The natural gas export debate remains pretty heated, especially with new export facilities being approved at a more rapid pace. At the same time, propane exports continue to slip out of the country with little fanfare. Where is all the propane going?

America is the propane export king

The U.S. is currently the world's top exporter of propane. It has surged past Middle Eastern rivals such as Qatar, Saudi Arabia, and the United Arab Emirates to take the top spot at more than 70 million barrels. That's well ahead of last year's more than 55 million barrels.

The company leading this surge is Enterprise Products Partners (EPD +0.31%). The midstream operator alone has exported nearly 60 million barrels of propane this year. It's not content with the status quo, either, continuing to ramp up export capacity and recently announcing another expansion at its LPG export facility in the Houston Ship Channel. The project, which won't be complete until 2015, adds another 1.5 million barrels per month of propane export capacity.

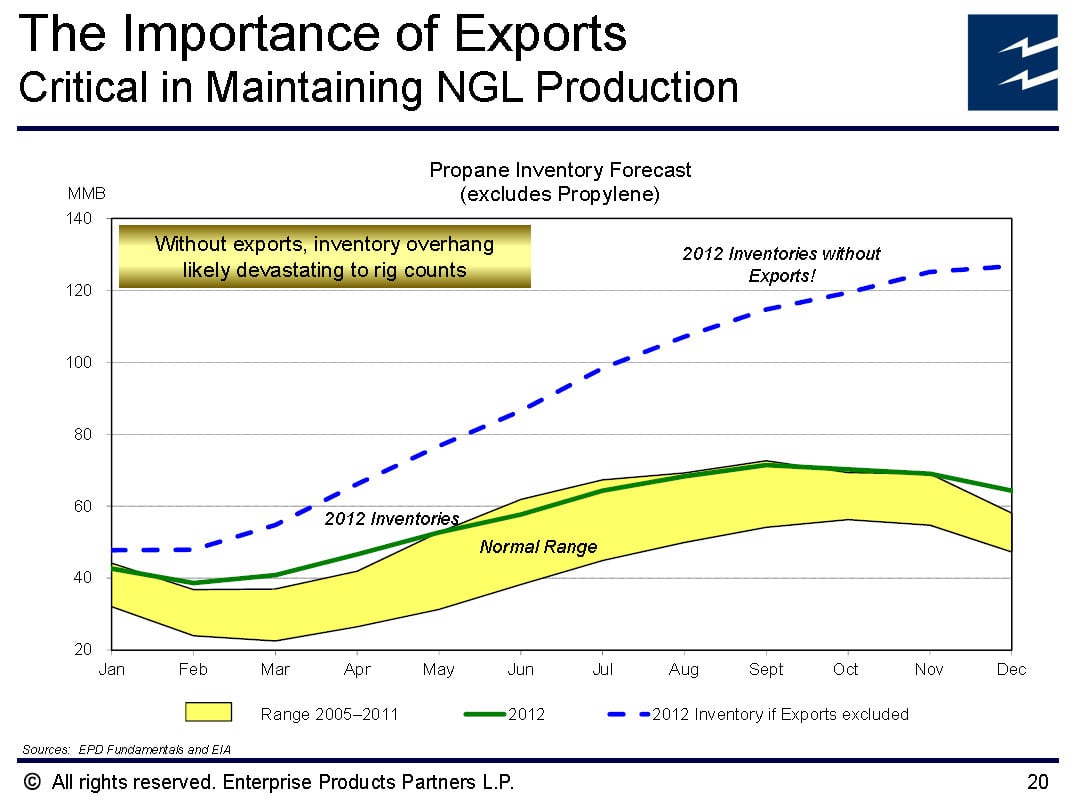

What's key here is that without Enterprise's export capacity, U.S. natural gas producers would be in trouble. As the following chart shows, without exports last year the U.S. would be significantly oversupplied with propane.

Source: Enterprise Products Partners Investor Presentation (link opens a PDF)

Failure to export propane would kill the economics of rich natural gas drilling. This is because propane makes up nearly 15% of the value of each Mcf of natural gas produced from a super rich gas well. An oversupply of propane would really slow down the drilling of liquids-rich natural gas drilling.

Where is it going?

Thankfully, there is plenty of propane demand worldwide that's able to take this supply. Most of our propane heads to South America for residential use, but a growing volume of it is making its way to Asia, especially Japan. Not only that but Marcellus propane will also soon be delivered to Europe.

That is because earlier this year Range Resources (RRC +1.14%) signed an agreement to have 20,000 barrels of propane per day shipped to Norway beginning in 2015. The propane will initially be processed at a MarkWest (NYSE: MWE) facility near Pittsburgh before flowing through the Mariner East pipeline, which is operated by Sunoco Logistics (NYSE: SXL) to Philadelphia for export by ship. Other big Marcellus gas producers could soon follow suit as the market for U.S. propane develops in Europe. That would further enhance the economics of MarkWest and Sunoco, which are investing heavily in infrastructure to process and transport Marcellus-sourced natural gas liquids like propane.

On the other hand, one place U.S. propane is struggling to access is China. A recent example of this is Targa Resources (TRGP +1.15%), which owns a propane export facility on the Houston Ship Channel and recently had talks with a Chinese buyer cease. Tougher laws made it easier for the buyer to get its propane from the Middle East. That said, there is plenty of demand elsewhere for Targa's exported volumes. Furthermore, Gulf Coast propane exports to Asia should get a boost when the Panama Canal widening is complete in 2015, which will lower transport time and cost.

Investor takeaway

Propane exports have enabled natural gas producers to get more value when drilling for liquids-rich natural gas. If it wasn't for exports, drillers might have had no choice but to turn off the capital flow directed at extracting additional liquids. Moves by Enterprise and Targa to add capacity will help put more propane into the global marketplace, which should keep the price of propane high enough to justify the drilling capital. That will keep the profits flowing for all the companies involved in the propane trade.

Propane is Just One Piece of America's Energy Bonanza