Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Yum! Brands (YUM -0.15%) fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Yum!'s story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's look at Yum!'s key statistics:

YUM Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

19% |

Fail |

|

Improving profit margin |

11.3% |

Pass |

|

Free cash flow growth > Net income growth |

16.1% vs. 32.4% |

Fail |

|

Improving EPS |

37.4% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

96.1% vs. 37.4% |

Fail |

Source: YCharts.

*Period begins at end of Q2 2010.

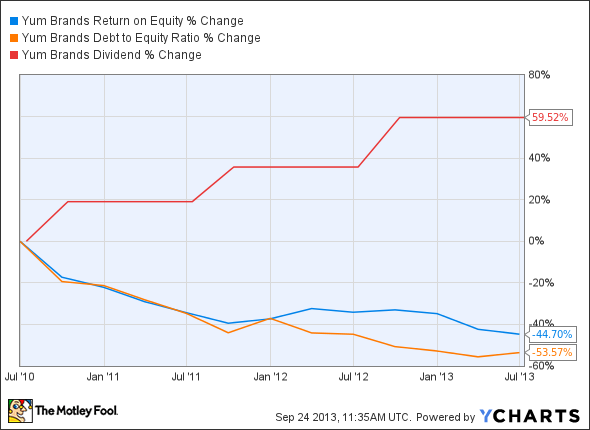

YUM Return on Equity data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(44.7%) |

Fail |

|

Declining debt to equity |

(53.6%) |

Pass |

|

Dividend growth > 25% |

59.5% |

Pass |

|

Free cash flow payout ratio < 50% |

52% |

Fail |

Source: YCharts.

*Period begins at end of Q2 2010.

How we got here and where we're going

Yum! earns only four out of nine passing grades today, and two of its failures were on account of mediocre free cash flow -- however, nominal free cash flow has been higher than net income for all of the past three years, typically by at least $500 million on a trailing 12-month basis. The company's reputation as a strong dividend payer may also come back to haunt it if Yum! finds itself unable to propel its earnings to a level commensurate with its share-price gains. Will Yum!'s shareholders be disappointed in the near future, or is the company only just gearing up for a period of even stronger growth? Let's dig deeper to find out.

One major challenge of late was the avian flu and chicken scandal at Yum!'s KFC restaurants in China, which caused double-digit same-store sales declines in the region. However, the company is still betting heavily on Chinese fast-food markets, as opened a number new of restaurants in China are still planned. Fool contributor Jayson Derrick notes that Yum!'s global rival McDonald's (MCD -0.40%) has also been aggressively expanding in China, which may lead to a price war for market share. Mickey D's is planning to add 300 new restaurants in the Middle Kingdom, bringing its total locations in the country up to 2,000. However, it still has a long way to go to match Yum!'s dominant 39% share of the Chinese fast-food market.

U.S. fast food giants, including but not limited to Yum!, have also been expanding into other emerging markets, particularly India, which offers monstrous long-term potential as per-capita incomes for more than a billion people continue to rise. Yum! has an ambitious plan to operate 1,000 fast-food restaurants in India by 2015. However, the company's Pizza Hut franchise already faces serious headwinds from Domino's Pizza (DPZ 0.69%), which operated around 552 stores in India by the end of 2012. McDonald's is also doing much better in India than it is in China, as it controls around 40% of the fast-food market in the world's second most-populous country.

Yum! has also been expanding its geographical presence in African markets -- Jayson Derrick notes that the company runs more than 700 outlets in South Africa alone, with virtually no competition from other U.S. brands or from local fast-food concepts. Yum!'s KFC "eleven" assembly-line concept might pose a threat to the more upmarket fast-casual chains that have become popular domestically. Taco Bell hasn't abandoned its guilty-pleasure roots, though -- the purveyor of cheap taco-like products recently rolled out its new "waffle taco" in 100 locations, which could take market share from McDonald's and its segment-leading morning fare. Yum! is growing in all directions, and it appears that, despite its shortcomings today, this fast-food leader has a good shot at long-term outperformance.

Putting the pieces together

Today, Yum! Brands has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.