Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

U.S. stock markets have fallen slightly during trading today after Federal Reserve Bank of Dallas President Richard Fisher said the central bank was close to slowing its asset purchase programs. Markets have been moving up or down lately based on the Fed's comments on "tapering," but long-term investors should keep in mind that the Fed will only slow stimulus and raise rates for the long term when it thinks the economy can handle it.

More importantly than tapering speculation was a report from the Institute for Supply Management saying that its nonmanufacturing index rose to 56% in July from 52.2% a month earlier. That follows strong manufacturing data last week and shows a little strength for businesses right now. When you add all of these factors up, the Dow Jones Industrial Average (^DJI 0.56%) has slipped 0.27% as of 3:25 p.m. EDT, while the S&P 500 (^GSPC -0.88%) lost 0.17%.

Among Dow components, Intel (INTC -2.40%) is one of the biggest losers today, falling 1.3%. But a closer look shows that Intel is trading ex-dividend today. That means investors who held the stock as of Friday night will receive the $0.225 quarterly dividend, but today it's trading without that dividend. When you take that dividend into account, it makes the drop significantly smaller and also gives us an idea of just how important a dividend is to investors.

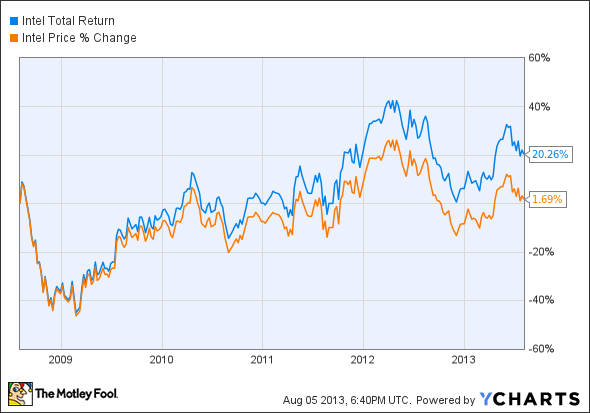

Over the past five years, Intel's stock is only up 1.7%, but the total return of the stock including dividends is 20.3%.

INTC Total Return Price data by YCharts.

Particularly when you get into well established, slower-growing companies like the ones that make up the Dow, the dividend becomes a huge part of your total returns. Sometimes the stock price only tells part of the story, and Intel's drop today is a great example.