Annaly Capital Management (NLY 0.19%) conducted its third-quarter conference call last week and gave investors a glimpse into management's opinions and vision for the future. Here are four of the most important takeaways.

4. Annaly will be just fine

With uncertainty surrounding the current economic environment, government regulation, and potential rising interest rates, CEO Wellington Denahan opened the conference call with a speech that can only be described as a brief history of U.S. financial crises and the failings of government regulators.

The point of the speech was seemingly one part education and one part testament that the company is still here. In operation since 1997, Annaly has survived numerous challenging economic environments and has delivered a total return to investors three times that of the S&P 500 over its lifespan.

As Denahan suggested, being flexible, responsive to unforeseen risk, and taking advantage of opportunities as they arise have allowed the company to be successful and will continue to be its approach for the future.

3. Quarterly earnings were OK -- and so is the dividend

Annaly's core earnings for the third quarter -- a metric that removes non-recurring gains and losses -- was $0.31 per share versus $0.28 in the third quarter of 2013. A significant improvement, and enough to continue supporting the $0.30 dividend.

Interest income from mortgage securities fell $48 million. According to CFO Votek, this was because of an increase in prepayment speeds. Essentially, when borrowers refinance or pay down their mortgage early, it shortens the duration, or length of payments, and Annaly's assets earn less interest.

The big positive for the quarter was a 15%, or $18.4 million, decrease in expenses. This was related to Annaly's $772 million sell-off of interest rate swaps in the second quarter. I'll go into greater detail on this, but "swaps" are used to lock in funding costs and protect Annaly's borrowings from rising interest rates.

Overall, earnings were strong enough for Annaly to maintain its dividend, and that is always good news for investors.

2. Interest rates will stay low

Watching mortgage real estate investment trusts, or mREITs, prepare their portfolios for rising interest rates has been a major theme over the last year. However, according to Annaly President Kevin Keyes, "[R]ates will be lower for longer."

Keyes suggested that before the U.S. Federal Reserve will increase rates, it will want to see a more stable global and domestic economy. But, Keyes is seeing "red lights" ahead.

Specifically in the U.S., Keyes suggested the 3.5% growth in GDP during the third quarter was aided by temporary increases in exports and government spending. He believes this masked the decline in "business investment, residential investment, and consumption [which] are all performing well below historical averages."

1. Here is why that's important

As mentioned earlier, Annaly uses interest rate swaps to lock in its borrowing costs and reduce its exposure to rising interest rates.

Here's the catch: Instead of paying 0.58% to borrow, Annaly is paying a fixed rate of 2.48% on its swap contracts. Since Annaly earns the difference between what it costs to borrow and the yield on assets -- which is currently 3% -- the more expensive swaps can have an enormous impact on earnings.

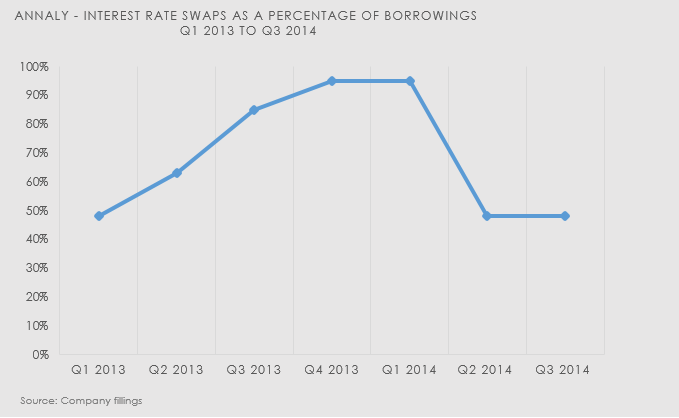

Starting in early 2013, rising interest rates seemed like an imminent threat. So, as you can see above, Annaly was willing to increase its use of swaps and sacrifice earnings power to protect the company long term.

However, the Federal Reserve never increased rates, and the time line has been pushed into mid-2015 or later. Annaly has adjusted by selling off the majority of its shorter-term swap contracts and is now borrowing at 1.64% compared to 1.81% a year ago. Not a particularly big difference, but according the company's CFO, it ended up saving Annaly $52 million in expenses during the quarter.

This will be worth monitoring, but for the time being, management suggested they are comfortable with their current position and it looks like they have found a happy medium between being protected from a rate increase and creating a solid return for shareholders.