With yields that nearly double the 10-year Treasury rate of 2.2%, real estate investment trusts, or REITs, are among the most attractive income investments.

But REITs aren't just about yield. Because they build and own diverse portfolios of properties, REITs offer potential growth as well as a dividend that's as reliable as collecting a rent check from some of the nation's top businesses.

In fact, all three companies I'll mention today have paid and increased their dividend every year for at least the past decade.

1. National Retail Properties (NNN 1.29%)

By increasing its dividend for 25 consecutive years, National Retail Properties has become one of the newest members of the elite Dividend Aristocrat club.

National Retail uses what are called sale-leasebacks to acquire retail properties, meaning they buy properties and lease them back to the original owners, thus allowing the former owner -- and now tenant -- to ditch his or her mortgage or free up capital. National Retail, meanwhile, gets to acquire a property with an existing tenant.

Here's the key: By acquiring well-located properties that are essential to the tenant's business, National Retail can lock tenants in to long-term leases of 10 years or longer. This simple formula has kept the company's occupancy above 96% for the past decade. Keeping occupancy high creates consistent cash flow for the company and more reliable dividends for investors.

2. Health Care REIT (HCN 1.46%)

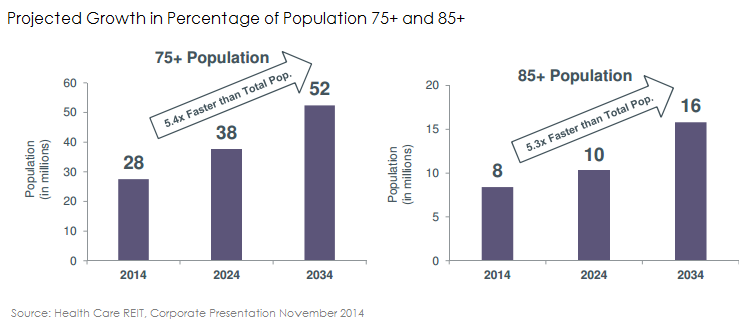

According to Health Care REIT, the percentage of those 75 and older in the U.S., U.K., and Canada -- the countries in which it operates -- is expected to increase from 28% of the population today to 38% in the next decade. This statistic puts Health Care REIT and its 1,246 health care-related properties in an opportunistic position.

Opportunity, however, is only half the battle. The healthcare real estate space requires a hands-on approach to managing properties, and Health Care REIT has partnered with some of the strongest operators. The company's senior living and assisted living properties have had at least 84% of rentable square feet occupied every quarter for the past eight years.

That's lower than National Retail's 96% occupancy, but because of the vast differences between single-tenant retail and multi-tenant senior housing, Health Care REIT's low point of 84% is strong among its direct peers.

Health Care REIT's relationships with operating partners also helps to enhance growth. In fact, in the first nine months of 2014, $1.2 billion of the company's $1.8 billion in new investments were with existing partners.

Ultimately, operating in a durable industry like healthcare and having strong partners to keep occupancy up make Health Care REIT a compelling long-term income investment.

3. Digital Realty Trust (DLR 0.75%)

For investors interested in cashing in on the growth of data storage and cloud computing, no data center REIT is better positioned than Digital Realty. The company currently owns only 131 properties, but don't be fooled, because it's still a $9.4 billion market-cap company. In fact, Digital Realty owns more than 10 times as many properties as its next closest data center REIT competitor.

Digital Realty's scale creates an enormous advantage for two main reasons. First, with more than 600 customers operating in various industries -- including financials, technology, telecom, and others -- the company is well insulated from industry downturns and the possibility that losing one customer could dramatically affect its cash flow.

Second, because of the company's size and stability, Digital Realty has access to a $2 billion worth of low-cost funding it can draw on anytime. That cushion gives the company extreme flexibility to grow or improve existing properties not available to smaller businesses. It also helps create a reliable and growing dividend investors can count on.

The best of the bunch

It's easy to get wrapped up in emerging trends and markets, but convenience stores, gas stations, and movie theaters aren't going anywhere.

National Retail's 2,038 properties leased to 400 different tenants makes it extremely durable, and its business model of signing high-quality retail tenants -- including 7-Eleven, Chuck E. Cheese, and LA Fitness -- to long-term leases has turned it into a symbol of consistency. For those reasons, National Retail is, in my opinion, your top income investment for 2015.