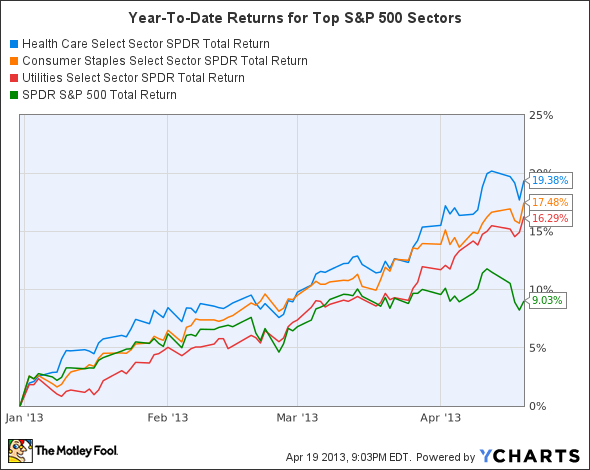

Even after this week's decline, the S&P 500 (^GSPC +0.15%) is still up more than 9% so far in 2013. But underneath that generally strong performance, there are many undercurrents among the various sectors of the market that most investors ignore. By looking beyond the headlines and seeing where the pockets of strength are in the market, you can better identify the industries that look the most promising right now.

Fortunately, it's easy to gauge the performance of individual sectors of the S&P 500. Thanks to ETFs designed specifically to track the various parts of the stock market, comparing different sectors' performance requires only looking at the returns of those ETFs. Today, let's take a quick look at the best-performing sectors so far in 2013.

S&P 500 Sectors Total Return Price data by YCharts.

On the upside, health-care stocks lead the way, followed by consumer staples and utility stocks. For health care, the impact of Obamacare on health-insurance companies has gotten the lion's share of attention, as controversy about Medicare Advantage reimbursement rates and concerns about employers moving from full-risk plans to self-insured fee arrangements weighed on UnitedHealth Group (UNH 2.02%) and other players in the industry. Yet pharmaceutical stocks have generally performed well, with several companies seeing approvals or substantial progress in clinical studies.

Consumer staples have climbed for several reasons, both fundamental and investment-related. For investors, consumer stocks represent a way to defend your portfolio from down markets, and fears that the market has gotten overvalued have pushed risk-averse investors into these more defensive names. Procter & Gamble (PG +1.00%) has climbed to new all-time highs, and investors have bid its valuation up to nearly 19 times earnings to take advantage of its 3% dividend yield. Yet for the most part, a slowly improving economy has bolstered consumer confidence, thereby lifting the prospects of many consumer-serving businesses.

Finally, utility stocks have been a somewhat surprising performer this year, but low natural-gas prices have helped electric utilities cut their costs. Duke Energy (DUK 0.98%) is still well off its all-time highs, but Southern (SO 0.34%) has stretched to new records as investors continue to gravitate to high-yielding dividend stocks backed by reasonable fundamentals. Here, too, valuations have gotten somewhat expensive, so treading carefully is the prudent course for risk-averse investors.

Can these sectors keep rising?

The challenge in investing is figuring out when trends are likely to continue and when they could reverse. Last week's market movements suggest the possibility of a coming inflection point in the market, but for now, the reasons that pushed these stocks to better returns still appear to be in place.