Stop me if you've heard this investment strategy before: Invest in biotechs with multiple shots on goal. The bigger the pipeline, the more likely the company will increase in value.

It sounds good in theory. Admittedly I espoused the investment idea five years go in this article, touting the pipelines of Seattle Genetics (SGEN), Exelixis (EXEL -1.66%), and Array BioPharma (ARRY).

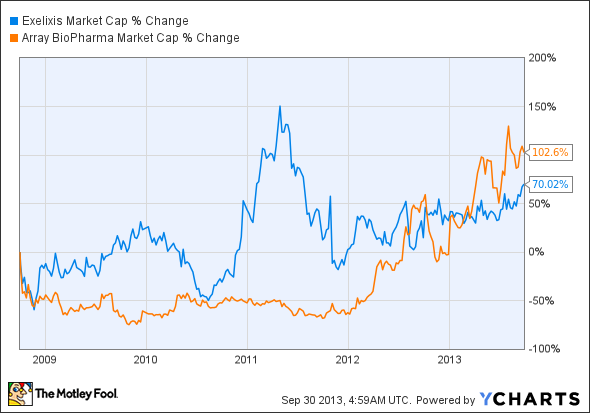

My thinking over the last half decade has changed. This chart shows why.

Clearly, Seattle Genetics is the winner of the bunch. Its cancer drug Adcetris was approved in 2011. From the chart, it looks like Exelixis and Array have sputtered along, but that's somewhat misleading.

EXEL Market Cap data by YCharts.

While long-term investors haven't benefited from owning the companies, they're both worth substantially more than they were five years ago. The higher valuation is just split among more shares because both companies had to sell shares to raise funds to pay for their pipeline development. Five years later, both companies have fewer drugs in their pipeline than they did back then although their lead drugs are clearly worth more.

It takes more than a pipeline

There seems to be two ways to solve the problem Exelixis and Array have demonstrated over the last five years.

You can find biotechs like Seattle Genetics that have a quick shot on goal. When I wrote the article five years ago, Seattle Genetics didn't have any drugs in phase 3 development, but it didn't need to. Adcetris got an accelerated approval based on its phase 2 program.

The other option is to look for companies that might not have to raise that much cash because they have financial support from big pharma. In addition to speed, Seattle Genetics got that, too, from Takeda Phamaceutical, which paid $60 million upfront for the rights to Adcetris outside of the U.S. and Canada and split the development costs with the biotech. The company has also licensed out its technology to multiple companies, bringing in licensing fees and potential milestone payments and royalties.

Things could have gone differently if Exelixis' partner Bristol-Myers Squibb had stuck to their deal instead of handing back rights to Exelixis' lead drug Cometriq. In the long run, the biotech should be better off retaining full rights to the drug, but it has hurt shareholders in the short term.

Two drugmakers with multiple shots on goal supported by big pharma

Isis Pharmaceuticals (IONS -0.24%) has about 20 drugs in clinical development, and many of them are already partnered with other companies. It just signed a fourth deal with Biogen Idec earlier this month to develop more drugs using its antisense technology. The duo hopes to identify two or more drug targets each year.

Regeneron Pharmaceuticals (REGN -0.80%) counts 14 drugs in its clinical pipeline, many of which are supported by its partnership with Sanofi. In fact, if you look at the second-quarter expenses, Regeneron spent $187 million on research and development, and Sanofi paid the biotech $85 million during the quarter. Sure, Regeneron is giving up potential upside, but the funding helps the biotech get a lot more done than it could on its own.

Neither company is necessarily cheap right now, but I'm willing to bet the strategy of multiple shots on goal plus big pharma support beats biotechs that decide to go it alone.

We'll see in five years.