Shares of Weyerhaeuser

How it got here

Weyerhaeuser is benefiting from a rebound in the housing sector as investor sentiment rises and prices stabilize, as well as strength in the company's cellulose fiber business, which is anticipated to have fewer maintenance costs and increased demand from global customers. Another factor driving the stock higher was Weyerhaeuser's decision in 2010 to convert its status to a real estate investment trust. It receives notable tax benefits as a REIT but, more importantly for shareholders, is required to pay out at least 90% of its net income in the form of a dividend to shareholders. With the S&P 500's average yield around 2%, Weyerhaeuser's 2.5% yield is a nice premium.

But, as always, Weyerhaeuser and its peers aren't without their own unique set of challenges. Weyerhaeuser itself cautioned that wood prices are expected to remain soft in the near future and noted that the housing sector is still very fragile. We've seen confirmation of this in many of Weyerhaeuser's peers. Universal Forest Products

How it stacks up

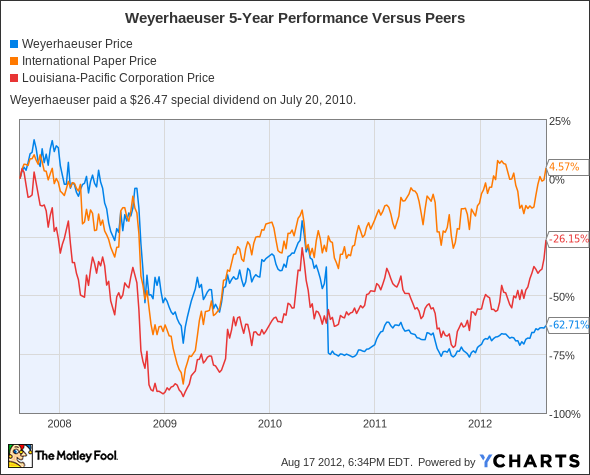

Let's see how Weyerhaeuser stacks up next to its peers.

Neither International Paper

|

Company |

Price / Book |

Price / Cash Flow |

Forward P/E |

Dividend Yield |

|---|---|---|---|---|

| Weyerhaeuser | 3.1 | 27.5 | 34.9 | 2.5% |

| International Paper | 2.2 | 5.2 | 9.6 | 3% |

| Louisiana-Pacific | 1.9 | N/M | N/M | 0% |

Source: Morningstar.

Now that's what I call three companies with three very different outlooks!

Louisiana-Pacific is a recently highlighted stock near a 52-week high that I suggested selling. The company hasn't been profitable in quite some time and demonstrates its reliance on the housing sector for its performance. With many foreclosed properties still unsold, building product providers like Louisiana-Pacific may not be the wisest investments.

International Paper, on the other hand, is a surprisingly good value with a premium yield of 3% and markedly lower forward multiple than its peers. It's had its fair share of weakness, with profits down 40% in its most recent quarter, but it presents the most compelling valuation here, hands down!

Weyerhaeuser enjoys the luxury of REIT status in that investors often give the valuations of these stocks a bit more leeway. However, it's worth noting that the company is valued at its highest price-to-book ratio over the past decade.

What's next

Now for the $64,000 question: What's next for Weyerhaeuser? That question depends on whether or not wood and pulp prices rise, if Weyerhaeuser can continue to control its expenses, and if the housing sector continues to recover.

Our very own CAPS community gives the company a four-star rating (out of five), with 85.5% of members expecting it to outperform. Although I've yet to make a CAPScall on Weyerhaeuser, I'm ready to change that by making a decidedly pessimistic underperform call on the stock.

Weyerhaeuser has strong brand recognition and a lucrative pulp partnership with Procter & Gamble, but it's also valued at decade-highs in terms of price-to-book and trades at an aggressive 35 times forward earnings. If the economy were growing at full speed, I wouldn't worry too much, but U.S. GDP figures are contracting, not expanding. There's little in the way of catalysts that would signify wood and pulp prices are going to rebound in any big way, and I still feel we are a long way from resolving the housing crisis and stabilizing prices. Until Weyerhaeuser's valuation more accurately reflects the state of the forestry market and the housing industry, I'll remain pessimistic.

The great thing about Weyerhaeuser is it's an easy-to-understand business. That's one premise behind Peter Lynch's investment style and one of the main reasons our team of analysts at Motley Fool Stock Advisor have picked out three winners for us middle-class investors that aren't already sitting on Warren Buffett-type cash. Find out the identity of these three stocks for free by clicking here to get your copy of this latest special report.

If you're still craving even more info on Weyerhaeuser, I would recommend adding the stock to your free and personalized watchlist so you can keep up on all of the latest news with the company.