The wealth-building power of compound interest will never cease to amaze me. It's a story of patience and attention to detail, where small, short-term differences add up to massive divergence over decades. And in the end, the biggest winners don't always deliver the fattest share-price returns.

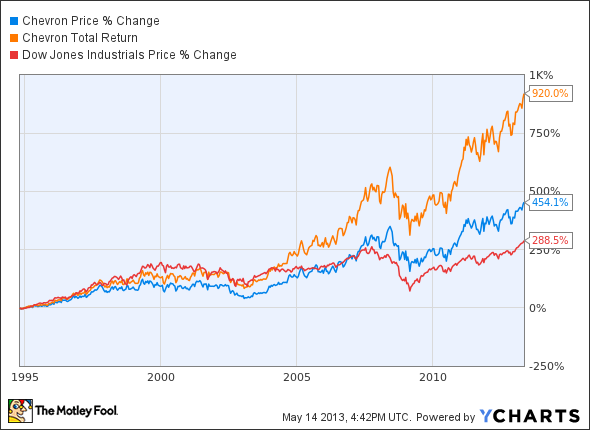

Today, I'm looking at petroleum products giant Chevron (CVX +3.33%). The stock has trounced the returns of the Dow Jones Industrial Average (^DJI 0.36%) over the last 20 years, but reinvesting dividends along the way would have more than doubled your returns again:

The black gold still deserves its rich name. Chevron powers its generous dividends with outsize cash flows. The company's dividend boosts have left fellow Dow component and cash machine ExxonMobil (XOM +0.51%) in the dust, even though Exxon's cash flows are an order of magnitude richer. Chevron hasn't suffered any massively damaging setbacks like BP 's (BP 0.31%) Deepwater Horizon disaster, which put a damper on that company's market-crushing dividend increases. Royal Dutch Shell's (NYSE: RDS-A) total payouts plunged when the merger of Royal Dutch and Shell was completed in 2005 -- and have stayed modest ever since.

CVX Dividend data by YCharts.

Simply put, Chevron's smooth execution is second to none, and its shareholders are enjoying the cash-based benefits. The company just implemented another 11% dividend increase, set to take effect when Chevron shares go ex-dividend on Wednesday. Buying now would get you started on a healthy dividend-reinvestment program right from the start -- and you've just seen the market-beating difference that habit can make.