General Mills (GIS 0.96%) operates in 100 countries, selling popular brands like Cheerios, Green Giant, Pillsbury, Betty Crocker, and more. The company's consistent real-world and stock performances over the long haul have been nothing short of extraordinary. Better yet, General Mills doesn't plan on slowing down, which of course leaves the Foolish reader wondering: is the stock worth a look?

Recent results

In the first quarter of fiscal year 2014, net sales jumped 8% year over year. This was primarily related to volume growth from new businesses, which we'll get to soon. Favorable pricing and product mix also aided the top line, but to a lesser extent. Diluted earnings per share plummeted 15% to $0.70. If you exclude certain items affecting comparability, diluted EPS actually increased 6%. Also, the U.S. Retail segment represents 60% of General Mills' sales. Therefore, it's good to see that net sales improved 4%, mostly thanks to Snacks, Big G, Baking Products, and Small Planet Foods.

The International segment is consistently growing, and the 22% increase in sales in the first quarter demonstrates this trend. Approximately 18% of net sales can be attributed to new businesses, especially Yoki and Yoplait Canada.

During the quarter, General Mills repurchased more than 6 million of its own shares. Dividend payments totaled $248 million, a 15% increase over the year-ago quarter. General Mills also reaffirmed its FY 2014 guidance for low-single-digit sales growth, mid-single-digit operating profit growth, and EPS of $2.87-$2.90.

Brand strength

You might be familiar with some of the established brands that helped drive sales in the most recent quarter, which include Lucky Charms, Cinnamon Toast Crunch, Progresso Light (soup), Yoplait Greek 100 (100-calorie yogurt), Totino's (frozen pizza), Larabar (fruit and energy bars), and Wanchai Ferry (frozen dumplings and dim sum in China).

However, General Mills knows that it must innovate in order to thrive. New products helped drive sales in the most recent quarter: Yoplait Greek yogurt, Nature Valley Soft-Basked Oatmeal Squares, Honey Nut Cheerios Medley Crunch, Pillsbury Gluten-Free refrigerated dough products, Helper dinner mix varieties, and Yoki Kit Facil dinner mixes.

General Mills vs. Kellogg

General Mills and Kellogg (K +0.00%) are often mentioned in the same breath. Kellogg is another phenomenal company with strong brands like Froot Loops, Eggo, Keebler, Pringles, and more. Kellogg also looks to innovation to drive growth. Right now, it's highly focused on the health-conscious consumer. For instance, Kellogg recently launched To-Go shakes, which target the on-the-go American worker who doesn't have time for breakfast yet also wants to eat healthy. These To-Go shakes offer:

- 21 vitamins and minerals

- 10 grams of protein

- 5 grams of fiber

In the second quarter, Kellogg's organic revenue declined 0.5% year over year due to lower volumes. U.S. snacks and cereals have been weak and Europe remains a drag. However, Kellogg is a consistent innovator, which was exemplified above. It's also willing to look for inorganic growth -- the Pringles acquisition is one example. Additionally, second quarter EPS improved 5.3%, which investors like to see.

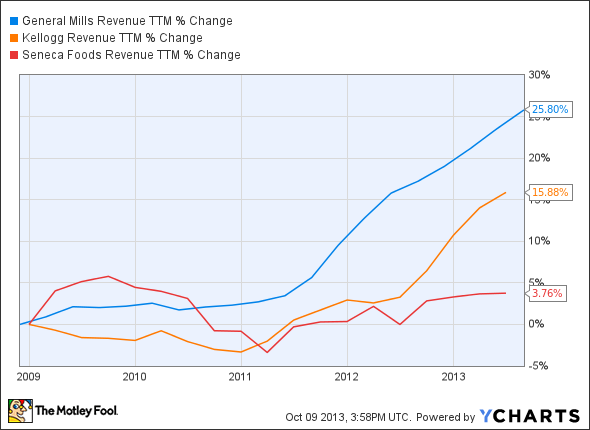

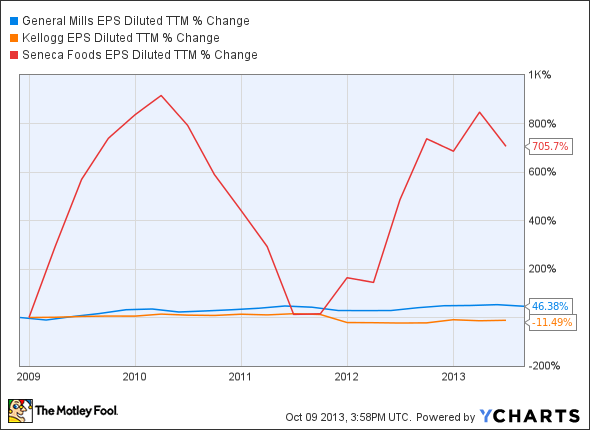

Below is a five-year performance comparison for these two companies and newcomer Seneca Foods (NASDAQ: SENEA) on both the top and bottom lines.

Top line:

GIS Revenue TTM data by YCharts

Bottom line:

GIS EPS Diluted TTM data by YCharts

General Mills has outperformed Kellogg on both the top and bottom lines. Seneca Foods is the world's largest producer of canned vegetables, with brands like Aunt Nellie's, Libby's, READ Salads, as well as Seneca Snacks. It has a leading market share position in retail private label, foodservice, and export canned fruit and vegetables, and it's No. 3 in branded canned fruits and vegetables. With hundreds canned and frozen foods at different sizes, Seneca Foods offers product diversification and affordability for consumers. Though you might have never heard of Seneca Foods, it operates in 80 countries and six continents and as an side also packs Green Giant for General Mills.

Seneca Foods is a much smaller and more volatile company than General Mills, but it's well positioned for the current health-conscious consumer trend. Also, its supply chain management and logistics strategy have proven to be superb, which is demonstrated by its bottom-line performance. The company's strategy is to offer high-quality foods at a low cost, and it's willing to acquire smaller companies to help fuel top-line growth.

Currently, Seneca Foods looks appealing on a valuation basis, trading at just 10 times earnings, whereas General Mills and Kellogg are trading at 18 and 23 times earnings, respectively. However, Seneca Foods doesn't offer any yield, whereas General Mills yields 3.10%, and Kellogg yields 3.00%. It also doesn't offer the strength of century old brands as its two larger peers do. In terms of financial strength, you will see that General Mills sports a debt-to-equity ratio of 0.99, similar to Seneca's debt-to-equity ratio of 1.1 and much more comforting than Kellogg's 4.99.

Best of the best

All three aforementioned companies are quality investment options. But based on superior brand strength, constant innovation, outperformance of peers on the top line, international expansion potential, and consistent capital returns to shareholders, General Mills should offer investors the most long-term potential with the most certainty going forward.