When Apple (AAPL 0.51%) announced its intent to start paying dividends, the yield looked stingy at just 1.8%. The stock climbed another 18% over the summer, easily crushing the Dow Jones Industrial Average (^DJI 0.53%) and reducing the already soft dividend to an even thinner 1.5% annual payout.

But then the tide turned against Cupertino. Share prices plunged 31% in four months, leaving opportunistic income investors with a far stronger dividend proposition. If you bought Apple shares yesterday, you locked in a 2.2% yield -- all without Apple lifting a finger to boost or accelerate its payout schedule, fiscal-cliff worries and bulging coffers notwithstanding.

Even so, Apple still lags far behind chip supplier Intel (INTC -0.98%) and its 4.1% dividend yield. Microsoft (MSFT) crossed the ford into value-investing land a decade ago and yields a respectable 3.4% today. So Cupertino hasn't exactly become the ideal income stock quite yet.

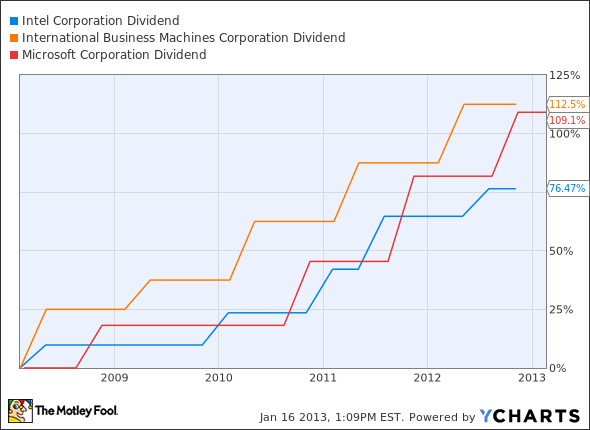

Apple did jump above IBM 's (IBM -0.37%) 1.8% yield, even though Big Blue strives to keep its direct shareholder returns as juicy as possible. All three of these Dow-bound tech stocks come with impeccable dividend-boosting pedigrees:

INTC Dividend data by YCharts.

Does this make Apple a better dividend investment than IBM? I don't think so.

Apple's cash reserves may be without equal outside the world of big banks, and its current cash-generation powers are also unparalleled. But Apple has chosen to keep the vast majority of these riches close to the vest. The company is scheduled to return about $10 billion to shareholders over the next year, not counting Apple's habit of printing $700 million of new shares every year without ever buying any of them back. That's out of free cash flow of $43 billion.

By contrast, Big Blue spent a sum of $14.7 billion on buybacks and dividends over the last 12 months out of $16 billion in free cash flow. That's a 92% direct cash return to shareholders.

If Apple adopted buyback and dividend plans of IBM's caliber, Cupertino would yield a direct shareholder return of 8.3%. It would be the fourth-richest yield in the S&P 500.

There's ample opportunity for Apple to boost its payouts, especially since the company can fall back on more than $120 billion in cash reserves.