When it comes to planning for retirement there's arguably nothing more critical for your investment portfolio than selecting high-quality dividend stocks. Although stocks with triple-digit annual gains may get all the attention right now, the often slow but steady growth afforded by consistent dividend stocks over the long term is what delivers astronomical multi-bagger opportunities that can make you rich.

You see, a regular dividend payment acts like a waving flag to investors that proclaims the sustainability and health of a business and its stipend. Furthermore, dividend income can help offset inevitable downturns in the U.S. economy and stock market. Finally, when reinvested, dividends offer the opportunity for investors to really compound their growth potential.

Image source: Getty Images.

But not all dividend stocks are created equally. An excessively high payout ratio (the amount paid to shareholders as a percentage of earnings per share) could signal that a company's payout is unsustainable. Additionally, a high yield could be the result of a falling stock price which could signify trouble in a company's underlying business model. In other words, when selecting quality dividend stocks it means looking at more than just their yield, even though a higher yield is more preferred.

A common stomping ground for high-yield dividends

Within the financial sector there are literally hundreds upon hundreds of dividend stocks to choose from. Banks and real estate investment trusts are common choices for income-seeking investors because of their generally high yields. The mortgage-REIT sector, for instance, is home to a handful of double-digit dividend stocks, but a mixture of net interest margin tightening coupled with the end of quantitative easing has pummeled the share price of these stocks and cancelled out most of the positive effect of these double-digit yields.

Yet, there's another industry within the financial sector that garners very little dividend attention, but is home to some of the soundest business models and steadiest dividend growth. I'd even go so far as to opine that dividend income in this oft overlooked sector actually grows on trees. The industry I'd suggest income-seekers and pre-retirees begin to seriously consider is none other than the insurance industry.

The ins and outs of the insurance industry

Insurance companies may be among the most boring business models you ever come across, but sometimes boring businesses make for the best investments.

The premise of the insurance industry -- which is primarily broken down into two major components, life and property & casualty – is simple: the consumer pays money in order to be protected against various types of financially altering events. P&C insurance, for instance, protects consumers' automobiles or their house against accidents or certain types of natural disasters. Life insurance, on the other hand, can provide a financial safety net for a policyholders' family or beneficiary should they pass away. The insurance industry, in turn, makes their profits by pooling these premium payments, investing them in usually safer securities like bonds and CDs, and then crossing its fingers that it brings in more in premium payments and net investment income combined than it pays out in policy claims.

As I alluded above, it's not a very exciting industry, but it has proven to be quite lucrative over time.

This isn't to say that insurers can't lose money or be dangerous investments, because they can. Tower Group is a good example of a P&C insurer gone wrong. Tower built itself up rapidly through a series of large acquisitions relative to its size and wound up eventually drowning under the weight of its own debt, as well as a large earnings restatement. The company wound up being acquired by ACP Re for just $2.50 a share two months ago, nearly a 90% discount from where it traded less than two years prior. Therefore, keeping a close eye on how levered an insurer might be is always a smart move.

Insurers are also susceptible to Acts of God. Natural disasters are unpredictable, which means that when disasters do occur insurers could wind up seeing hefty losses. For instance, the devastating earthquake in Japan in 2011 was a crushing blow for supplemental income insurer Aflac (AFL +0.50%) which had to pay out a significant number of claims. Of course, Aflac is doing just fine now, but it's a good reminder for investors to analyze whether or not insurers have a strong balance sheet capable of covering their behinds in case of a large catastrophe.

Image source: Getty Images.

Why insurance?

In spite of these challenges the insurance industry as a whole appears to possess a solid business model that should be supportive of continued dividend growth.

The reason I'd suggest this is insurers tend to possess strong premium pricing power regardless of how well or poorly the economy is doing. Insurers that make large policy payouts following a catastrophe often raise premiums rates the following year in order to once again build up their cash reserves. However, even in years where no large catastrophes occur insurers can still enact premium price hikes if needed with the justification being that they're building up their cash reserves in preparation for the next catastrophe.

To be clear about one thing, insurers aren't just hiking premium costs on consumers with every chance they get. In fact, most insurance companies performed quite well in the recently released customer satisfaction study from ACSI. But, what this shows is that should it become necessary to raise their prices in order to ensure the stability of their business, insurers could do so.

Insurers could also be on the precipice of benefiting from a rising interest rate environment. With QE now over, the Federal Reserve may begin raising its target federal funds rate as soon as next year. Higher lending rates can mean big bucks for insurers since they usually invest in interest-sensitive, but safe, investments like bonds and CDs.

Dividend stocks in the insurance industry you should be following

Now that you have a better idea of why the insurance industry is poised for success, let's have a look at three dividend stocks you should certainly be following very closely.

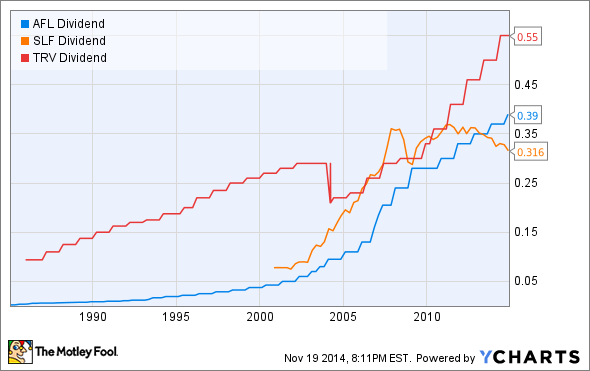

AFL Dividend data by YCharts

First up is supplemental income provider Aflac which is currently riding a 32-year streak of boosting its annual payout. According to Aflac's latest earnings report, which is where it announced a better than 5% increase to its payout, "Our objective is to grow the dividend at a rate generally in line with the increase in operating earnings before the impact of foreign currency translation." In short, the dividend keeps growing because Aflac's business is steadily growing. Sure, there will continue to be catastrophe's that affect its business, but Aflac is in good shape to tackle those problems and take care of its customers if and when the time comes. With a forward P/E of just nine and a 2.6% yield this is still a highly attractive dividend stock.

Secondly, I'd urge you to add Sun Life Financial (SLF +0.70%) to your watchlist. Sun Life provides a number of life insurance options to consumers as well as wealth management services. Though it doesn't have a 32-year streak of raising its dividend like Aflac to speak of, it has more than quadrupled its payout since 2001 and is currently paying shareholders 3.5%, which is significantly above the close to 2% yield S&P 500 index holders are currently receiving. Similar to Aflac, which derives its business from Japan and the U.S., Sun Life is geographically diversified and saw its greatest strength in the third quarter coming from Canada. With assets under management rising by double-digits in some regions I believe Sun Life's dividend will be safe for many years to come.

Lastly, in the P&C space I would direct your attention to insurance giant Travelers (TRV +0.36%). Its 2.1% yield might not seem overwhelming, but with the exception of 2003 through 2005 the company has raised its payout in each of the past 25 years. Travelers' size gives it quite the advantage when it comes to advertising to consumers as well as pricing its policies, which ultimately translates into sizable profits quarter after quarter.