If you're looking for a high-yielding stock, commercial mortgage real estate investment trust Starwood Property Trust (STWD +0.05%) sports an attractive 8.6% yield.

However, this specialized lender offers much more than just a big dividend. As the largest player in the space, Starwood Property is safer than most and has some of the biggest opportunities for growth -- in fact, the stock has a total return of 100% over the last three years.

What exactly does it do?

Just like individuals need a mortgage to buy a home, businesses will use mortgages to acquire commercial property; this is where commercial mortgage REITs come in. These companies primarily make loans and own securities backed by commercial real estate assets. This could include a wide variety of real estate, but for Starwood Property it's mainly hotels and office space.

This might sound similar to traditional banks, but there are a few key differences.

First, rather than using deposits, investments are funded by selling additional shares of stock or by borrowing. Second, while banks typically focus on longer-term loans backed by stable assets, commercial mortgage REITs can be more flexible and offer unique shorter-term financing solutions. For instance, Starwood Property focuses on "assets in transition." Among other things, this includes loans for construction or redevelopment.

The final piece to the big picture is its status as a real estate investment trust. Essentially, by investing almost exclusively in real estate assets and paying out 90% of their income to shareholders, REITs receive significant tax breaks. The huge dividend payout is how we end up with the much larger than average yield.

Where's the opportunity?

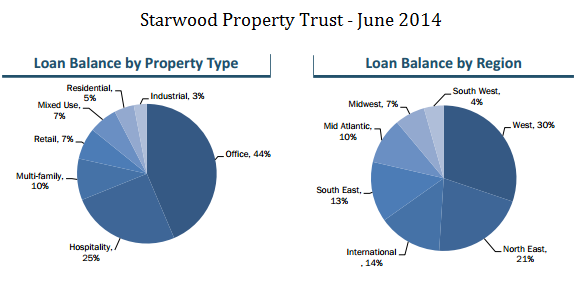

Starwood Property's asset and geographic diversity make it a particularly attractive investment.

While 44% and 25% of its loans are concentrated in office space and hotels, respectively, the company also makes industrial, retail, and even residential loans. By operating all over the U.S., as well as having the expertise to underwrite and invest in a wide range of loans and securities, Starwood Property has the ability to go anywhere and invest in almost anything.

Moreover, in April 2013 Starwood Property acquired special servicer LNR. Adding a another level of versatility, special servicers earn fees representing lenders by restructuring or foreclosing on defaulting loans. Just as important, as the named servicer to over $100 billion worth of commercial loans, Starwood Property has priceless insights into the U.S and European debt market that are not available to its rivals -- this is a huge competitive advantage.

How Starwood Property manages risk

The other side of opportunity is managing risk, and sharing common ground with banks is a nice tip-off that commercial mortgage REITs aren't exactly risk-free. While there are several business-specific risks, the economy is one of the most important.

Since Starwood Property's inception in 2009, it hasn't had a single loan go bad. This means every loan the company has made is either paid back or being paid back. That's extremely impressive, but don't be fooled: even risky loans can perform well in a strong economy. When recession hits, however, we find out who is truly being smart about lending. There are a few ways to spot the more prudent lenders.

The average loan-to-value on Starwood Property's loans is currently 65%. This means its average loan is worth 65% of the asset's value. More important, it means Starwood Property is lending with a cushion, and it is still protected even if real estate values fall.

Starwood Property also borrows, and the more debt the company takes on the more gains and losses are magnified. It works similar to a mortgage on a house: If you put $20,000 down on a $100,000 house, you have a debt-to-equity ratio of five to one. If the house appreciates in value by 20% ($20,000), you have doubled your investment; however, if the value declines by 20% you lose your entire investment.

Following the second quarter, Starwood Property had a debt-to-equity ratio of one-and-a-half to one. By keeping this ratio low, it can avoid taking much more serious losses. Ultimately, by taking on less debt and making good loans with a sizable cushion, Starwood Property is well protected against risk.

Bonus: Management

For a company to capture opportunity and effectively manage risk it needs experienced management. Barry Sternlicht, founder of Starwood Hotels and current CEO of Starwood Property Trust, has decades' worth of commercial investment experience, and he is supported by a team that has been with him for more than 14 years.

Put together a company that has a diversity of opportunity, that focuses on risk management, and has an experienced management team, and Starwood Property Trust is among the most attractive high-yield investments.