"The market has become even more challenging, with declines in order rates for both original equipment and aftermarket," stated Mike Sutherlin, President and CEO of Joy Global (JOY +0.00%). If that doesn't make you at least a little nervous, then consider another recent quote of his: "The current outlook is unlikely to support annual revenue above $4 billion."

Recent results and expectations

Joy Global delivered $5.66 billion in revenue in FY 2012, but it expects $4.9 billion-$5.0 billion in revenue in FY 2013. And based on the quote above, FY 2014 isn't likely to show an improvement.

And if you're seeking better news on the bottom line, look elsewhere. Joy Global expects FY 2013 EPS of $5.60-$5.80, a decline from the $7.13 delivered in FY 2012. This is simply an excess supply/reduced demand situation, and the market is likely to get worse before it improves.

To further exemplify Joy Global's current situation, Q3 net sales came in at $1.3 billion versus $1.4 billion in the year-ago quarter. Bookings plummeted 36% to $695 million in the same period. Original equipment orders dropped 76%, and aftermarket orders declining 13%.

Even if you adjust for foreign exchange impact, total bookings fell 28% year over year, with original equipment orders and aftermarket orders falling 63% and 7%, respectively. Diluted EPS came in at $1.71 versus $1.82 in the year-ago quarter, and those numbers don't improve when you exclude unusual items: $1.70 vs. $1.87 in the year-ago quarter.

On the bright side, cash provided by operations improved to $350 million versus $157 million in the year-ago quarter, and Joy Global plans on repurchasing $1.0 billion of its own shares over the next 36 months.

Essentially, this well-managed company is doing everything it can to grow its bottom line in a still-challenging market. With order rates expected to be weaker than previously anticipated, Joy Global will focus on efficiency. In addition to accounts receivable and inventory reductions, as well as a lower cost base, Joy Global's capex spend will drop to $125 million per year, from $240 million in FY 2012, and its pension funding will decline by approximately $115 million by FY 2014.

Industry trends

The economic recovery isn't what it was cracked up to be, which has led to surplus of mined commodities. Prices for industrials and bulk commodities dropped 20.40% over the last 18 months through August. This has led to many closures throughout the industry, simply because cost-heavy mines can't operate at profitable levels.

The United States has seen tepid growth, China's growth has slowed, and Europe's occasional signs of hope just aren't consistent.

Joy Global vs. peers

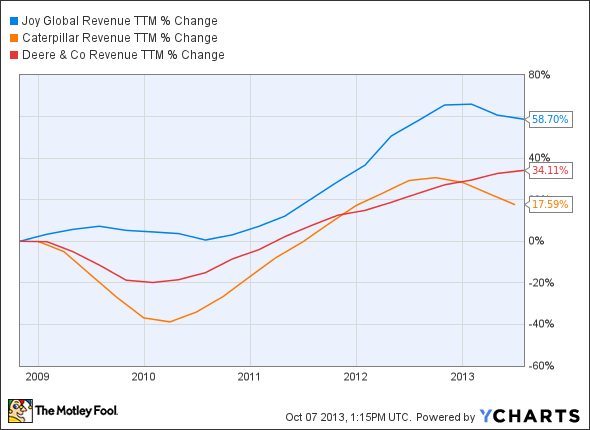

The chart below compares five-year revenue performances for Joy Global, Caterpillar (CAT +11.63%), and Deere (DE +1.13%). Though Joy Global has been the top performer, notice that only one of these three companies has grown on the top line recently:

JOY Revenue TTM data by YCharts

You will notice a similar trend on the bottom line:

JOY EPS Diluted TTM data by YCharts

Unlike Joy Global, Deere's Q3 sales improved 4% year over year, with agricultural and turf sales increasing 8%, and construction and forestry equipment sales dropping 11%.

For FY 2013, Deere expects agricultural and turf sales to improve 7% year over year, thanks to higher commodity prices, strong farm incomes, international expansion, and new lines of advanced equipment. Construction and forestry equipment sales are expected to decline 8%, due to a weak construction environment. Global forestry sales are actually expected to improve, primarily because of increased U.S. demand.

For Deere, farm industry strength in the United States should offset weakness in Europe. But Brazil, the company's key growth driver, has grown unstable environment because of civil unrest.

When it comes to top-line performance, Joy Global and Caterpillar have a lot in common recently. For the three months ended Aug. 31, 2013, Caterpillar's machinery sales dropped 10% year over year, and Caterpillar has now seen nine consecutive months of sales declines. Back in May 2012, many people were excited about a sustainable economic recovery, and demand for manufacturing equipment increased. However, this trend proved to be unsustainable, and Caterpillar has suffered rising inventories of unsold equipment.

Slowing growth in China has played a big role, a weak Europe hasn't helped, Brazil has become unpredictable, and U.S. growth is anemic. Caterpillar has lowered its FY 2013 revenue guidance to $56 billion-$58 billion from $57 billion-$61 billion. The only potential good news is that Ben Bernake opted to maintain quantitative easing, which should buoy the housing market. However, organic growth is necessary for people to invest with confidence.

The bottom line

This might not be the best time to initiate a positive position in farm & construction machinery. If you're adamant about investing in one of these companies right now, then Deere may offer the most potential. All three companies should remain long-term winners, but Joy Global and Caterpillar will likely be taking scenic detours before they reestablish consistent top-line growth.