Noodles & Co. (NDLS 6.45%), one of the best-performing initial public offerings this year, has a history of entrepreneurship, hard work, and amazing growth. Founded in 1995 by former PepsiCo marketing executive Aaron Kennedy, the company nearly went out of business in 1996 after receiving harsh reviews by food critics.

After reworking its menu and changing the decor, the company started to get positive feedback very quickly. Since then, the company increased its revenue base from $300,000 to $300 million before going public.

However, unlike Chipotle Mexican Grill (CMG 1.46%) -- which operates more than 1,200 restaurants -- or Panera Bread (PNRA +0.00%) -- which has franchised more than half of its restaurants -- Noodles has only 339 locations, owns most of its restaurants, and has no exposure to international markets. The company clearly has plenty of room for growth left. How does Noodles plan to win the fast-casual dining space?

It's all about competitive advantages

Despite the fierce competition in the fast-casual space, Noodles has built great competitive advantages that should help it achieve successful international expansion while keeping a strong position in the U.S. market.

First, Noodles is a very efficient restaurant. A restaurant's contribution margin is based on an evaluation of each menu item's profitability, calculated as the menu price minus its cost. Noodles has practically maximized this rate for its small scale of operations. In 2012, the company-owned restaurant contribution margin was 20.3%, among the highest in the industry, but still below Panera's restaurant-level margin of 22% or Chipotle's 27.6%.

Second, there may be many fast-casual restaurants in town, but few of them specialize in noodles-based dishes. This is a great advantage for Noodles. Chipotle, on the other hand, specializes in Mexican cuisine, which is a saturated space considering that Qdoba, Illegal Pete's, and several other small chains are in the same business. As a matter of fact, Mexican concepts account for almost a quarter of the whole fast-casual restaurant industry in the U.S.

Panera, which specializes in breakfast items such as pastries and sandwiches, is also under heavy competition not only from fast-casual diners, but also from coffee-focused chains, such as Starbucks and Krispy Kreme Doughnuts. After experiencing exponential growth in the past five years, Panera had a weak second quarter, evidencing fierce competition. After all, according to Morningstar, the combined value of the bakery-cafe and sandwich concepts makes up more than a third of the $31 billion fast-casual industry.

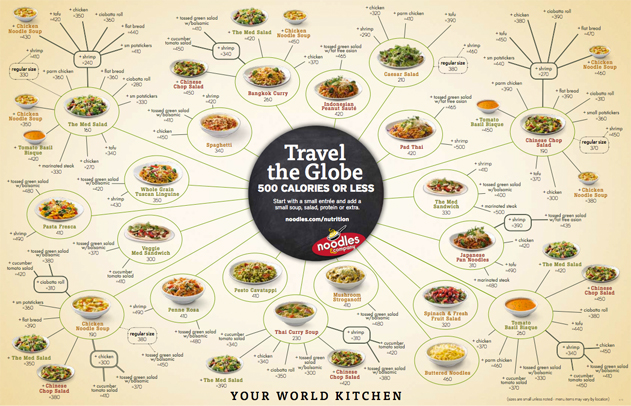

Finally, the restaurant chain has created a very versatile, top-quality food menu. From Japanese pan noodles to Italian pasta fresca, the Noodles menu is healthy, full of variety, and global. Moreover, Noodles sells its food at relatively low prices: You can get a bowl of noodles for $6. Perhaps in part because of this, approximately 40% of its customers visit the restaurant at least once a month.

Source: Noodles website.

A word of caution

In terms of valuation, the current stock price may not be an interesting entry point. Considering that last year the company had sales of $300 million and a net income of $5 million, and assuming 250 locations last year, author of The Small-Cap Investor Ian Wyatt notes that the average sales per location were just $1.2 million, 40% lower than Chipotle's.

On the other hand, at the current stock price, the market is valuing each Noodles store at roughly $3.7 million. This is still below Chipotle, which has more than 1,300 locations but also a market capitalization above $13 billion. It is also below Panera, which has a $4.92 billion market cap for roughly 1,541 stores.

What a Fool believes

Noodles has sufficient competitive advantages to outperform in an increasingly fierce industry. Like Chipotle and Panera, the company has posted amazing top-line growth in recent years. However, Noodles does not have to deal with as many direct competitors as Chipotle and Panera do.

With few locations, the company will also benefit enormously from further expansion, both in the U.S. and abroad.

Regarding its current valuation, Noodles may be slightly overvalued at first sight. However, management forecasts 2,500 stores in the next 15 to 20 years. At the current revenue growth rate, each store could generate the same amount of sales as a Chipotle store in the medium run. These numbers suggest that Noodles' current valuation may not be irrational: Noodles' real growth story has just started.