Over the last six months, Intuitive Surgical (ISRG 0.91%) shares have fallen about 30%. With almost one third of the company's market capitalization cut off the top, how is the stock looking today? Let's take a look at the valuation based on the underlying fundamentals.

DCF valuation

The value of any enduring business is simply equal to its future cash flows discounted by the time value of money -- that's exactly what a discounted cash flow valuation does. So let's take a look at Intuitive Surgical's current ability to grow free cash flow.

Despite a "concerted effort by vocal critics of robotic surgery," as Intuitive Surgical CEO Gary Guthart said in the company's first-quarter earnings release, and economic pressures on U.S. systems sales likely stemming from Obamacare implications, the company's overall free cash flow trend is generally upward.

But when you zoom in on the company's most recent quarter, operating income declined by 2.6% as U.S. system sales fell 6% from the year-ago quarter, showing signs of system saturation.

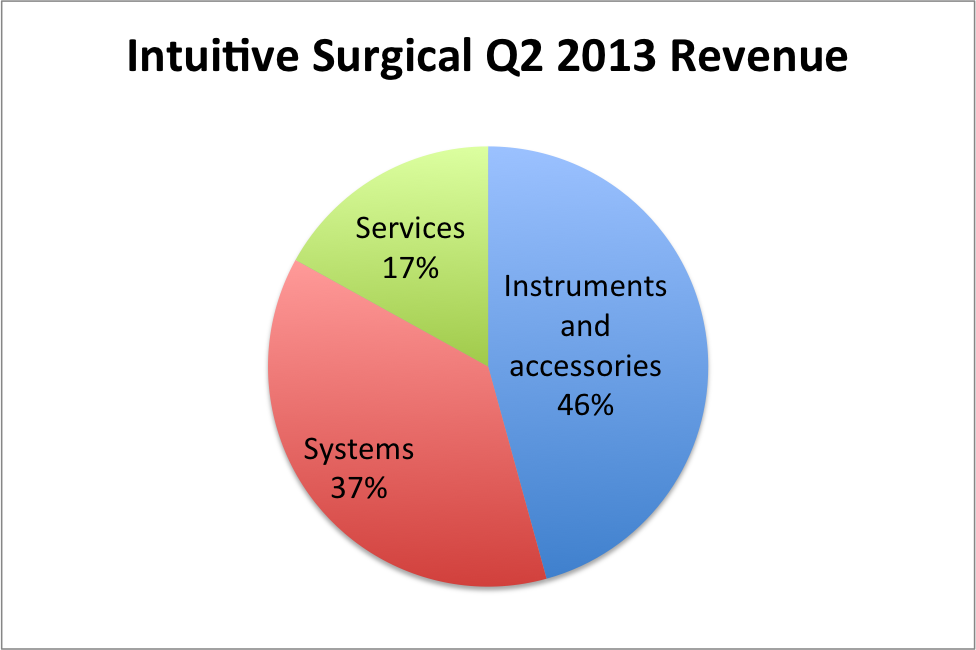

Still, Intuitive Surgical's razor-and-blade model could keep growth rates afloat even if system sales face challenges going forward. In fact, the company's instruments and accessories sales account for the largest portion of revenue, not system sales.

Source: Data retrieved from second-quarter earnings release.

And instruments and accessories revenue, in the company's most recent quarter, were up 18% from the year-ago quarter.

Furthermore, according to the company's second-quarter earnings release, the main drivers behind instruments and accessories sales growth are growth in surgical procedures and increased utilization of new products. Both of these drivers can continue without system sales growth.

So what growth can we expect, going forward? Zooming back out, trailing-12-month free cash flow is up 12.8% from 2012's levels. Combining this overall positive trend with the recent slowdown as a preliminary warning for potential system saturation, we likely have a starting point.

Given these trends and the company's recently accelerated share repurchase program, I believe the following expectations for free cash flow growth per share offer a conservative outlook for the company over the next 10 years.

|

Year |

Growth Rate |

|---|---|

|

1 |

10% |

|

2 |

9.5% |

|

3 |

9% |

|

4 |

8.6% |

|

5 |

8.1% |

|

6 |

7.7% |

|

7 |

7.4% |

|

8 |

7% |

|

9 |

6.6% |

|

10 |

6.3% |

Based on this scenario and using a 10% discount rate, the fair value of Intuitive Surgical stock is about $413. This means shares are trading at about a 6% discount to this fair value estimate today.

But is a 6% margin of safety really sufficient for a company that derives all of its revenue from sales based on one product? Definitely not. I'd require at least a 25% margin of safety to account for the risk of major recalls or any potential problem with the product line that the company is so dependent on.

Based on these numbers and a required 25% margin of safety, the stock wouldn't be a buy until it traded at about $310.

Reverse DCF valuation

A reverse DCF valuation suggests that the assumed growth rate by the market for the company's free cash flow is about 13% at today's stock price. In other words, even after a sell-off, the market is certainly more bullish than the conservative assumptions in the DCF valuation above.

Interestingly, analyst estimates fall in line with the assumed growth rate by the market. Of the analysts compiled by Yahoo! Finance, they expect 13.8% EPS growth per annum over the next five years.

With the analyst expectations already priced into the stock based on this reverse DCF valuation, it's no surprise that analysts, on average, have a hold rating on the stock.

How to think about Intuitive Surgical stock

When it's all said and done, the consensus here is that the stock is fairly valued. Or, in analyst lingo, the stock is a hold. While I often don't mind picking up shares of a business when it is fairly valued if it has enduring characteristics, Intuitive Surgical just doesn't pass through my filters. Sure, the company basically has no competitors. But its dependence on the da Vinci requires me to demand that 25% margin of safety.

Yes, my estimates may be too conservative. But I'd prefer to err on the side of conservatism than the side of aggressiveness.

What do you think? Is Intuitive Surgical a buy, sell, or hold?