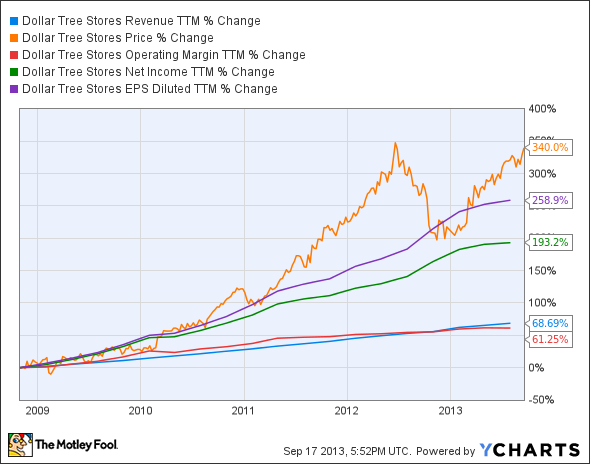

Dollar Tree (DLTR +0.24%) is among the most successful single-price-point retailers in the U.S. It operates more than 4,842 stores across 48 states in the U.S. and five Provinces in Canada. The chart below shows that the company has been performing consistently well over the past five years.

DLTR Revenue TTM data by YCharts

A stubborn job market coupled with lackluster wage growth has led plenty of shoppers to move from Wal-Mart Stores and club channels to dollar stores. This switch of consumers away from Wal-Mart is reflected in the lackluster quarterly results that it posted recently. The growth of the dollar stores revolves around serving customers who have pretty restricted incomes and little or no revolving consumer credit available. The dollar stores cater to these consumers, as well as customers who shopped elsewhere in better economic conditions and are now looking to cut down on expenses.

Despite all the cheer about the economy being on the path to recovery, there's no denying the fact that inconsistency still prevails as the chart below indicates. As a result of this uncertainty, nothing has changed much for many Americans and hence, they are still cautious about the size of their shopping baskets.

source: tradingeconomics.com

This is where a retailer like Dollar Tree moves in and serves such target customers. This is the reason that Dollar Tree has been consistently doing well right through the recession and even now. In the second-quarter, it reported a 9.8% increase in earnings as compared to the same quarter last year. The company also reported year-over-year revenue growth of 8.8% with total sales reaching $1.85 billion.

The company's guidance indicates that its sales for the third quarter of 2013 will be in the range of $1.87 billion to $1.92 billion. Comparable-store sales gains are expected to be in the low- to mid-single digits. Diluted earnings-per-share are estimated to be in the range of $0.54 to $0.59.

The threats

Dollar Tree is one of its own fiercest competitors. This may sound surprising, but that's a fact if we look at the pace at which it opens, relocates and closes stores. In the second quarter, for example, it opened 81 new stores, expanded or relocated 31 stores and closed two. This is around 9.5 "locations bounce" per week. Any strategic decision error on this front could only add to losses.

Another threat that needs to be sorted out internally by Dollar Tree is optimizing its supply chain management, which involves the process of identifying a wider selection of core items that should always be in stock at all locations. If not managed properly, this could lead to a higher attrition rate in consumer loyalty.

Competition

Dollar General (NYSE: DG) is the nation's largest dollar store chain by market cap and operates more than 10,000 stores in 40 states. Its recent results have been strong as well. Earnings increased 11.6% and net sales increased 11.3% as compared to the same quarter last year. The company has opened 375 new outlets during the first half of 2013. To keep this momentum intact, Dollar General plans to open 650 new stores. In addition, it plans to remodel or relocate 550 stores. The expansion of Dollar General is a threat to Dollar Tree since they cater to the same target consumers.

Family Dollar (NYSE: FDO) has been increasing its dividend, has a low debt to equity ratio and is a very defensive stock with a beta of 0.15, making it a very safe pick. One could complain about a very low dividend yield of 1.40% but the fact that it has increased its dividend consistently for more than three decades now cannot be ignored.

As with most dollar stores that have added tobacco products, the gross margin at Family Dollar has decreased as well. However, as per details made available by the company, 60% of transactions involving tobacco also have other items in the shopping basket. So this has resulted in higher sales and should lead to higher gross margin in the future.

Conclusion

Dollar Tree has appreciated strongly this year with the stock up over 40%. However, investors should consider taking some money off the table since competition is heating up in the sector with the likes of Dollar General on an aggressive expansion drive.