"Do not put all your eggs in one basket" is probably one of the biggest cliches in investing. However, it is also one of the most important rules of long-term investing. Still, achieving optimal levels of portfolio diversification in this era of globalization and increasing asset class correlation seems to be pretty challenging.

A diversified equity portfolio is vital to long-term success

While a decent mix of asset classes (e.g., stocks, bonds, commodities, etc.) within a portfolio can make a case for decent portfolio diversification, over the longer term it does little to maximize returns, as most of the other asset classes -- especially bonds and precious metals -- have near-negative correlation to equities. After all, diversification at the expense of returns is pretty much a losing bet.

On the other hand, a well-diversified equity portfolio is vital for the success of an investor with a focus on the long haul.

So let's take a look at two equity ETFs that offer both diversification and growth opportunity for investors.

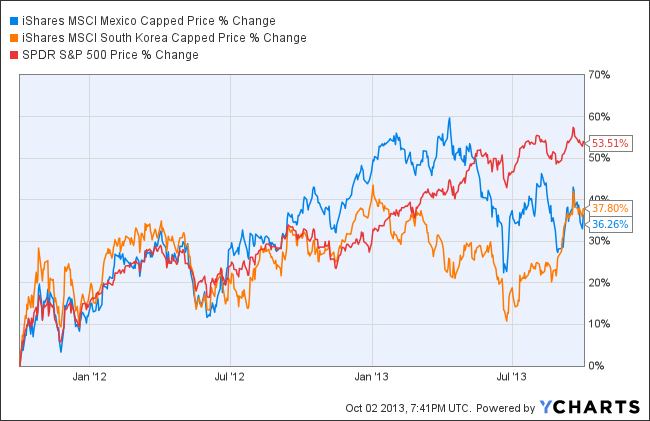

The iShares MSCI Mexico Capped ETF (EWW +4.42%) and the iShares MSCI South Korea Capped ETF (EWY +2.80%) provide a pure play on Mexican and South Korean equity markets, respectively.

The two ETFs have underperformed U.S equities, represented here by the SPDR S&P 500 (SPY 0.85%) ETF, over the past two years. However, they could prove to be solid bets for U.S. investors going forward. While the past few months have been disastrous for most emerging-market equities, the Mexican and South Korean stock markets have been extremely resilient.

In fact, during the recent sell-off since May this year, most equities in the emerging-market space have suffered double-digit losses. The domestic stock markets in India and Indonesia lost almost 10% and 27%, respectively. However, the Mexican and South Korean stock markets have fared comparatively well, returning -2.8% and 5%, respectively, since May.

A brighter long-term picture

Improving macroeconomic fundamentals, low inflation levels, and resilient currencies have been the primary catalysts for the relative outperformance of the Mexican and South Korean equity markets. Furthermore, contrary to most emerging markets, these two economies are the least vulnerable to foreign portfolio flows, as they do not have huge budget deficits to be financed by these foreign fund inflows.

Of course, this owes largely to the fact that both economies are primarily export-driven, which gives them a favorable trade balance. Therefore, one could argue that so long as the global economy recovers (which it is doing already), these economies are destined to do well.

The Mexico capped ETF has an impressive asset base of about $2.62 billion and charges an expense ratio of 0.5%. The South Korean Capped ETF manages a huge asset base of $3.85 billion and charges investors 62 basis points in fees and expenses.

The right amount of diversification

Both of these ETFs have been showing decreasing correlation to U.S.equities, thereby resulting in higher levels of diversification. In order to highlight this, I computed the correlation coefficient for these ETFs against U.S equities as represented by the S&P 500 over the past four years.

Interestingly, over this time frame the Mexico Capped ETF and the South Korean Capped ETF have had correlations of 59.5% and 66.4%, respectively, against the S&P 500 index. Any broad-based U.S equity ETF would have a correlation of more than 90% versus the S&P 500 index, so these emerging-market ETFs seem to provide diversification that, over the long term, could surely translate into a big difference in performance.

The bottom line

Diversification is one of the essential ingredients of long-term investing success, because it enables investors to ride out the short-term volatility that equity markets exhibit without severely compromising the overall portfolio returns. And these two ETFs, with their improving fundamentals, are surely effective ways to do it, especially at a time when diversification is growing ever more difficult to achieve.