Let's take a closer look at Cincinnati Financial to see whether it can sustain its long streak of rewarding dividend payouts to investors.

Dividend Stats on Cincinnati Financial

|

| |

|---|---|

|

Current Quarterly Dividend Per Share |

$0.4075 |

|

Current Yield |

3.3% |

|

Number of Consecutive Years With Dividend Increases |

52 years |

|

Payout Ratio |

63% |

|

Last Increase |

June 2012 |

Source: Yahoo! Finance. Last increase refers to ex-dividend date.

What's been up with Cincinnati Financial lately?

Property and casualty insurance companies have seen some major ups and downs over the past few years, as a series of major catastrophic events have led to extremely bad losses. But, while industry giants Allstate (ALL +0.03%) and Travelers (TRV 0.25%) posted losses related to Hurricane Sandy of more than $1 billion each, Cincinnati Financial largely dodged Sandy's bullet, with losses of only $30 million. Yet, players throughout the industry have seen the long-term benefit from those events of stronger pricing power at policy-renewal time and, if the bad loss experience finally comes to an end, that will mean even bigger profits for Cincinnati Financial and its peers.

In fact, Cincinnati Financial has already seen that favorable outcome come to pass. In its most recent quarter, the company posted its best underwriting results in more than 10 years, spending less than $0.82 on claims and other expenses for every dollar of premiums. With many insurance companies routinely paying more than 100% of its premium revenue on claims, and counting on investment returns to make up the difference, Cincinnati Financial's experience is truly remarkable.

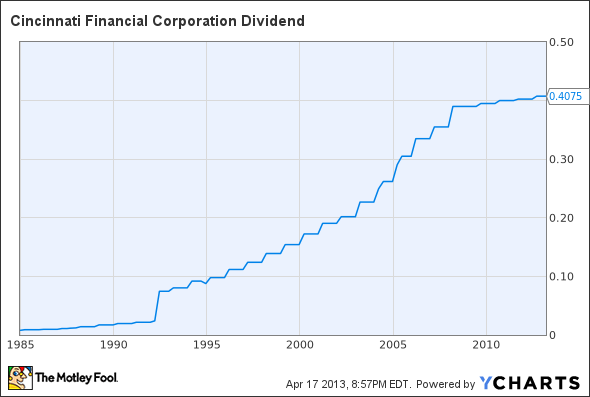

Cincinnati Financial dividend data by YCharts.

What's much less remarkable is the fact that Cincinnati Financial has been making only token dividend increases for the past several years, with only quarter-cent and half-cent payout hikes since 2009. With a past history of much more aggressive dividend raises, Cincinnati Financial is signaling that it may be nearing the upper limit of its willingness to share income with shareholders.

When will Cincinnati Financial's dividends rise again?

Cincinnati Financial typically raises its dividends in June, so we're just about due for another hike. Yet, given its past stinginess, I'd be surprised to see a raise to more than $0.41 per share. As I expect with a payout ratio above 60%, Cincinnati Financial will do the minimum possible to extend its streak, and keep its spot among the Dividend Aristocrats.

Click here to add Cincinnati Financial to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.