After suffering an abrupt fall that interrupted an impressive upward trajectory, shares of Fortuna Silver Mines (NYSE: FSM) are clearly taking a moment to find their footing. A welcome 132% increase in net income for the first quarter provided a small boost this week, but severe damage takes time to heal.

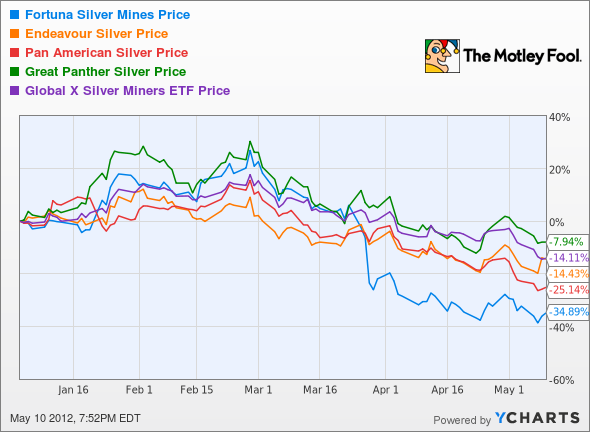

Without question, silver miners as a group are likewise trying to gain a foothold here in 2012 and stage the sort of climb that has typified this bull-market cycle for precious metals. Silver has only lost a sliver so far this year, while the performance of the Global X Silver Miners ETF suggests that miners on average have shed roughly 14% year to date. Endeavour Silver (NYSE: EXK) has moved with the pack, while Pan American Silver (Nasdaq: PAAS) has turned from a bargain into a gift following a sharp 25% decline thus far. On the following chart, meanwhile, you will see that Fortuna Silver Mines broke away from the pack to the downside in late March after revealing a sharply higher cost structure at its Caylloma mine in Peru.

Fortunately for Fortuna and its fortitudinous fold of faithful followers, the San Jose mine in Mexico continues to ramp up beautifully, providing a powerful counterpoint to the elevated costs at Caylloma. Even as the Caylloma cash cost rose sequentially to $7.21 per ounce, the company improved its consolidated mine operating margin substantially from 43% in the fourth quarter of 2011 to 52% in the first quarter of 2012. The San Jose operation is running three months ahead of schedule in pursuit of 1,400-ton-per-day throughput, and continues to achieve underground development milestones well in advance of planned production. That enviable condition lends substantial support to Fortuna's plan to deliver 6.4 million silver-equivalent ounces by 2014.

Although Aurcana (OTC: AUNFF.PK) retains the distinction of the silver industry's greatest growth story as production from its Shafter mine draws near, Fortuna's rapidly expanding production profile may have us all looking back at the current stock price as a powerful opportunity. I have purchased shares myself in recent weeks, and I fully expect to earn a tidy profit as San Jose matures. It may take a bit before my bullish CAPScall on the stock moves back into the green, but investing in this sector has turned me into a very patient Fool. In the meantime, stay in the loop by bookmarking my article list for ongoing coverage of silver and gold miners, or follow me on Twitter. Whatever path you choose, I hope you make a fortuna.

- Add Fortuna Silver Mines to My Watchlist.

- Add Endeavour Silver to My Watchlist.

- Add Pan American Silver to My Watchlist.

- Add Aurcana to My Watchlist.