Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

What: Shares of Hertz (NYSE: HTZ) rose 10% today after it finally came to a buyout agreement with Dollar Thrifty (NYSE: DTG). Competitor Avis Budget (Nasdaq: CAR) even came along for the ride for a short period, rising 10% at the open of trading.

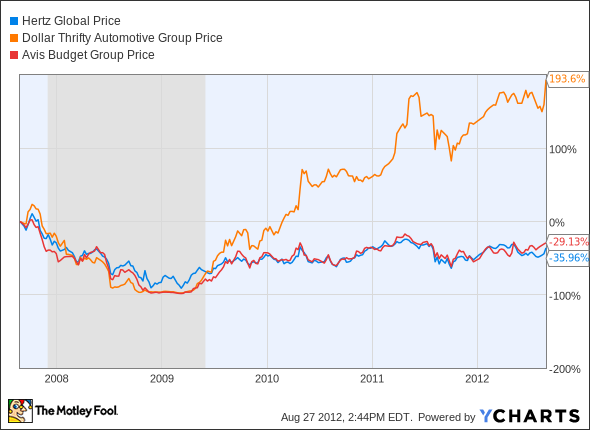

So what: Hertz will pay $87.50 per share for Dollar Thrifty in a deal that values the company at $2.3 billion. The three companies have been taking part in a deal-making dance for more than two years, and Hertz finally came away as the winner, sort of. Hertz is paying nearly double its initial offer, and the only winner among the three on the stock market in the past five years has been Dollar Thrifty.

HTZ data by YCharts

Now what: Hertz is paying more than 14 times Dollar Thrifty's 2011 net income, not a bad price but not a steal either. Hertz is hoping the deal will help the company internationally and against smaller rivals as well as projecting $160 million in savings annually. If that number alone came true, the deal would be a success, but synergies rarely live up to expectations in buyouts.

Tiny rivals are the real threat here, and I don't think this changes the competitive picture. If prices rise now that there is one fewer major competitor, I think it will only embolden small rivals. I would sell major car renters on the pop today because I don't think the deal will live up to its billing as a strategic win for Hertz.

Interested in more info on Hertz? Add it to your watchlist by clicking here.