Dividend stocks outperform non-dividend-paying stocks over the long run. It happens in good markets and bad, and the benefit of dividends can be quite striking -- dividend payments have made up about 40% of the market's average annual return from 1936 to the present day.

But few of us can invest in every single dividend-paying stock on the market, and even if we could, we're likely to find better gains by being selective. Today, two huge consumer companies will square off in a head-to-head battle to determine which offers a better dividend for your portfolio.

Tale of the tape

Altria (MO 0.51%), founded as Philip Morris in 1902 as the American branch of a London-based tobacconist, is among the largest tobacco companies in the world. Its stable of tobacco brands includes Philip Morris USA, John Middleton, U.S. Smokeless Tobacco Company. Altria also owns Ste. Michelle Wine Estates, one of the country's largest and most popular wineries, and holds a minority interest in one of the world's largest brewers, SABMiller. Altria is headquartered in Richmond, Virginia, and controls about half of the U.S. tobacco market, but its position was once much larger -- in the past decade, Altria has spun off Philip Morris International (PM +0.59%) (in 2008) and Kraft (in 2007) to constrain its focus to domestic tobacco sales.

McDonald's (MCD +0.52%), founded in the 1940s but reestablished under Ray Kroc's guidance in 1955, is the world's largest fast food company by sales . There are almost 34,500 McDonald's restaurants (over 80% of which are franchised) serving nearly 69 million people in 119 countries. Headquartered in Oak Brook, Illinois, McDonald's has operations in the U.S., Europe, Asia-Pacific, Middle East and Africa along with Canada, Latin America and Corporates.

|

Statistic |

Altria |

McDonald's |

|---|---|---|

|

Market cap |

$71.2 billion |

$94.7 billion |

|

P/E ratio |

16.2 |

17.4 |

|

Trailing 12-month profit margin |

25.3% |

19.9% |

|

TTM free cash flow margin* |

25.4% |

14.6% |

|

Five-year total return |

35.5% |

94.7% |

Source: Morningstar and YCharts.

* Free cash flow margin is free cash flow divided by revenue for the trailing 12 months.

Round one: endurance (dividend-paying streak)

Altria has paid uninterrupted dividends for decades as Philip Morris, and we can trace its streak of dividend increases to 1968. That handily bests McDonald's, which only initiated payments in 1976.

Winner: Altria, 1-0.

Round two: stability (dividend-raising streak)

As mentioned above, Altria's 44-year streak of consecutive increases is longer than McDonald's dividend's existence. Despite raising its dividend at least once per year since 1976, McDonald's is doomed to come up short.

Winner: Altria, 2-0.

Round three: power (dividend yield)

Some dividends are enticing, others are merely tokens that barely affect an investor's decision. Have our two companies sustained strong yields over time? Let's take a look:

MO Dividend Yield (TTM) data by YCharts

Winner: Altria, 3-0.

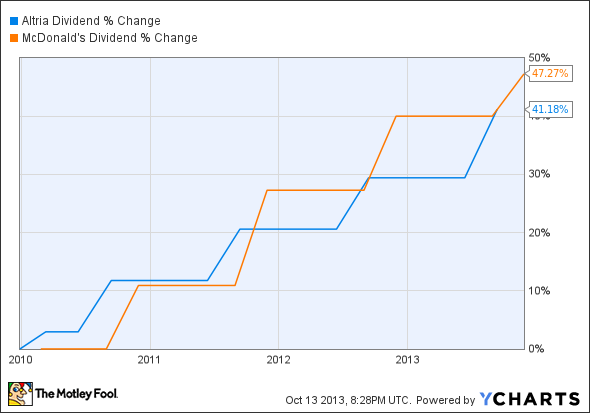

Round four: strength (recent dividend growth)

A stock's yield can stay high without much effort if its share price doesn't budge, so let's take a look at the growth in payouts over the past five years.

MO Dividend data by YCharts

Winner: McDonald's, 1-3.

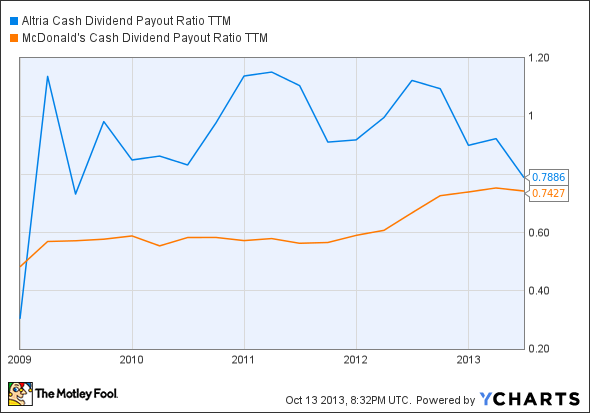

Round five: flexibility (free cash flow payout ratio)

A company that pays out too much of its free cash flow in dividends could be at risk of a cutback, particularly if business weakens. We want to see sustainable payouts, so lower is better:

MO Cash Dividend Payout Ratio TTM data by YCharts

Winner: McDonald's, 2-3.

Bonus round: opportunities and threats

Altria may have won the best-of-five on the basis of its history, but investors should never base their decisions on past performance alone. Tomorrow might bring a far different business environment, so it's important to also examine each company's potential, whether it happens to be nearly boundless or constrained too tightly for growth.

Altria opportunities

- Altria's subsidiary Numark launched its first e-cigarette to gain market share in a rare promising segment.

- The company's renowned Marlboro brand is still world's top-selling cigarette.

- Altria recently boosted its previous $300 million buyback program to $1 billion.

McDonald's opportunities

- McDonald's is poised to benefit from a rebound in Chinese fast-food markets.

- The company plans to open vegetarian restaurants in India.

- The company recently rolled out "Mighty Wings" across 14,000 locations in the U.S.

Altria threats

- Altria is highly constrained by tightening tobacco regulations in the United States.

- Many cigarette manufacturers have experienced declining U.S. sales volume.

- The U.S. government might raise the federal cigarette tax by 93%, to $1.94 per pack.

McDonald's threats

- A shift toward fast casual franchises might undermine McDonald's domestic popularity.

- Increasing health awareness is turning away people from eating fast food.

- McDonald's is presently embroiled in a simmering Chinese meat-quality scandal.

One dividend to rule them all

In this writer's humble opinion, it seems that McDonald's has a better shot at long-term outperformance, thanks to its aggressive expansion in emerging markets, where it has shown an ability to adapt to local taste preferences. Altria has to face emerging threats from stringent domestic health regulations as well as massive tax increases, but has no similar escape route to international markets, thanks to its divestment of Philip Morris International. You might disagree, and if so, you're encouraged to share your viewpoint in the comments below. No dividend is completely perfect, but some are bound to produce better results than others. Keep your eyes open -- you never know where you might find the next great dividend stock!