Happy Friday! There are more good news articles, commentaries, and analyst reports on the Web every week than anyone could read in a month. Here are eight fascinating pieces I read this week.

Strategy

The blog Farnam Street points out two types of failure described in the book Mastery:

Think of it this way: There are two kinds of failure. The first comes from never trying out your ideas because you are afraid, or because you are waiting for the perfect time. This kind of failure you can never learn from, and such timidity will destroy you. The second kind comes from a bold and venturesome spirit. If you fail in this way, the hit that you take to your reputation is greatly outweighed by what you learn. Repeated failure will toughen your spirit and show you with absolute clarity how things must be done. In fact, it is a curse to have everything go right on your first attempt. You will fail to question the element of luck, making you think that you have the golden touch. When you do inevitably fail, it will confuse and demoralize you past the point of learning. In any case, to apprentice as an entrepreneur you must act on your ideas as early as possible, exposing them to the public, a part of you even hoping that you'll fail. You have everything to gain.

Dividend boom

Eddy Elfenbein writes about the surge in dividend payments:

Before we're done, the [S&P 500] dividends paid out in 2013 will probably be more than 50% higher than what was paid out in 2010. That's remarkable.

The dividend payout ratio for the last four quarters is now just over 33%. Except for the depths of the financial crisis, that's the highest ratio in more than 10 years. (During the financial crisis, the ratio climbed not due to higher dividends but to plunging earnings.)

Outlooks

Felix Salmon writes a great profile on financial guru Dave Ramsey, including a debate Ramsey had with Motley Fool writer Brian Stoffel:

Ramsey recently debated that subject on his radio show with Brian Stoffel, a columnist for The Motley Fool, who wrote about that 12% number in the wake of the Twitter fight. Stoffel said 12% was unrealistic; Ramsey said that it wasn't, and that if his listeners had taken his advice and followed it for the past 20 years, "they would have had a pretty strong rate of return." He challenged Stoffel "to analyze that and figure that out," which Stoffel obviously couldn't do on a live radio show.

But here are the numbers, using data from Morningstar. If someone invested equally in four mutual funds corresponding to Ramsey's plan, using the kind of load-charging funds he recommends, over the past 20 years the annualized return would have been 7.6%.

New normal

The Financial Times asks if home ownership in America is losings its allure:

The US home-ownership rate has dropped to an 18-year-low at about 65 per cent -- down from a peak of 70 per cent before the crash -- and economists say it is set to fall as low as 60 per cent. Some industry watchers are now asking if the US, after a multi-decade push toward home ownership, is shifting toward being a nation of renters.

"With the housing bubble bursting, the home-ownership rate was always going to drop. In some respects this has been healthy as the country has been reversing some of the excess. Not everybody should have been homeowners," says Michael Gapen, senior economist at Barclays. "But there is now an open question about where it will settle."

Say my name

The Economist takes a business lesson from the hit show Breaking Bad:

The first lesson from "Breaking Bad" is that high-growth businesses come from unexpected places. Mr White uses his skills as a chemist to revolutionise the slapdash meth industry (he was a researcher before becoming a teacher). He is not alone. William Thorndike of Harvard Business School (HBS) studied eight bosses whose firms outperformed the S&P 500 index more than 20-fold over their business careers. He found that they were all outsiders who brought fresh perspectives on their industries. Clayton Christensen, also at HBS, argues that great entrepreneurs look at the world through a "marginal lens". It so happens that Bill Gates, a university drop-out working in a then marginal bit of the computer industry, started Microsoft in Mr White's home-town, Albuquerque, before moving to Seattle.

What's in a name?

Some polls show a majority of Americans aren't happy with Obamacare. But strip out the name and ask people if they like the Affordable Care Act's individual components, and the answer is a resounding "yes," writes the Los Angeles Times:

Tax credits for small businesses to buy insurance: 88% in favor.

Closing the Medicare drug benefit doughnut hole: 81% in favor.

Extension of dependent coverage to offspring up to age 26: 76% in favor.

Expanding Medicaid: 71% in favor.

Ban on exclusions for preexisting conditions: 66% in favor.

Recovery

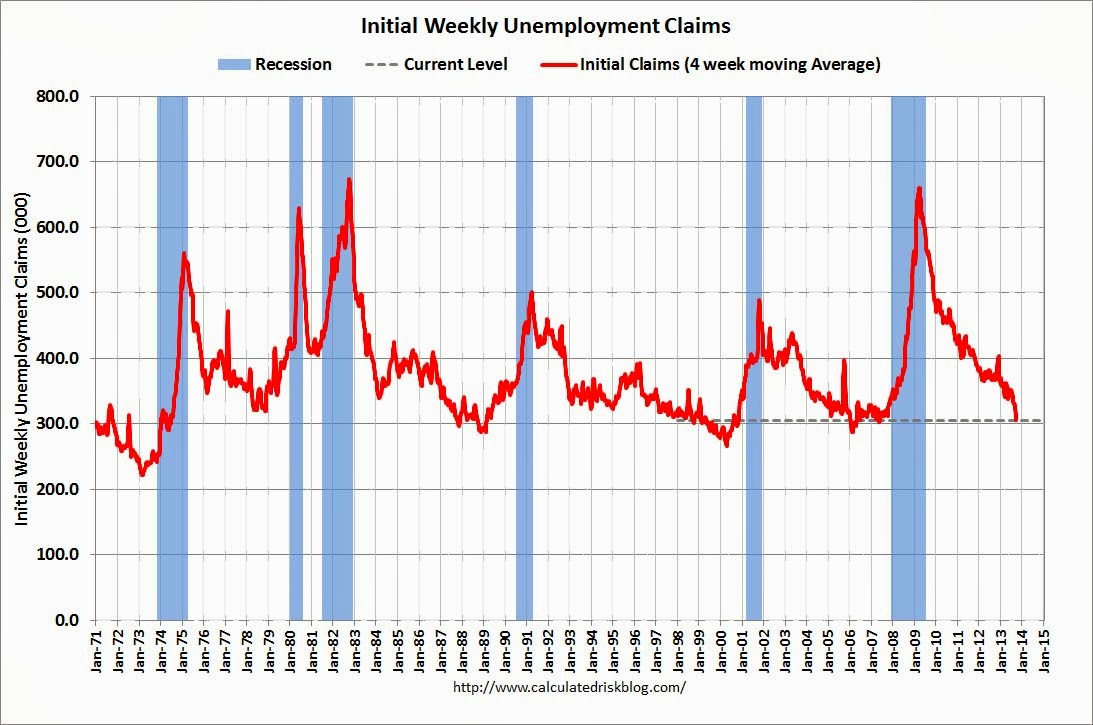

Initial unemployment claims are now low by any measure, as the blog Calculated Risk shows:

Golden years

Retirement is becoming a dream for many, writes BlackRock:

In this new world of investing, where people are living longer and there is increased economic uncertainty, imagining a relaxing retirement can seem difficult. So difficult that 7% of workers don't plan to retire at all, according to the Employee Benefit Research Institute's 2013 Retirement Confidence Survey. And for those that are thinking about retirement, many are putting it off. 36% of workers report that they expect to retire after age 65. Compare this to 1991, when just 11% of workers expected to retire after age 65.

Enjoy your weekend.