If you're like most people, then you don't want to get old. While Nu Skin Enterprises (NUS +0.53%) can't prevent you from getting old, it does sell products that can help you slow down the process cosmetically. Therefore, even if you're the rough and rugged type who has no interest in improving your appearance, you still have to admit that an enormous amount of the population wants to look younger. That being the case, in Nu Skin, you might have a quality investment opportunity on your hands.

Confidence beyond appearance

Nu Skin isn't the most well-known company in the world, and some people don't agree with its business model. However, Nu Skin continues to prove those people wrong. For instance, the stock is up 441% over the past five years. That might be an impressive number, but past performance doesn't indicate future success.

While there are some companies upping their guidance in the current economic environment, those companies aren't in the majority. Nu Skin, however, does fit into this category. Nu Skin recently upped its FY 2013 revenue guidance to a range of $2.91 billion-$2.95 billion from $2.83 billion-$2.86 billion. And it upped its FY 2013 earnings-per-share guidance to $5.05-$5.15 from $4.85-$5.00. This type of raised guidance will pique any investor's interest.

This is all great news, but you might be wondering why Nu Skin is so confident.

International growth

Nu Skin is enjoying strong momentum in Greater China, North Asia, and the Americas. This is primarily due to the company's ageLOC product launches. To tie at least one specific number to this strong momentum, Nu Skin expects $380 million-$400 million in sales in the second half of the year from the global roll-out of its ageLOC TR90 -- a four-product weight-management system.

Even if Nu Skin happens to fall short of expectations on the sales front, it recently announced that it will repurchase $400 million worth of shares, which will help aid the bottom line thanks to a reduced share count. Over the long haul, Nu Skin is also confident in its ability to generate cash flow and repurchase its own stock.

Getting back to geographic performance, consider the revenue growth in the three aforementioned regions in the second quarter (year over year):

- Greater China: up 35%

- North Asia: up 11%

- Americas: up 17%

An interesting pattern takes place whenever Nu Skin enters a new market. At first, Nu Skin sees rapid growth, which is then followed by declining revenue. However, Nu Skin often sees renewed growth via new product introductions, increased actives, and better distributor productivity.

Nu Skin's success has been largely based on in-depth research, analytics, and constant innovation. But this doesn't guarantee that it's the best investment option in its peer group.

Not the prom queens

Avon Products (AVP +0.00%) and Herbalife (HLF 2.71%) might offer similar products and business plans, but they're not going to steal the spotlight from Nu Skin.

Herbalife has been in the spotlight for a good part of 2013, with the Bill Ackman (shorting the stock) versus Carl Icahn (long the stock and taunting Bill Ackman) battle. If you remove all of the drama and assume that Herbalife is 100% legit, then while it's impressive, it still falls a little short of Nu Skin. First consider some key metric comparisons:

|

Forward P/E |

Net Margin |

ROE |

Dividend Yield |

Debt-to-Equity Ratio | |

|---|---|---|---|---|---|

|

Nu Skin |

16 |

10.31% |

38.45% |

1.30% |

0.29 |

|

Avon |

16 |

(1.06%) |

(4.54%) |

1.20% |

2.56 |

|

Herbalife |

13 |

11.30% |

141.79% |

1.70% |

2.22 |

Nu Skin and Herbalife are both impressive fundamentally. Actually, you could make a strong case that Herbalife steals the show. But the impressive debt management at Nu Skin is too appealing to pass up, and you're not going to have to deal with any billionaire-battle drama. As far as Avon is concerned, it doesn't hold a candle to Nu Skin or Herbalife, which is further proven in the charts below.

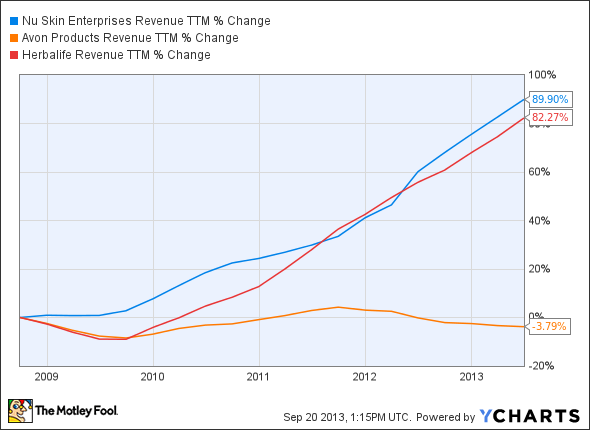

Revenue growth over the past five years:

Nu Skin revenue trailing-12 months data by YCharts

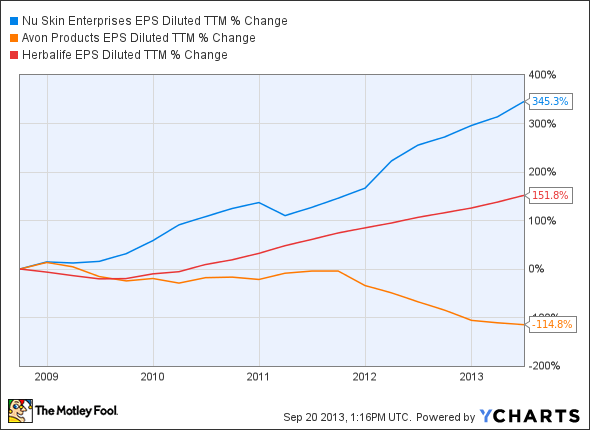

Earnings-per-share growth over the past five years:

Nu Skin EPS diluted trailing-12 months data by YCharts

The bottom line

If you're looking for a long-term investment in a company that continues to prove naysayers wrong, is fundamentally sound, is seeing growth overseas, and buys back its own shares, consider Nu Skin. If the stock suffers at any point due to external events, then you might want to look at it as an opportunity to add to your position.