Now that 2012's nearly in the rearview mirror, investors are beginning to sift through the market for the best stocks of the upcoming year. The future is plagued with uncertainty, but that has always been the case, and it has never stopped us from seeking out long-term values. One way to find those values is to look for companies with a long history of success. The Dow Jones Industrial Average (^DJI 0.69%) contains many such companies, but some are better investments than others.

Today we'll be taking a look at Wal-Mart (WMT -1.75%), a Dow component since 1997, to see whether its preparations for 2013 -- and analyst attitudes -- indicate a stock with growth potential or one to avoid.

First-half recap

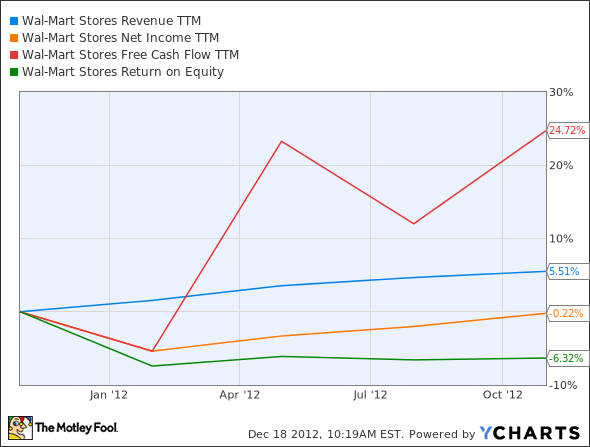

When we last looked at Wal-Mart, its outperformance relative to the Dow was evident. However, it's worth taking a look at its fundamentals before we dive into analyst expectations for the upcoming year. As you can see below, Wal-Mart's greatest accomplishment over the past four quarters lies in the growth of its free cash flow:

WMT Revenue TTM data by YCharts.

But will that continue? Analysts are on the fence, as evidenced by 2013's projections:

|

Market Cap |

$231.1 billion |

|

P/E; Forward P/E |

14.2; 12.3 |

|

Price to Free Cash Flow |

16.1 |

|

2013 Projected Growth Rate |

9.3% |

|

2013 EPS Estimates |

$5.38 |

|

5-Year Annualized Projected Growth Rate |

9.2% |

|

Buy/Hold/Sell Ratings |

12/15/0 |

|

Average Price Target |

$79.06 |

Sources: Yahoo! Finance; Morningstar. TTM = trailing 12 months.

What the numbers don't tell you

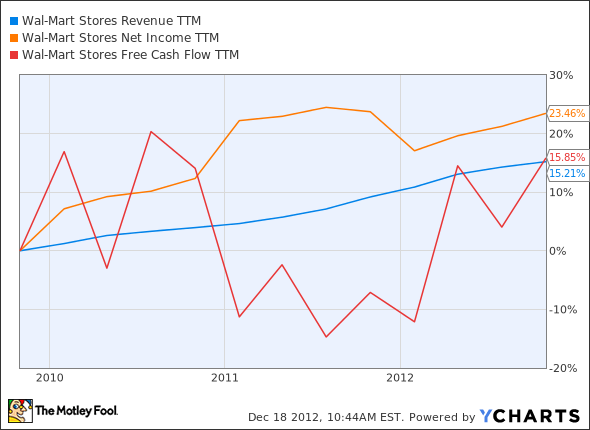

A five-year annualized growth rate of 9.2% is quite an impressive target for a company that's already the world's largest private-sector employer. Over the past few years, Wal-Mart has managed to improve its free cash flow at an even faster rate, with total five-year free cash flow growth at 124%. Its net income and revenue have improved at a much slower rate, and if you narrow the horizon to three years, Wal-Mart's jagged free cash flow looks respectable but hardly capable of the growth analysts expect:

WMT Revenue TTM data by YCharts.

A big source of potential growth in years to come will be the online retail space, where Wal-Mart remains far behind Amazon.com (AMZN 1.30%). My fellow Fool Jessica Alling points out that only 1% of Wal-Mart's revenue comes from e-commerce sales, but that amount is still worth 10% of Amazon's sales. Doubling that number in one year is a tall order, but the right promotional strategy could easily produce annualized sales growth in the 50% range for the next two or three years.

Wal-Mart can also use its growing clout in a retail environment that has wreaked havoc on electronics specialty retailers to enhance its appeal to cost-conscious gadget buyers. Best Buy (BBY -0.11%) hasn't had an answer to the "showrooming" phenomenon that Amazon has popularized, and Radio Shack's (RSHCQ) shift toward phone sales leaves it vulnerable to any convenient competitor with a superior selection.

Wal-Mart has a better combination of retail infrastructure and online presence than anyone in the space, but it doesn't do enough to promote that to consumers. Neither Best Buy nor Radio Shack has a real answer to the online phenomenon. Pairing online selection with the convenience of brick-and-mortar retail (assisted by Wal-Mart's new experiment with same-day deliveries) would be enough to put Wal-Mart ahead for good -- and put these competitors six feet under.

Another advantage Wal-Mart boasts over most of its peers -- including Amazon -- is a growing international presence that now accounts for 30% of its total sales. China is already home to several hundred Wal-Marts stores, and India will be a great frontier of possibilities next year since the Indian government voted to allow foreign direct investment in the country's retail sector earlier this month. Wal-Mart presently operates a small joint venture in India with only 20 stores. That number could easily increase to the triple digits.

However, Wal-Mart is also recognizing that expansion isn't everything, and it has dialed back its growth plans somewhat after recognizing that its rapid growth in China came at the cost of profitability. Look for a smarter, leaner international expansion project from the retail giant next year, paired with an enhanced online presence.

International growth could easily become a thorn in Wal-Mart's side if it continues to make missteps like the large bribery scandal now unfolding in Mexico. That issue will be worth watching over the next year, as there are sure to be new twists in this New York Times-led investigation. It's not likely to destroy the company, but it could diminish its brand power enough to depress growth in 2013.