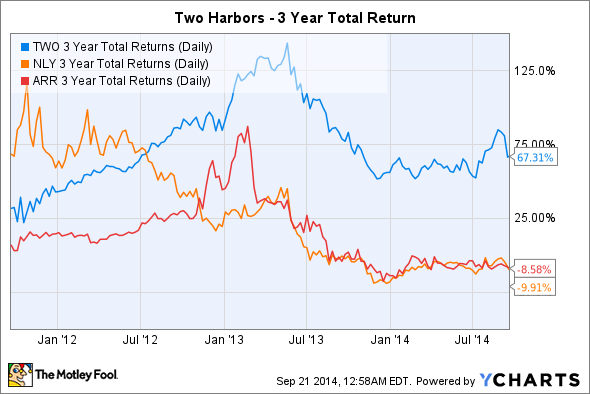

With 10%-plus dividend yields, mortgage REITs are one of the best at lining investors' pockets with cash. Over the last three years, however, returns have been far from consistent.

Two Harbors Investment Corp. is one of the few mREITs that has bucked this trend. While competitors from Annaly Capital Management to ARMOUR Residential REIT have floundered, Two Harbors has continued to crank out a massive total return for shareholders.

To determine whether Two Harbors in the right stock for you, investors need to understand the "four Ws": What the company does, where the dividend come from, why it's better than competition, and when is the right time to buy?

What do they do?

Two Harbors is in the business of financing, investing in, and managing a portfolio of residential mortgage-backed securities -- which are essentially large pools of residential mortgage debt.

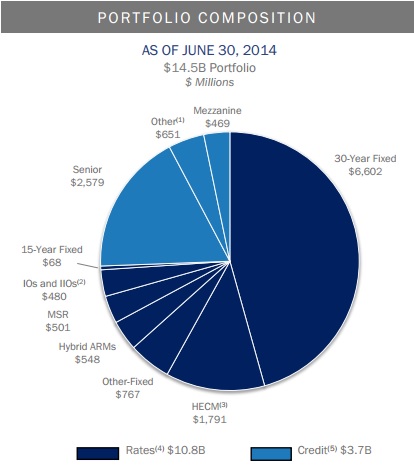

Depending on the credit quality or type of mortgages packaged into the securities, however, these assets can behave and yield very differently. Shown below is the breakdown of Two Harbor's investment portfolio as of September 2014.

Source: Company filings.

The dark blue section represents the "rates" strategy. These assets are high-credit quality and have low risk of default, but they are lower yielding and highly sensitive to prevailing interest rates. Meaning, if interest rates rise, the market value of currently owned securities falls, and if rates fall, the market value rises.

The lighter blue section is the "credit" strategy, of which, 78% is subprime mortgages. These assets were purchased at deep discounts following the financial crisis and are likely to wind down as opportunity to buy at the same value dwindles.

The remaining 22% is heavily weighted in residential mortgage loans, or loans that have not been packaged into securities. Both subprime and mortgage loans are higher-yielding and less exposed to interest rates, but they depend heavily on credit quality and the strength of the residential mortgage market.

Where do dividends come from?

Two Harbor's strategy is to borrow short term, buy the longer-term asset shown above, and earn the difference between what it costs to borrow and the yield on assets. From there, 90% of taxable income is distributed to shareholders.

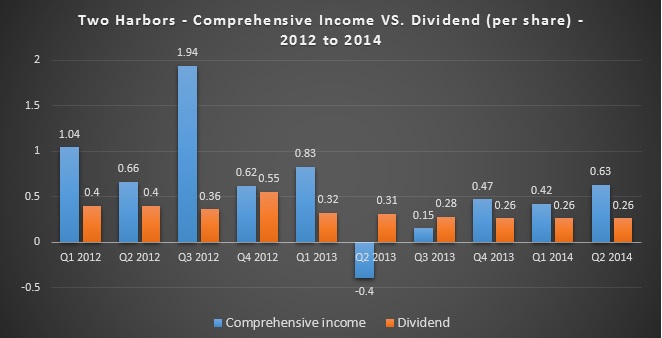

Since, most mREITs do not report taxable income in their filings, comprehensive income is a useful alternative. This metric combines net income with changes in the fair value of assets.

Shown below are Two Harbor's changes in comprehensive income per share and dividend per share from 2012 to the second quarter in 2014.

Source: Company filings.

As you can see, periods with stronger comprehensive income correlate with greater dividends. And while the dividend looks, and is, fairly inconsistent, Two Harbors is one of the best at taking advantage of strong investing environments and protecting itself from storms.

Ultimately, understanding that comprehensive income -- rather than typical investing metrics like net income or revenue -- is a much better indicator of dividend stability, and is essential to judging Two Harbors business.

Why is the company better than the competition?

A flexible business model that allows for a diversity in asset classes that can perform in a variety of environments is the reason Two Harbors has outperformed competition.

The typical mREIT prepares for rising interest rates by playing exclusively defense -- for instance, reducing leverage and using derivatives to limit interest rate exposure. While Two Harbors also uses these strategies, it creates better returns by also going on the offensive, investing in mortgage servicing rights, or MSRs, and mortgage conduit.

MSRs are contracts that earn fees for intermediating between mortgage lenders and borrowers. Mortgage conduit involves buying residential mortgage loans, getting them packaged into securities, and creating a return after selling them into the secondary market.

To date, these assets make up about 10% of Two Harbor's portfolio; however, because of their superior performance in a rising interest rate environment, management is most excited about the potential and growing importance of these two asset classes.

When is the right time to buy?

Despite Two Harbors being better protected from interest rates compared to similar companies, once interest rates rise -- which, according the Federal Reserve's estimates (link opens a PDF), will happen in mid-2015 -- it will likely have a negative impact on the company's performance.

With that said, the beauty of investing in a company that is adaptable, can invest in a diverse array of assets, and both grows and protects its book value, is that over time, the good will outweigh the bad. I see Two Harbors as a great income stock to buy today, and one of the few mREITs worth holding through a rising interest rate environment.