The retail bloodbath continues this week, as shares of Staples

Amid all this carnage, it seems that investors must now ask themselves the question: Can these companies survive? Which specialty retailers will survive the apparent retail consolidation driven by Amazon.com

How it got here

The past five years have not been kind to office-supply superstores:

SPLS Total Return Price data by YCharts.

Electronics-focused retailers have also suffered badly:

BBY Total Return Price data by YCharts.

On the other hand, both Amazon and the two largest big-box retailers have gained over the last half-decade, with Amazon and Wal-Mart using scale to their advantage:

AMZN Total Return Price data by YCharts.

There are plenty of success stories in specialty retail. The difference between the success stories and the carnage you see above is that many products still lure customers to retail locations. Pet supplies, sporting goods, well-run department stores, auto parts, jewelers, and home furnishings all boast at least some companies that have performed well in recent years:

PETM Total Return Price data by YCharts.

What you need to know

There's something these companies have that Staples and the other office-supply stores don't -- a superior customer experience, or superior specialty product depth and knowledge. Printer paper is printer paper anywhere. Do you need a new three-hole punch? Order it on Amazon, or just go to your local Wal-Mart.

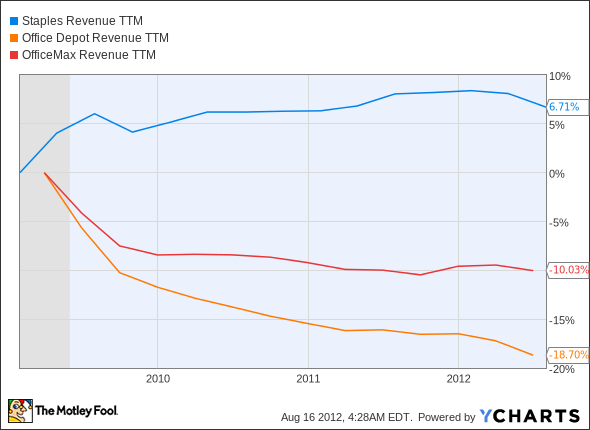

Staples has kept itself afloat with tremendous e-commerce sales figures, clocking in second only to Amazon for online revenue in 2010, but that hasn't stopped a virtual flatlining of its revenue after exiting the recession. Office Depot and OfficeMax, lacking a strong online presence, have seen their top lines plunge:

SPLS Revenue TTM data by YCharts.

Now that Amazon's committed itself to building a strong office-supply presence online, Staples will have to contend with heightened competition from an e-tailing juggernaut that's dedicated to growth at all costs. Its top line is already turning lower, which doesn't bode well in the face of this new challenge.

Maybe we can get a better view of the battlefield if we dig down into the numbers of each company:

|

Company |

P/E Ratio |

Price to Free Cash Flow |

Net Margin (TTM) |

5-Year Annualized Income Growth |

|---|---|---|---|---|

| Staples | 8.2 | 6.0 | 3.7% | (2.0%) |

| Office Depot | 5.4 | 5.2 | 1.0% | (26.1%) |

| OfficeMax | 11.0 | 12.1 | 0.6% | (24.8%) |

| Amazon.com | 289.2 | 99.5 | 0.7% | 4.3% |

| Wal-Mart | 15.5 | 17.8 | 3.5% | 5.6 % |

Source: Morningstar and S&P Capital IQ. TTM = trailing 12 months.

The market is pricing in further declines, based on the office-supply sector's inability to grow its earnings after the recession. Amazon... well, Amazon is special. Its top-line growth has been phenomenal, but investors seem to have given it a free pass on profitability, since its stock rise has mostly followed the growth of revenue, rather than earnings, over the past few years. But regardless of Amazon's long-term profitability potential, it does pose a grievous threat to the office-supply sector as long as it retains enough free cash flow to fund its operations.

Staples, Office Depot, and OfficeMax won't go quietly, though. They've kept free cash flow yields -- which is the level of free cash flow available to each share divided by the share's price -- much higher than Amazon's for some time:

AMZN Free Cash Flow Yield data by YCharts.

Amazon does have superior scale in its favor. Until very recently, it had much higher levels of total free cash flow than any of the office-supply stores, and only Staples has the ability to challenge that:

AMZN Free Cash Flow TTM data by YCharts.

If the sector's weakness continues, Amazon might pull ahead for good. It may just take awhile before the cash flow statements show it.

What's next?

I fully expect to see some articles recommending Staples as a good buy because of the market's "overreaction." Heck, there may even be a few contrarians willing to push Office Depot or OfficeMax into each other's arms. If you've learned anything from the demise of booksellers and the slow death of electronics retailers, you shouldn't expect the third time to be the charm for bricks and mortar.

You're not a Neanderthal. You know why? Your human ancestors were just a little smarter, just a little faster, and maybe they just plain wanted to win a little bit more. Do you want to invest in Neanderthal companies that don't rise to new challenges, or do you want your portfolio to evolve?

Maybe you should look into some consumer stocks Wall Street's too big to notice. You might become a millionaire, like some crazy people who invested in Amazon 10 years ago. Click here to find out where the next Amazon-level growth stocks are going to be, at no cost.