The stock market's recent volatility has brought the once-unknown category of inverse volatility ETFs into the limelight -- specifically, the particular variety of limelight that shines when investors learn the hard way that what has been a winning investment can lose nearly all of its value in a single day.

Yet as devastating as the collapses of the VelocityShares Daily Inverse VIX Short-Term ETN and ProShares Short VIX Short-Term Futures were, investors need to understand that the volatility-related instruments that survived this month's market oscillations have been even more dangerous for long-term investors' financial health. Indeed, the losses that instruments like iPath S&P 500 VIX Short-Term Futures (VXX +0.00%), VelocityShares Daily 2x VIX Short-Term ETN (NYSEMKT: TVIX), and ProShares Ultra VIX Short-Term Futures (UVXY 6.98%) have delivered over the years have been even larger on a percentage basis.

Image source: Getty Images.

Don't let short-term gains fool you

It's tempting to think that now that volatility in the market is back, the best way to profit from it is to switch gears and bet on its continuing. With the VelocityShares inverse VIX ETN likely becoming unavailable for trading within the next week, the only surviving alternative within that fund family will be the long-volatility counterpart.

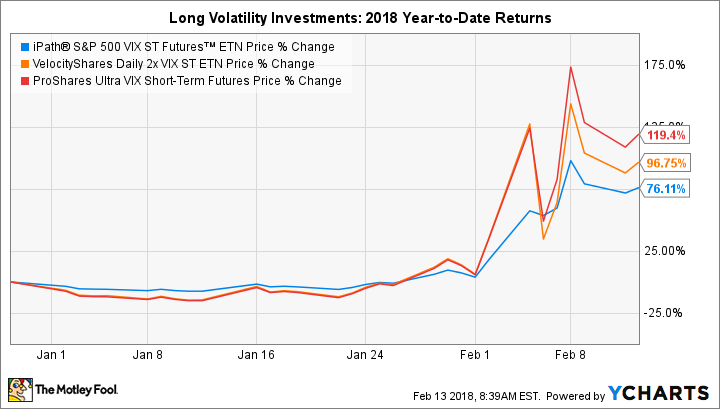

Investors also tend to chase past returns, and the three long-volatility ETFs above have been among the best performers in the market so far in 2018, as you can see below:

Data source: YCharts.com.

Quick gains of as much as 120% are hard to find anywhere else and look especially attractive to those who want to make up for big losses quickly.

A dubious long-term track record

Yet the problem with these investments is that they were never meant to be long-term plays. The names of the VelocityShares investments make that abundantly clear, referring to "daily" as the appropriate length of time to measure performance. All of the funds' prospectus materials call out the dangers of using these investments even over modestly long periods of time.

Just looking at the way these investments have performed over periods of a single year show how dangerous they've been for investors:

|

Year |

iPath return |

VelocityShares return |

ProShares return |

|---|---|---|---|

|

2017 |

(72.6%) |

(94.2%) |

(94.2%) |

|

2016 |

(68.3%) |

(93.9%) |

(93.8%) |

|

2015 |

(36.2%) |

(77.3%) |

(77.5%) |

|

2014 |

(25.9%) |

(63.2%) |

(62.5%) |

|

2013 |

(66.6%) |

(92%) |

(92%) |

|

2012 |

(77.6%) |

(97.1%) |

(97.1%) |

|

2011 |

(5.5%) |

(50.6%) |

N/A |

|

2010 |

(72.4%) |

N/A |

N/A |

|

2009 |

(67.4%)* |

N/A |

N/A |

Data source: Yahoo! Finance. N/A = fund not in existence during full year. * Partial year since inception Jan. 29, 2009.

As you can see, there's never been a year since these funds existed that they've resulted in a positive annual return.

Heads you lose, tails you lose

Perhaps the most telling thing about these funds is what happened in 2011. During that year, as you can see above, the long-volatility iPath ETN lost just over 5% of its value. Yet the ProShares inverse-volatility ETF didn't just lose ground as well; it plunged more than 45%. In other words, there was no way you could have been right betting on volatility with these funds during that 2011 year, when the broader market traded within a relatively tight range of +10% to -10% and finished the year flat.

It's this behavior more than the long-tail risk of a huge volatility move that explains why the prospectuses for some of these investments said that their long-term expected value was zero. The only winners from these investments were the entities that issued the notes in the first place, collecting money that they rightly believed they'd never have to repay.

Steer clear

The dangers of leveraged ETFs are well-known, but more esoteric investments like volatility trackers didn't reach the consciousness of the investing community until inverse volatility ETFs produced huge gains and then blew up in spectacular fashion. The lesson for investors is that the only valid use for these trading tools is as a short-term bet on the immediate direction of volatility, and the likelihood of complete long-term loss of capital is much higher with surviving long-volatility investments than with their inverse counterparts.